Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

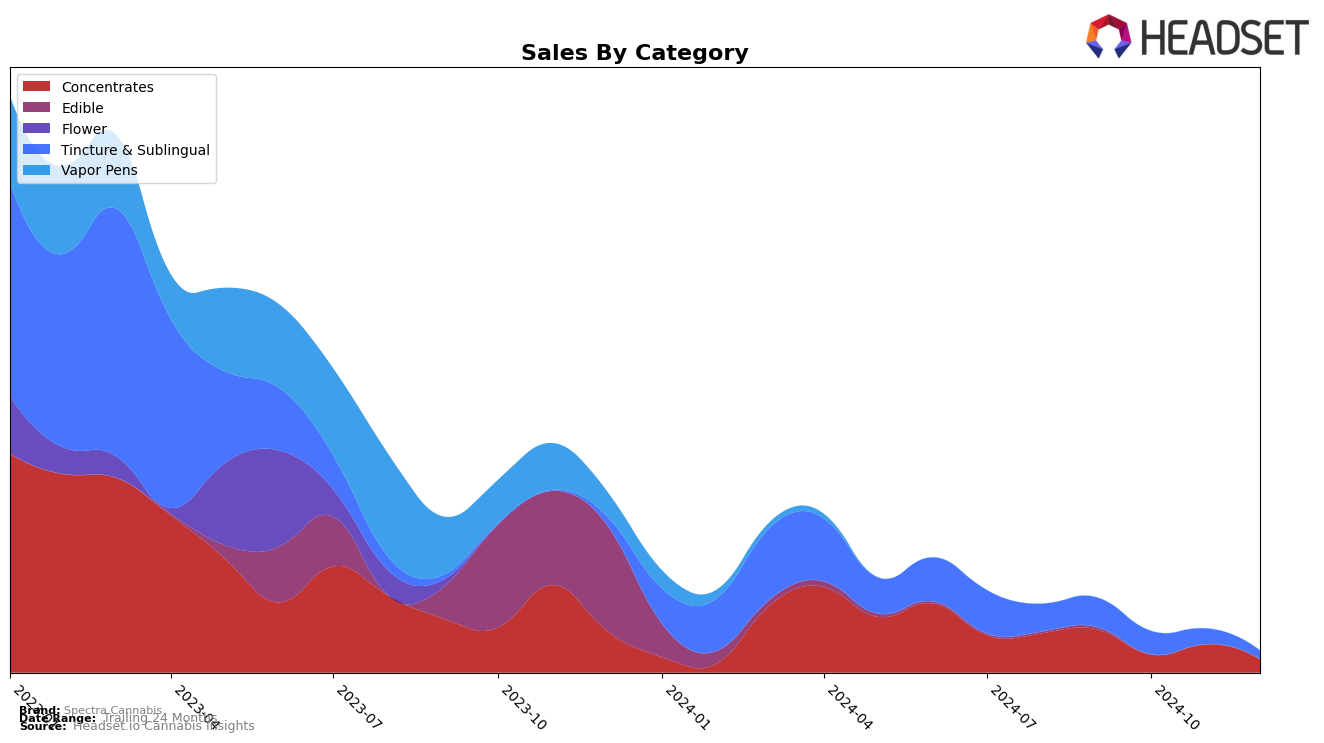

In the state of Illinois, Spectra Cannabis has shown a notable presence in the Concentrates category. Although the brand did not make it into the top 30 rankings from October to December 2024, it was ranked 34th in September 2024, indicating that it was close to breaking into the more competitive tier. This initial ranking suggests that Spectra Cannabis had a reasonable market presence, but the absence of rankings in subsequent months could imply a loss of momentum or increased competition within the state. It is important to note that their sales in September amounted to $12,485, a figure that provides a baseline for understanding their market position during that time.

The lack of rankings in the following months may indicate challenges in maintaining visibility or competitiveness in the Illinois market, especially in the Concentrates category. This could be a result of various factors such as increased competition, shifts in consumer preferences, or strategic changes within the brand itself. While Spectra Cannabis's initial entry into the rankings highlights potential, their disappearance from the top 30 in subsequent months points to a need for strategic adjustments to regain traction. Observing how Spectra Cannabis adapts to these challenges in the coming months will be crucial for understanding their long-term performance and market strategy.

Competitive Landscape

In the competitive landscape of concentrates in Illinois, Spectra Cannabis has been facing significant challenges, particularly in maintaining its rank and sales momentum. As of September 2024, Spectra Cannabis was ranked 34th, but it has not appeared in the top 20 in subsequent months, indicating a struggle to gain traction in this competitive market. In contrast, competitors like #Hash and Paul Bunyan have also seen fluctuations, with #Hash dropping from 26th to 30th and Paul Bunyan maintaining a presence in the rankings, albeit at lower positions. Meanwhile, (the) Essence has consistently held a stronger position, ranking 14th in September and maintaining a stable presence at 16th in the following months, underscoring its robust market performance. This competitive pressure highlights the need for Spectra Cannabis to innovate and strategize effectively to improve its market standing and sales in the Illinois concentrates category.

Notable Products

In December 2024, the top-performing product for Spectra Cannabis was the CBD/THC 1:1 Therapeutic Edible Full Spectrum Oil Syringe (1g) within the Concentrates category, maintaining its first-place ranking from November with a sales figure of 93. The Sleep - CBD/THC 1:1 Cannamist Oral Spray retained its second position in the Tincture & Sublingual category, although it experienced a decrease in sales from previous months. The CBD/THC 2:1 Cannamist moved up to third place, showing an improvement from its fourth position in November. Meanwhile, the Relax - CBD/THC 2:1 Canna Drops Oral Spray dropped to fourth place, slightly increasing its sales compared to November. Lastly, the CBD/THC 1:1 Sleep Therapeutic Edible Full Spectrum Co2 Oil + CBN Syringe re-entered the rankings in fifth place after not appearing in the top ranks for the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.