Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

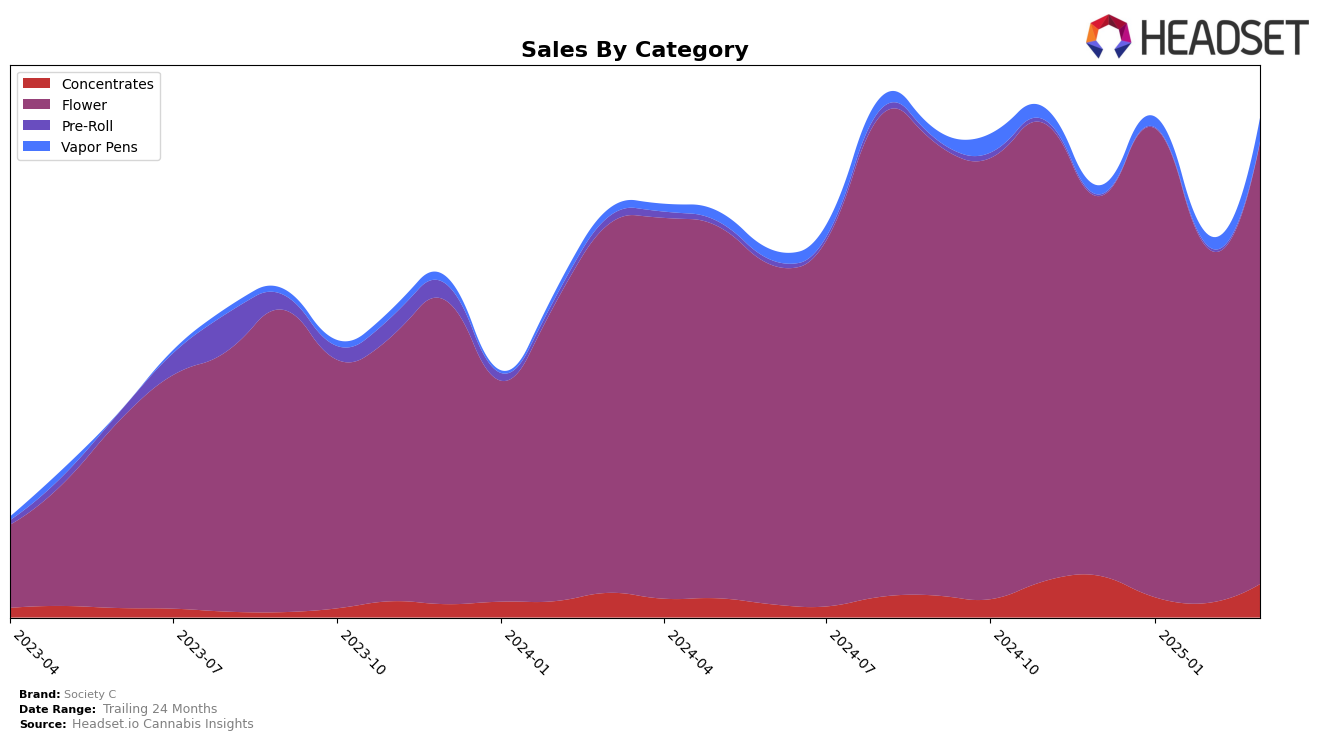

Society C has shown a dynamic performance across different categories in Michigan. In the Concentrates category, the brand experienced a significant fluctuation in rankings from December 2024 to March 2025. It started at a commendable 8th position, dropped to 26th in February, but rebounded to 12th by March. Such volatility indicates both challenges and resilience in this segment. On the other hand, the Flower category has been a stronghold for Society C, maintaining a top-three position throughout the period, even securing the number one spot in January 2025. This consistency in Flower suggests a strong consumer preference and brand loyalty in this category.

In the Vapor Pens category, Society C's performance was less prominent, as it did not appear in the top 30 rankings until March 2025 when it climbed to 33rd position. This upward trend, although outside the top 30, indicates a potential growth area for the brand. The absence from the top rankings in prior months highlights the competitive nature of this category and suggests room for strategic improvements. The overall sales trajectory in Michigan shows Society C's capability to adapt and thrive in a competitive market, with notable strengths in certain categories that could be leveraged for future expansion and stability.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Society C has experienced notable fluctuations in its rank and sales performance from December 2024 to March 2025. Initially, Society C held the second position in December 2024, but ascended to the top rank in January 2025, showcasing a significant boost in sales momentum. However, by February 2025, Society C's rank dropped to third, before recovering to second place in March 2025. This dynamic positioning is influenced by the performance of competitors such as High Minded, which consistently remained a strong contender, reclaiming the top spot in March 2025 after a brief dip. Meanwhile, Pro Gro demonstrated a steady presence, peaking at the number one position in February 2025, before settling back to third in March. The competitive shifts highlight the volatile nature of the market, where brands like Play Cannabis also made significant strides, climbing from eleventh in January to fourth by March 2025. These dynamics underscore the importance for Society C to continuously innovate and adapt its strategies to maintain and improve its market position amidst fierce competition.

Notable Products

In March 2025, Gastro Pop (3.5g) reclaimed the top position in Society C's product lineup, leading the sales with 26,962 units. Devil's Drip (3.5g) maintained a strong performance, moving up to second place from third in February. The Runtz (3.5g) held steady in third place, showing consistent demand. Project Z (3.5g) re-entered the rankings at fourth, after not ranking in February. El Chivo (3.5g) experienced a decline, dropping to fifth place after leading in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.