Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

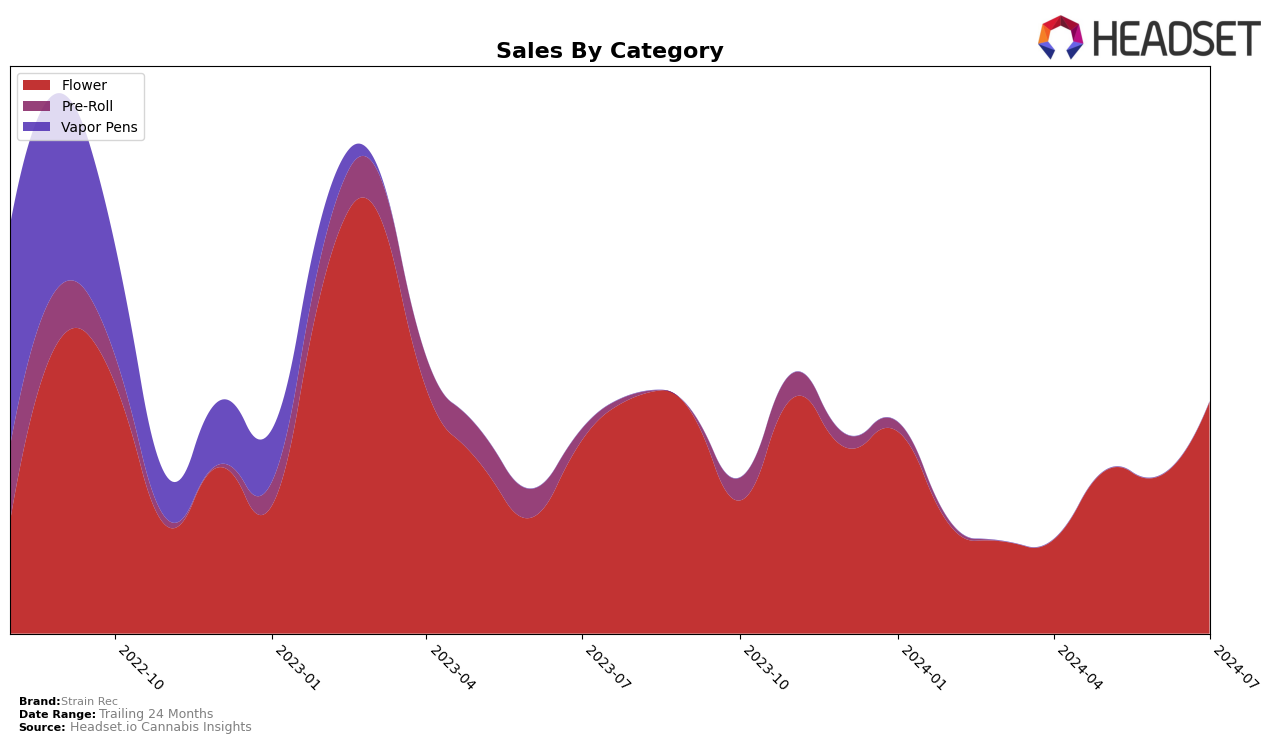

Strain Rec has shown notable improvement in its performance across various categories and states over the past few months. In Saskatchewan, the brand has made significant strides in the Flower category. Despite starting at a rank of 50 in April 2024, Strain Rec climbed to the 30th position by July 2024. This impressive upward movement indicates a growing consumer preference and an effective market strategy. The sales figures also reflect this positive trend, with a substantial increase from $19,054 in April to $47,555 in July. Such growth highlights Strain Rec's potential to continue its upward trajectory in Saskatchewan's competitive Flower market.

However, Strain Rec's performance is not uniformly positive across all regions and categories. In some states, the brand did not make it into the top 30 rankings, which could be a cause for concern. This absence from the top rankings suggests that Strain Rec might need to reassess its market approach or product offerings in these areas. While the brand's success in Saskatchewan is commendable, the mixed results across different markets underline the importance of targeted strategies and localized marketing efforts to replicate such success elsewhere. The varying performance across states and categories provides valuable insights into where Strain Rec is thriving and where there is room for improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Strain Rec has shown notable fluctuations in rank and sales over recent months. Starting from a rank of 50 in April 2024, Strain Rec improved significantly to 35 in May, then slightly declined to 36 in June, before climbing back up to 30 in July. This upward trend in July is particularly encouraging, especially when compared to competitors like Weed Pool, which maintained a relatively stable but higher rank, peaking at 23 in June before dropping to 29 in July. Another competitor, Hiway, experienced a sharp decline from 15 in April to 32 in July, indicating potential market volatility. Meanwhile, Palmetto re-entered the top 50 in July at rank 34 after missing the top 20 for several months. The entry of Holy Mountain at rank 28 in July also adds to the competitive pressure. Strain Rec's ability to improve its rank amidst such competition suggests a positive reception in the market, but continuous monitoring and strategic adjustments will be crucial to maintain and enhance its position.

Notable Products

In July 2024, Lemon OG Haze (28g) maintained its top position for Strain Rec with a remarkable sales figure of 505 units. Privada OG #18 (3.5g) climbed to the second rank, improving from its previous fourth position in May and June. Sour Kosher (3.5g) saw a rise to the third rank, marking a steady increase since its debut at the fifth rank in June. Raspberry Cough (3.5g) entered the rankings at fourth place after not being listed in the previous months. Notably, Bazooka (3.5g), which held the third rank consistently from April to June, did not appear in the top ranks for July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.