Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

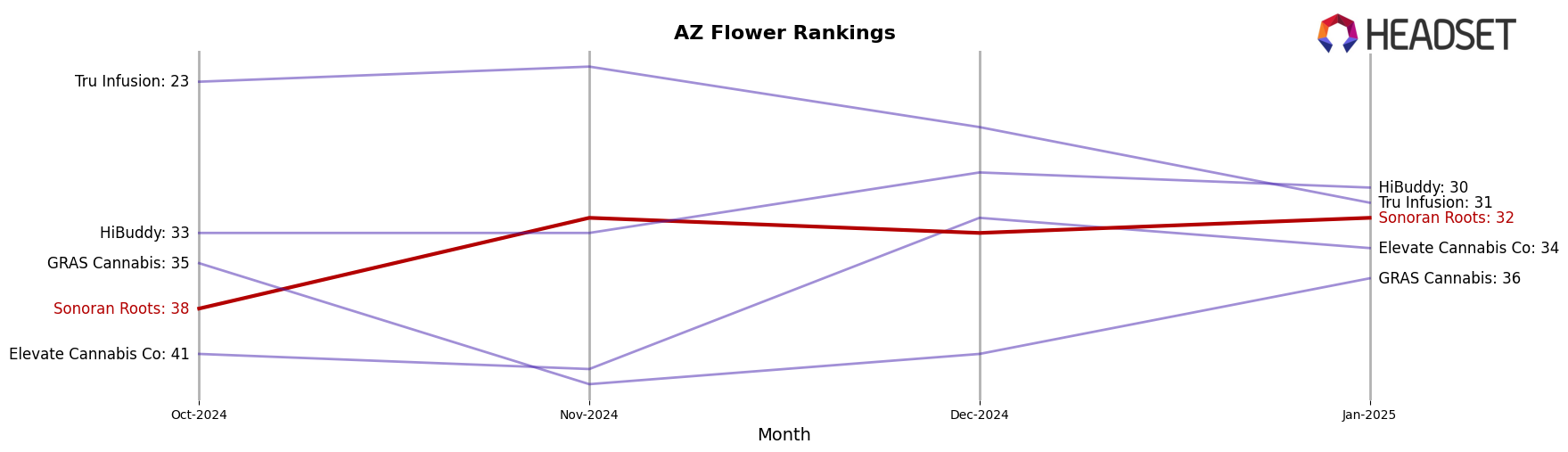

Sonoran Roots has shown a consistent performance in the Arizona market, particularly in the Flower category. Starting from October 2024, the brand was not in the top 30, ranking at 38, but made a significant leap to 32 by November, maintaining this position into January 2025. This upward trend indicates a growing presence and possibly an increasing consumer preference for their Flower products. However, despite this improvement, Sonoran Roots has yet to break into the top 30, suggesting there is still room for growth and competition within this category.

In the Pre-Roll category, Sonoran Roots has demonstrated a more prominent and consistent ranking within the top 30 in Arizona. The brand improved its position from 38 in October 2024 to 31 in November and December, and further climbed to 29 by January 2025. This steady rise in rankings highlights a positive reception and potentially a strategic focus on expanding their Pre-Roll offerings. The consistent sales growth in this category suggests that Sonoran Roots is successfully capturing a significant share of the market, although further insights would be needed to understand the dynamics fully.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Sonoran Roots has shown a steady performance with a slight upward trend in its ranking from October 2024 to January 2025. Starting at rank 38 in October 2024, Sonoran Roots improved to rank 32 by January 2025, indicating a positive reception in the market. This improvement is noteworthy when compared to competitors like Elevate Cannabis Co, which fluctuated between ranks 41 and 32, and Tru Infusion, which saw a decline from rank 23 to 31 over the same period. Meanwhile, HiBuddy maintained a relatively stable position, hovering around rank 30, while GRAS Cannabis experienced more volatility, dropping to rank 43 in November before recovering to rank 36 by January. These dynamics suggest that Sonoran Roots is gaining traction and could potentially surpass some of its competitors if the current trend continues, making it a brand to watch in the Arizona market.

Notable Products

In January 2025, Sonoran Roots' top-performing product was Cherry Cosmo Pre-Roll (1g) which climbed to the number one spot with sales of 1550 units. Kush Mints (3.5g) followed closely in second place, showing a significant increase from its third-place ranking in December 2024. Ghost OG Pre-Roll (1g) made a strong debut at the third position, despite not being ranked in the previous months. Bananaconda #4 Pre-Roll (1g) and Sticky Cake Pre-Roll (1g) secured fourth and fifth places respectively, both entering the rankings for the first time. This shift indicates a growing preference for pre-roll products within the Sonoran Roots lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.