Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

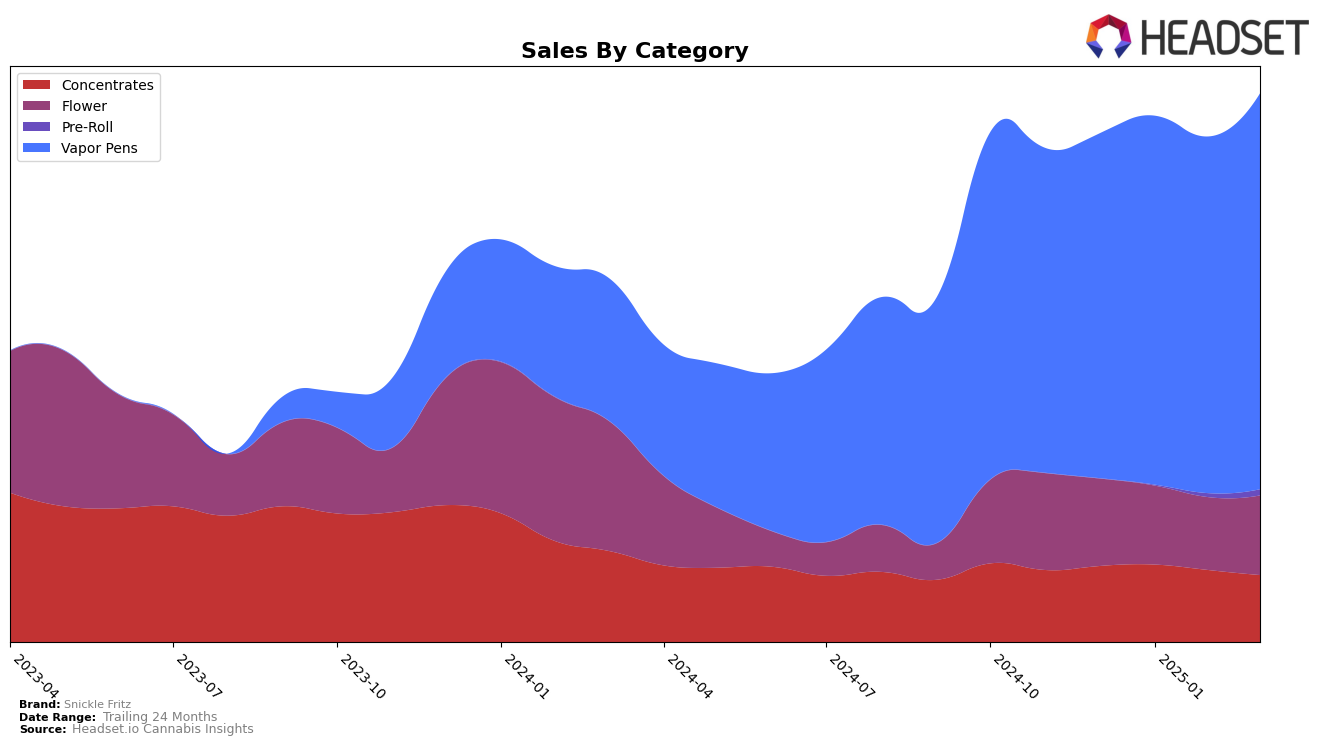

In the state of Washington, Snickle Fritz has demonstrated consistent performance in the Concentrates and Vapor Pens categories. The brand maintained a steady rank of 6th place in the Concentrates category until March 2025, when it dropped to 9th. This decline could suggest increased competition or shifting consumer preferences. In contrast, Snickle Fritz's Vapor Pens category showed slight improvement, moving up from the 9th position in December 2024 to 8th by February 2025, where it remained stable through March. Such stability in the Vapor Pens category indicates a strong market presence and potentially loyal customer base.

However, Snickle Fritz's performance in the Flower category in Washington presents a more mixed picture. Initially ranked 36th in December 2024, the brand climbed to 29th in February 2025, only to fall back to 34th by March. This fluctuation suggests that while there was a brief period of improved sales or market strategy, sustaining that momentum proved challenging. Notably, the brand's absence from the top 30 in the Flower category during December and January highlights a significant area for potential growth and strategic focus.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Snickle Fritz has shown a promising upward trajectory in recent months. From December 2024 to March 2025, Snickle Fritz improved its rank from 9th to 8th, indicating a positive reception in the market. This rise in rank is particularly notable when compared to competitors like Dabstract, which maintained a steady rank of 8th and 9th, and Ooowee, which fluctuated between 10th and 13th. Snickle Fritz's sales figures have also shown a consistent upward trend, culminating in a significant increase in March 2025. This growth is in contrast to EZ Vape, which, despite holding a stable 7th rank, experienced a more modest sales increase. Meanwhile, Full Spec maintained its 6th rank with consistently higher sales, indicating that while Snickle Fritz is gaining ground, there is still room for growth to catch up with the top-tier brands in this category.

Notable Products

In March 2025, the top-performing product from Snickle Fritz was the Biscotti Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank consistently over the past four months with sales figures reaching 9,651 units. The Lime Sorbet Distillate Cartridge (1g) saw a notable rise to second place, up from fourth in February, indicating a significant increase in popularity. The Slurricane Distillate Cartridge (1g) held steady in third place, while the Tropical Slushie Distillate Cartridge (1g) dropped from second in February to fourth in March. Hawaiian Zkittlez Distillate Cartridge (1g) consistently remained in fifth place, showing stable performance. Overall, the rankings highlight a dynamic shift in consumer preferences, particularly for Lime Sorbet, which experienced a notable climb in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.