Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

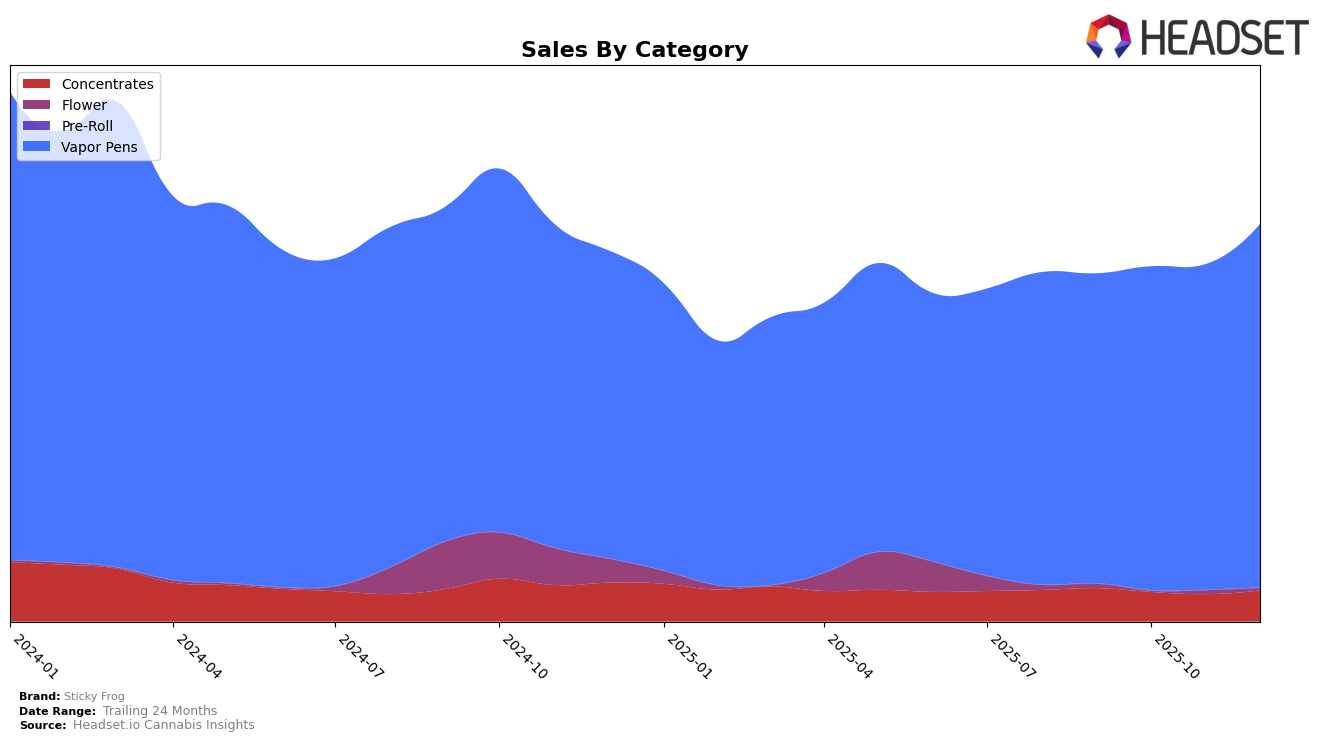

In the Washington market, Sticky Frog has demonstrated varying performance across different product categories. In the Concentrates category, the brand experienced a decline in rankings from September to November 2025, moving from the 6th to the 10th position, before slightly improving to 9th in December. This movement suggests a competitive landscape in the Concentrates sector, where Sticky Frog's performance was challenged. Despite this, the brand's sales for Concentrates showed an upward trend in December, indicating a potential recovery. Such fluctuations highlight the dynamic nature of consumer preferences and market competition in Washington's cannabis industry.

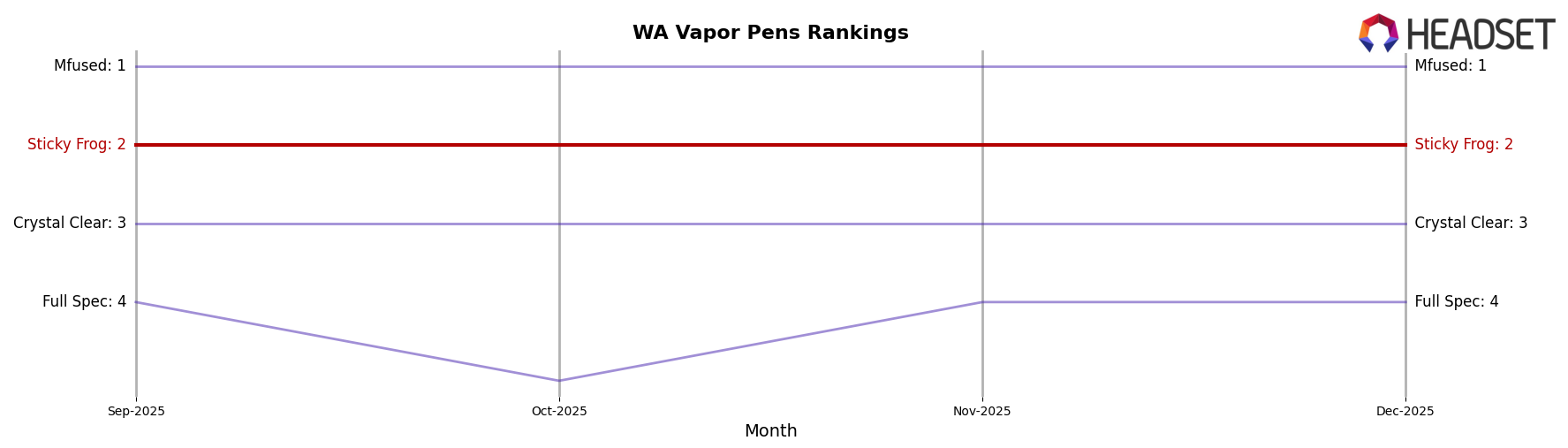

The Vapor Pens category tells a different story for Sticky Frog in Washington. The brand maintained a consistent 2nd place ranking from September through December 2025, showcasing its strong position and consumer appeal in this segment. The sales figures for Vapor Pens also reflect a positive trajectory, with December sales reaching nearly $1.9 million, marking a significant increase from previous months. This consistent ranking and sales growth in Vapor Pens underline Sticky Frog's robust market presence and consumer loyalty in this category, contrasting with the more volatile performance seen in Concentrates.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Sticky Frog consistently holds the second rank from September to December 2025, indicating a stable position in the market. Despite this consistency, it trails behind Mfused, which maintains the top spot throughout the same period. Sticky Frog's sales show a positive upward trend, culminating in a notable increase by December 2025. However, Mfused continues to outpace Sticky Frog in sales, suggesting a significant gap that Sticky Frog needs to address to challenge the leader. Meanwhile, Crystal Clear remains a consistent third, closely following Sticky Frog, which emphasizes the need for Sticky Frog to innovate or enhance its offerings to prevent any potential overtaking. The competitive dynamics in this category highlight the importance for Sticky Frog to strategize effectively to maintain and potentially improve its market position.

Notable Products

In December 2025, Sticky Frog's Raspberry Skywalker Distillate Panda Pen Cartridge (1g) emerged as the top-performing product, maintaining its number one rank from November, with sales reaching 6002. Berry Gelato Distillate Panda Pen Cartridge (1g) held steady at the second position, showing consistent performance across the months. Terpaja Blast Juice Box Live Resin Disposable Panda Pen (1g) remained in third place, despite a drop in sales from October. Northern Lights HTE Cartridge (1g) improved its rank to fourth, recovering from a lack of ranking data in October. Lastly, Tropical Trainwreck HTE Panda Pod (1g) saw a slight decline, moving from fourth to fifth place since September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.