Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

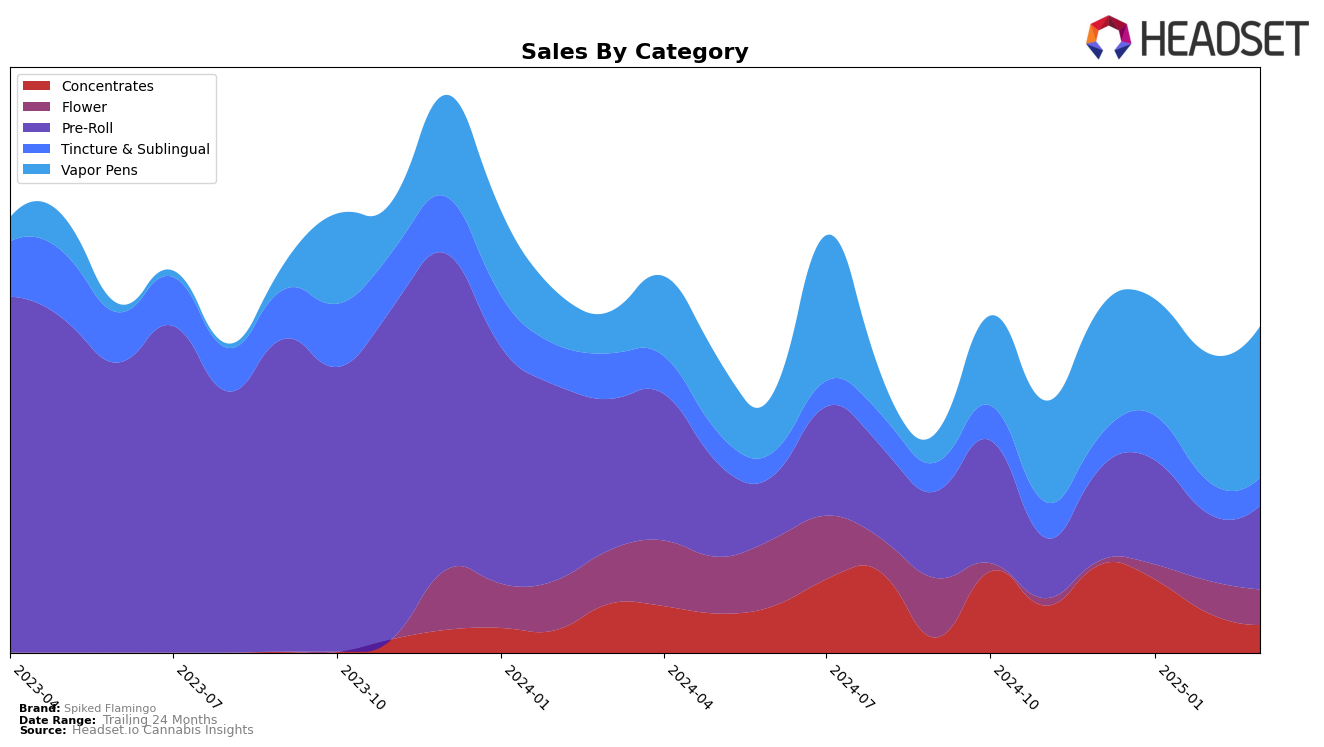

In the state of Nevada, Spiked Flamingo has shown varied performance across different cannabis categories. Notably, in the Concentrates category, there has been a consistent decline in rankings from 9th in December 2024 to 20th by March 2025, which coincides with a decrease in sales figures over the same period. This downward trend suggests a potential challenge in maintaining market share within this category. Conversely, in the Vapor Pens category, Spiked Flamingo has seen a positive trajectory, improving its rank from 25th in December to 21st in March, indicating a strengthening position in this segment. The Tincture & Sublingual category stands out as a stronghold for the brand, maintaining a steady rank of 2nd throughout the months, underscoring its robust presence in this niche.

In contrast, Spiked Flamingo's performance in the Flower category in Nevada reveals a more dynamic movement. The brand was not within the top 30 in December 2024 but made significant strides to rank 67th by February 2025, showing a promising upward trend. However, this momentum slightly tapered off, with a minor drop to the 70th position in March. In the Pre-Roll category, the brand demonstrates relative stability, with rankings fluctuating between 18th and 25th, suggesting a consistent, albeit competitive, market presence. The absence of a December ranking for Flower indicates a potential area of growth, as the brand was able to break into the top 100 in the subsequent months, reflecting strategic efforts to enhance its footprint in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Spiked Flamingo has shown a promising upward trajectory in rank from December 2024 to March 2025. Initially ranked 25th in December 2024, Spiked Flamingo climbed to 21st by March 2025, reflecting a consistent improvement in its market position. This ascent is notable when compared to competitors like Packs (fka Packwoods), which saw a decline from 13th to 20th place over the same period, and Hippies, which improved slightly from 31st to 22nd. Meanwhile, LP Exotics made a significant leap from 38th to 19th, indicating a strong surge in sales. Despite this competitive pressure, Spiked Flamingo's steady rise in rank suggests effective market strategies and growing consumer preference, positioning it well against brands like Panna Extracts, which remained outside the top 20 throughout the period. This trend highlights Spiked Flamingo's potential for continued growth in the Nevada vapor pen market.

Notable Products

In March 2025, the top-performing product for Spiked Flamingo was Biscotti Infused Pre-Roll (1g), which ascended to the number one rank from third place in February. Creamsicle Distillate Cartridge (1g) secured the second position, marking its debut in the rankings. OG Strawberry Distillate Cartridge (1g) followed closely in third place, also entering the rankings for the first time. Fear & Loathing Infused Pre-Roll (1g), which previously held the top spot in February, dropped to fourth place with notable sales of 764 units. High Octane Infused Pre-Roll 3-Pack (1.5g) rounded out the top five, maintaining its position from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.