Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

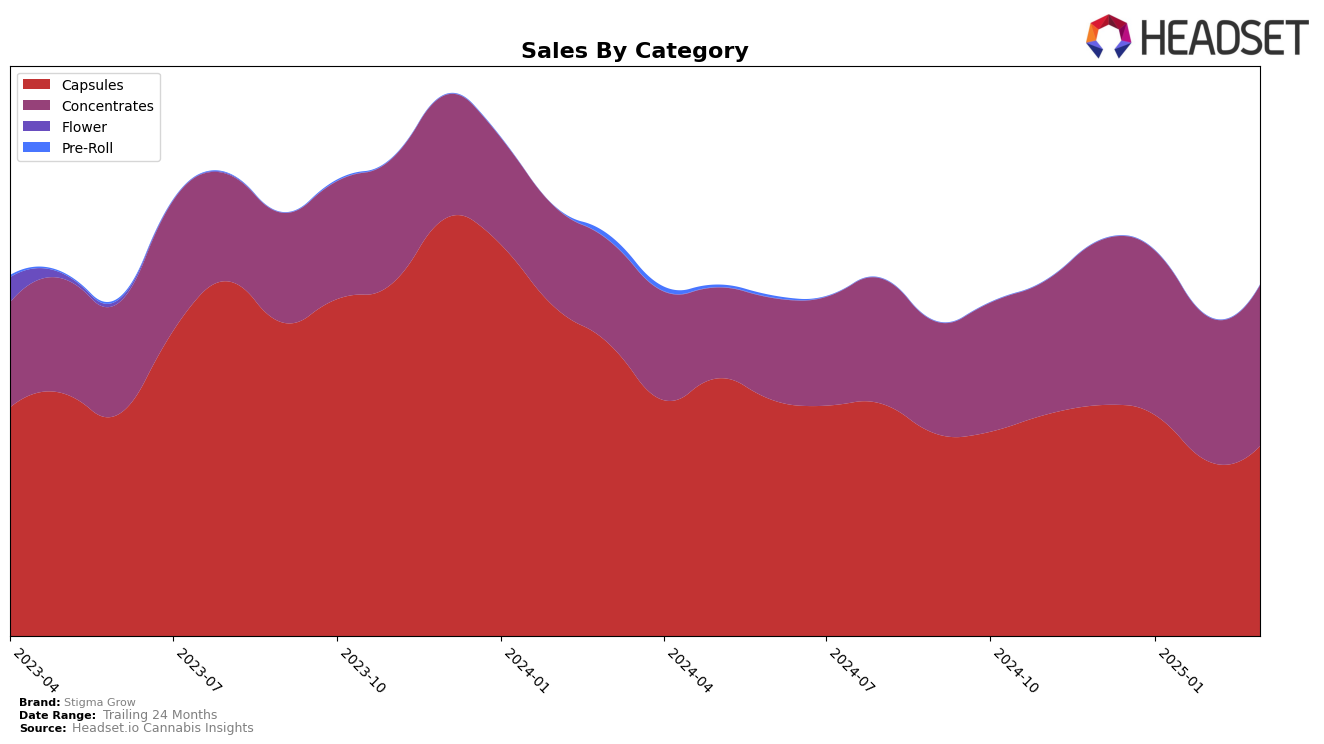

Stigma Grow has shown a steady performance in the Alberta market, particularly in the Capsules category, where it consistently maintained its third-place rank from December 2024 through March 2025. This stability suggests a strong foothold in the Alberta capsules market despite some fluctuations in monthly sales figures. In the Concentrates category, Stigma Grow exhibited positive momentum by climbing from the 17th position in December 2024 to a peak at 12th in January 2025 before settling at 14th in March 2025. This upward trend indicates a growing acceptance and demand for their concentrates in Alberta, even though they didn't break into the top 10.

In British Columbia, Stigma Grow's performance in the Capsules category was marked by a slight fluctuation, moving from 7th place in December 2024 to 6th place by March 2025. This slight improvement, coupled with the sales figures, suggests a resilient presence in the BC market. However, in the Concentrates category, the brand experienced more variability, with ranks oscillating between 13th and 16th. Meanwhile, in Ontario, Stigma Grow maintained a consistent 8th place in Capsules until March 2025, where it dropped slightly to 9th. The Concentrates category in Ontario presents a more challenging landscape, as Stigma Grow was not ranked in the top 30 for January and February 2025, although it reappeared at 43rd in March 2025. This indicates a need for strategic adjustments to improve their standing in Ontario's concentrates market.

Competitive Landscape

In the competitive landscape of the Capsules category in Alberta, Stigma Grow consistently held the third rank from December 2024 to March 2025. Despite maintaining its position, Stigma Grow's sales figures showed a decline from December 2024 to February 2025, before a slight recovery in March 2025. This stability in rank suggests a strong brand presence, although it trails behind Tweed and Glacial Gold, which have consistently occupied the first and second ranks respectively. Notably, Tweed has shown robust sales growth, further widening the gap between itself and Stigma Grow. Meanwhile, Emprise Canada and Frank have fluctuated between the fourth and sixth positions, indicating potential volatility in the lower ranks. This competitive analysis highlights the need for Stigma Grow to innovate or increase marketing efforts to boost sales and close the gap with the leading brands in the Alberta market.

Notable Products

In March 2025, Stigma Grow's top-performing product was Indica RSO Capsules 25-Pack (250mg) in the Capsules category, maintaining its first-place rank for four consecutive months with a sales figure of 4734 units. Following closely, Phoenix Tears RSO (1g) in the Concentrates category also retained its second-place position, demonstrating consistent performance. CBD Softgels 15-Pack (750mg CBD) remained in third place, marking a notable increase in sales from the previous month. Phoenix Tears Resin (1g) and Phoenix Tears Honey Oil (1g) continued to hold the fourth and fifth positions respectively, showing steady sales figures. Overall, the rankings for these top products have remained unchanged from previous months, indicating a stable demand for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.