Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

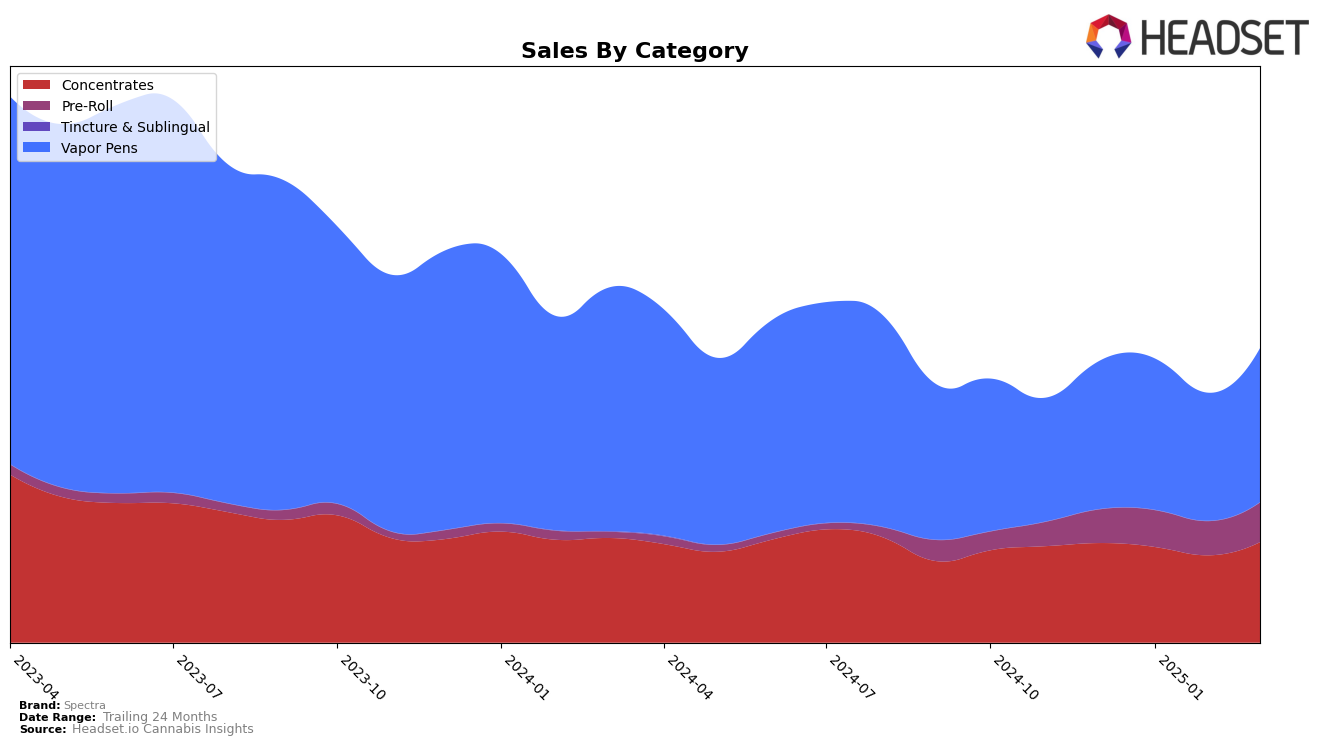

Spectra has shown consistent performance in the Colorado market, particularly in the Concentrates category, where it has maintained a steady third-place ranking from December 2024 through March 2025. While sales dipped slightly in February, there was a notable recovery in March, indicating resilience and potential growth in consumer demand. In the Vapor Pens category, Spectra experienced some fluctuations, dropping to 16th place in February but quickly rebounding to 12th place by March. This suggests a competitive landscape in the Vapor Pens category, where Spectra is managing to hold its ground despite the volatility. Such consistent rankings in a competitive market demonstrate Spectra's strong brand presence and consumer loyalty in the Concentrates segment.

In the Pre-Roll category, Spectra's performance has been more variable, with rankings ranging from 18th to 21st place over the four-month period. Despite not breaking into the top 15, the upward movement from 21st in December to 19th in March hints at a positive trajectory that could see further improvement if current trends continue. However, the category remains challenging, and maintaining momentum will be crucial for Spectra to achieve higher rankings. The absence of Spectra from the top 30 brands in other states or categories could indicate areas for potential expansion or a need for strategic adjustments to enhance market penetration. Overall, while Spectra's performance in Colorado is commendable, there are opportunities for growth and optimization in certain categories.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Spectra has experienced fluctuations in its ranking, reflecting a dynamic market environment. As of March 2025, Spectra holds the 12th position, showing resilience after a dip to 16th in February. This recovery is noteworthy, especially when compared to Billo, which improved its rank from 15th to 11th during the same period. Meanwhile, Green Dot Labs consistently outperformed Spectra, maintaining a top 10 position, though its sales showed a downward trend from December 2024 to March 2025. The Clear also demonstrated a strong performance, climbing from 18th to 13th, which could pose a competitive threat to Spectra. Despite these challenges, Spectra's sales rebounded in March 2025, indicating potential for growth and stability in the coming months. This competitive analysis highlights the importance for Spectra to leverage strategic marketing and product differentiation to enhance its market position in the Colorado vapor pen category.

Notable Products

In March 2025, Spectra's top-performing product was Plant Power 6 - Lemon Cookies Wax (1g), securing the number one rank with notable sales of 1573 units. Plant Power 6 - Rainmaker Wax (1g) climbed up to the second position from fourth place in February, showcasing a strong upward trend. Plant Power 9 - Bro G Infused Blunt (1.5g) maintained its third rank from the previous month, indicating consistent demand. Meanwhile, Plant Power 6 - Orange Cookie Chem Wax (1g) held steady in fourth place, mirroring its February ranking. Finally, Plant Power 6 - Mac Wax (1g) entered the top five for the first time, rounding out the list at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.