Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

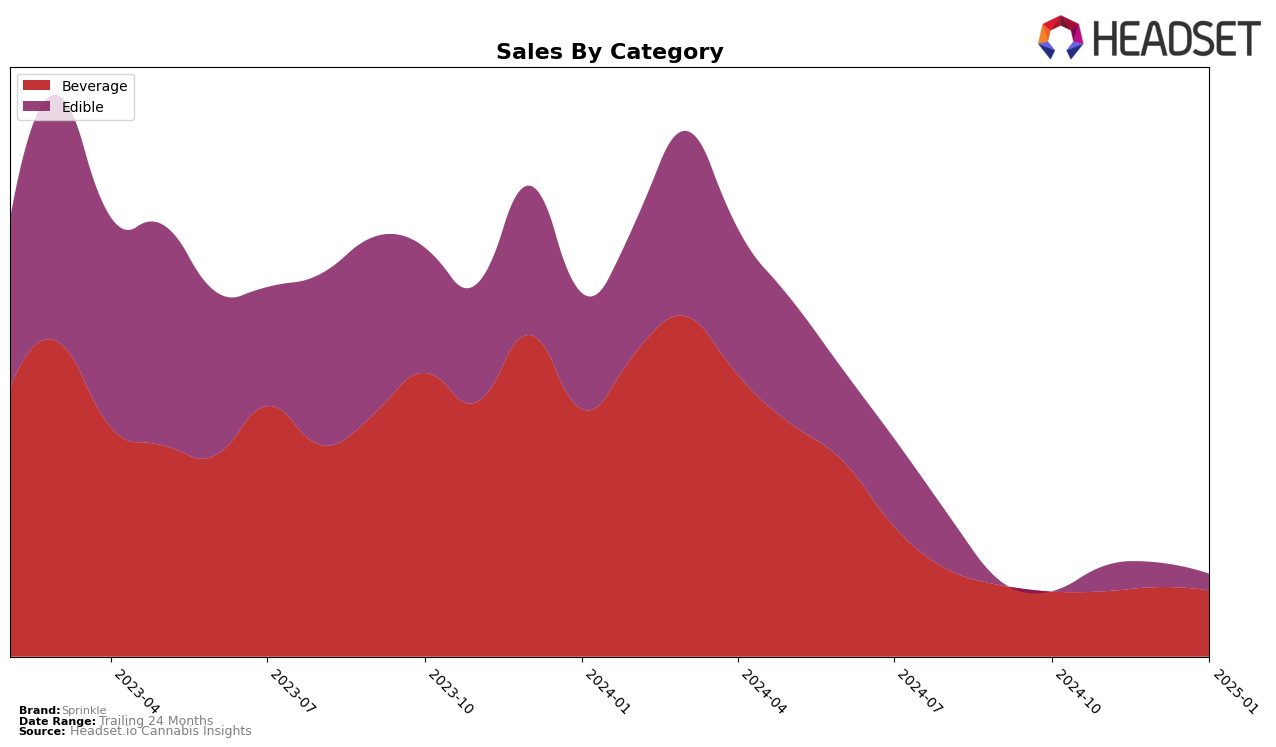

Sprinkle has shown a consistent performance in the Arizona market, particularly within the Beverage category. From October 2024 to January 2025, Sprinkle maintained a steady rank of 5th place, demonstrating a solid foothold in this segment. This stability is underscored by their sales figures, which saw a slight increase from $22,844 in October to $24,207 in December before settling at $23,205 in January. Such consistency in the top 5 indicates a strong consumer base and effective market strategies within the state. However, it's worth noting that Sprinkle did not appear in the top 30 rankings for the Edible category in October 2024, suggesting potential areas for growth or a need to reassess their strategy in this particular segment.

By November 2024, Sprinkle made significant strides in the Edible category in Arizona, entering the rankings at 48th place and improving to 44th by December. Although they did not break into the top 30, this upward movement suggests a positive trend that could lead to better placement in the future. The sales figures for Edibles, while not as robust as Beverages, reflect a steady demand with $10,804 in November and slightly decreasing to $10,574 in December. This data could be indicative of a growing interest in Sprinkle's edible products, albeit at a more gradual pace compared to their beverages. The contrast in performance between the two categories highlights distinct challenges and opportunities for Sprinkle as they navigate the competitive landscape of the cannabis market in Arizona.

Competitive Landscape

In the Arizona beverage category, Sprinkle has shown a consistent performance, maintaining its rank at 5th place from November 2024 through January 2025. This stability in ranking suggests a steady market presence, although it faces stiff competition from brands like Nebula, which consistently holds the 4th position, and High Tide, which remains firmly in 3rd place. Despite Sprinkle's stable ranking, its sales figures have not seen significant growth, indicating potential challenges in capturing additional market share. In contrast, High Tide experienced a notable sales increase by January 2025, suggesting successful marketing or product strategies that Sprinkle might consider emulating. Meanwhile, tonic and Pure & Simple have shown fluctuations in their rankings, with Pure & Simple improving to 6th place in January 2025, potentially posing a future threat to Sprinkle's position. Overall, while Sprinkle maintains a strong foothold, it may need to innovate or adjust strategies to enhance its sales growth and competitive edge in the Arizona market.

Notable Products

In January 2025, the top-performing product from Sprinkle was the GO Simple Dissolvable 10-Pack (100mg) in the Beverage category, maintaining its first-place rank from October 2024 despite a decrease in sales to 414 units. The Night Relaxation w/Melatonin Dissolvable Powder 10-Pack (100mg THC, 3mg Melatonin) climbed to the second position, showing notable improvement from its fourth place in November 2024, with sales reaching 351 units. The CBD/THC 1:1 Purely Simple Powder Dissolvable 10-Pack (100mg CBD, 100mg THC) dropped to third place after leading in November and December 2024, with sales at 342 units. Sleepy Night Relax Dissolvable Powder Packet 10-Pack (100mg) fell to fourth place, continuing its decline since October 2024. Lastly, the Purely Simple Bulk Sprinkle (1000mg) remained stable in fifth place, having only been introduced in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.