Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

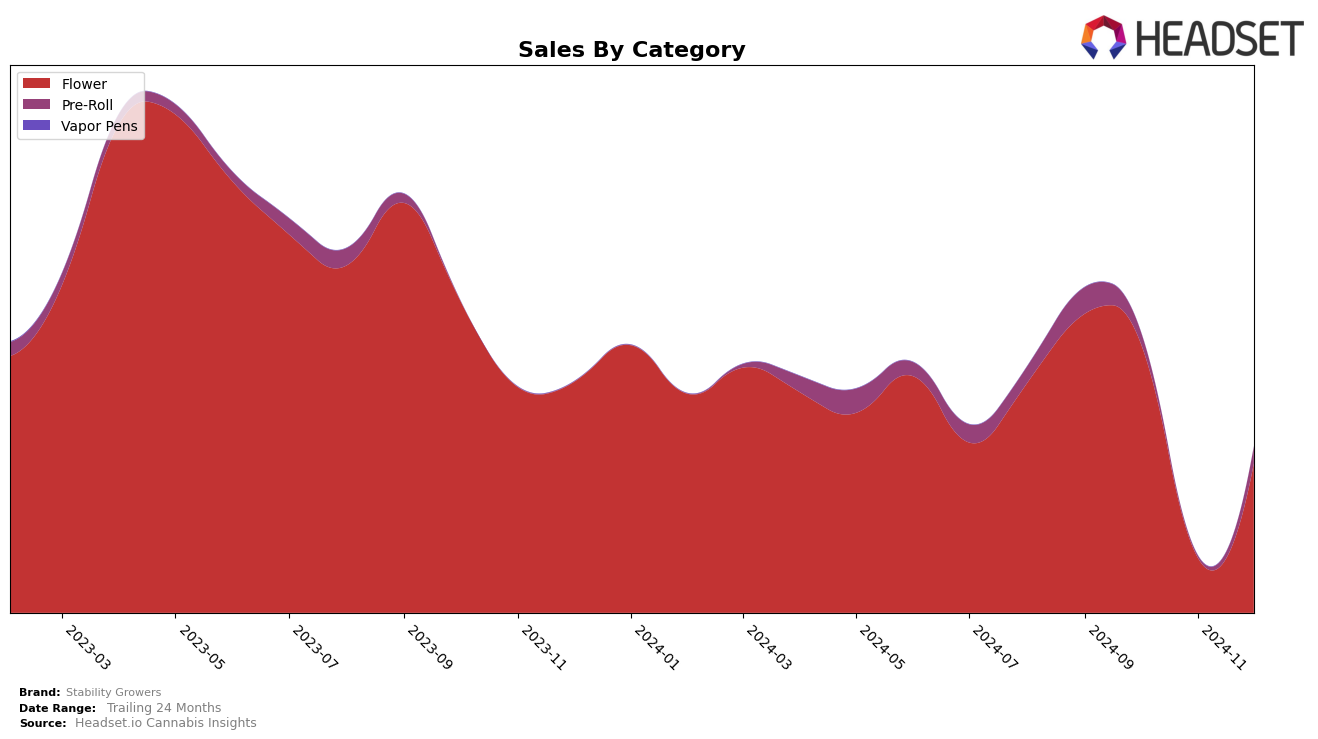

Stability Growers has experienced notable fluctuations in its performance across various categories and states, particularly in Missouri. In the Flower category, the brand maintained a relatively stable presence in the top 30 rankings throughout the final months of 2024, with a significant drop in November where it fell to 43rd place, only to recover to 29th by December. This suggests a potential issue that was addressed effectively, allowing the brand to regain its footing. Interestingly, sales in this category showed a substantial dip in November, which correlates with the ranking drop, followed by a recovery in December, indicating a possible seasonal or operational factor at play.

In contrast, the Pre-Roll category in Missouri presented more challenges for Stability Growers. The brand started in the 33rd position in September and slipped out of the top 30 entirely by November, only to make a slight comeback to 40th place by December. This indicates a struggle to maintain a competitive edge in this category, possibly due to increased competition or changing consumer preferences. The absence from the top 30 in November is a critical point of concern, suggesting a need for strategic adjustments to regain market presence. Overall, while Stability Growers shows resilience in the Flower category, there is a clear opportunity for improvement in the Pre-Roll sector.

Competitive Landscape

In the Missouri flower category, Stability Growers experienced notable fluctuations in its ranking over the last few months of 2024, reflecting a dynamic competitive landscape. Initially holding a strong position in September with a rank of 18, Stability Growers saw a decline to 19 in October, followed by a significant drop to 43 in November, before recovering slightly to 29 in December. This volatility contrasts with competitors like Atta, which maintained a more stable presence, consistently ranking within the top 20 until a slight dip to 27 in December. Meanwhile, Sundro Cannabis showed resilience, hovering around the mid-20s, and CAMP Cannabis maintained a steady rank in the high 20s. The sharp decline in Stability Growers' November ranking coincided with a significant drop in sales, indicating potential challenges in market presence or consumer preference during that period. However, the partial recovery in December suggests an opportunity for Stability Growers to regain its footing in the competitive Missouri flower market.

Notable Products

In December 2024, the top-performing product for Stability Growers was Show Stopper Pre-Roll (0.5g) in the Pre-Roll category, securing the first position with notable sales of 1298 units. Following closely was Donny Burger Pre-Roll (0.5g), also in the Pre-Roll category, ranked second. Golden Goat (3.5g) in the Flower category maintained its third position from November, indicating consistent demand. Larry OG Pre-Roll (0.5g) and Golden Goat Pre-Roll (1g) rounded out the top five, ranking fourth and fifth respectively. Compared to previous months, Golden Goat (3.5g) showed a significant improvement from its fifth position in September to consistently remain in the top three by December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.