Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

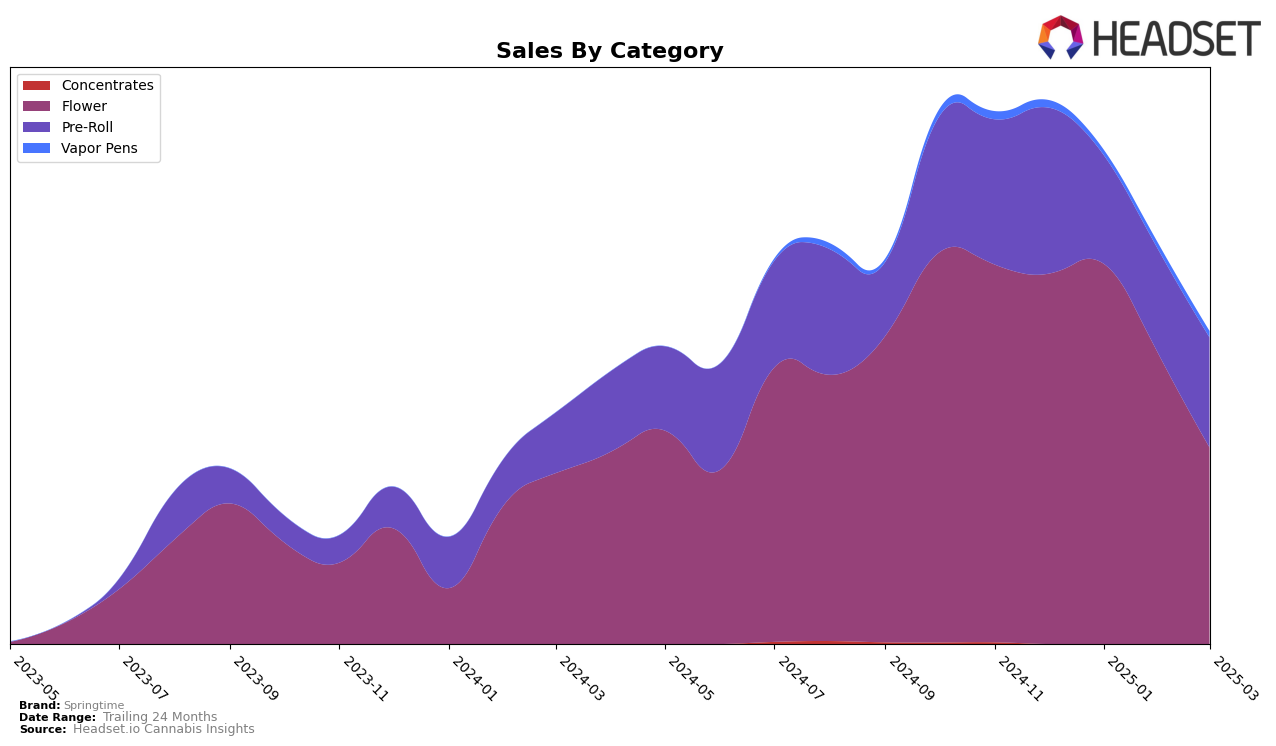

Springtime's performance in the Massachusetts market shows notable fluctuations across different categories. In the Flower category, Springtime began strong with a rank of 9th in December 2024, improving to 8th in January 2025. However, the brand experienced a decline in the following months, dropping to 10th in February and further down to 15th by March. This downward trend is reflected in their sales, which peaked in January but then saw a significant decrease by March. Meanwhile, in the Pre-Roll category, Springtime maintained a more stable presence, starting at 9th in December, slipping to 14th in January, and then holding the 13th position in both February and March. This steadiness in ranking suggests a more consistent performance in Pre-Rolls compared to the more volatile Flower category.

The fluctuations in Springtime's rankings across categories highlight the competitive nature of the Massachusetts cannabis market. The fact that Springtime was able to maintain a place within the top 30 in both categories is a testament to its brand strength, though the drop in Flower rankings could indicate increased competition or shifting consumer preferences. The absence of Springtime from the top 30 in any given month would have been a significant concern, but their consistent presence suggests resilience. The Pre-Roll category's more stable performance might indicate a stronger consumer loyalty or a less saturated market segment, offering potential insights into strategic areas for growth and focus in future months.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Springtime has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially holding a strong 9th rank in December, Springtime improved slightly to 8th in January, but then saw a decline to 10th in February and further to 15th by March. This downward trend in rank corresponds with a decrease in sales from January to March, suggesting potential challenges in maintaining consumer interest or facing increased competition. Notably, Cresco Labs has shown a significant upward trajectory, moving from 36th to 13th place, indicating a robust increase in market presence and possibly capturing some of Springtime's market share. Meanwhile, In House and Cheech & Chong's have maintained relatively stable positions, with In House experiencing a slight dip in February but recovering by March. These dynamics highlight the competitive pressures Springtime faces in retaining its market position amidst aggressive advancements by other brands.

Notable Products

In March 2025, the top-performing product from Springtime was Georgia Pie Pre-Roll (1g) in the Pre-Roll category, which achieved the number one rank with sales of 13,012 units. This product saw a significant rise from its previous rank of third in January 2025. Layer Cake Pre-Roll (1g) secured the second position, maintaining a strong presence after being unranked in the previous months. Banana Kush Pre-Roll (1g) entered the top three for the first time, indicating a new preference trend among consumers. Apple Fritter Pre-Roll (1g) and Apple Fritter #3 Pre-Roll (1g) rounded out the top five, with the former improving slightly from its fifth position in December 2024 to fourth in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.