Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

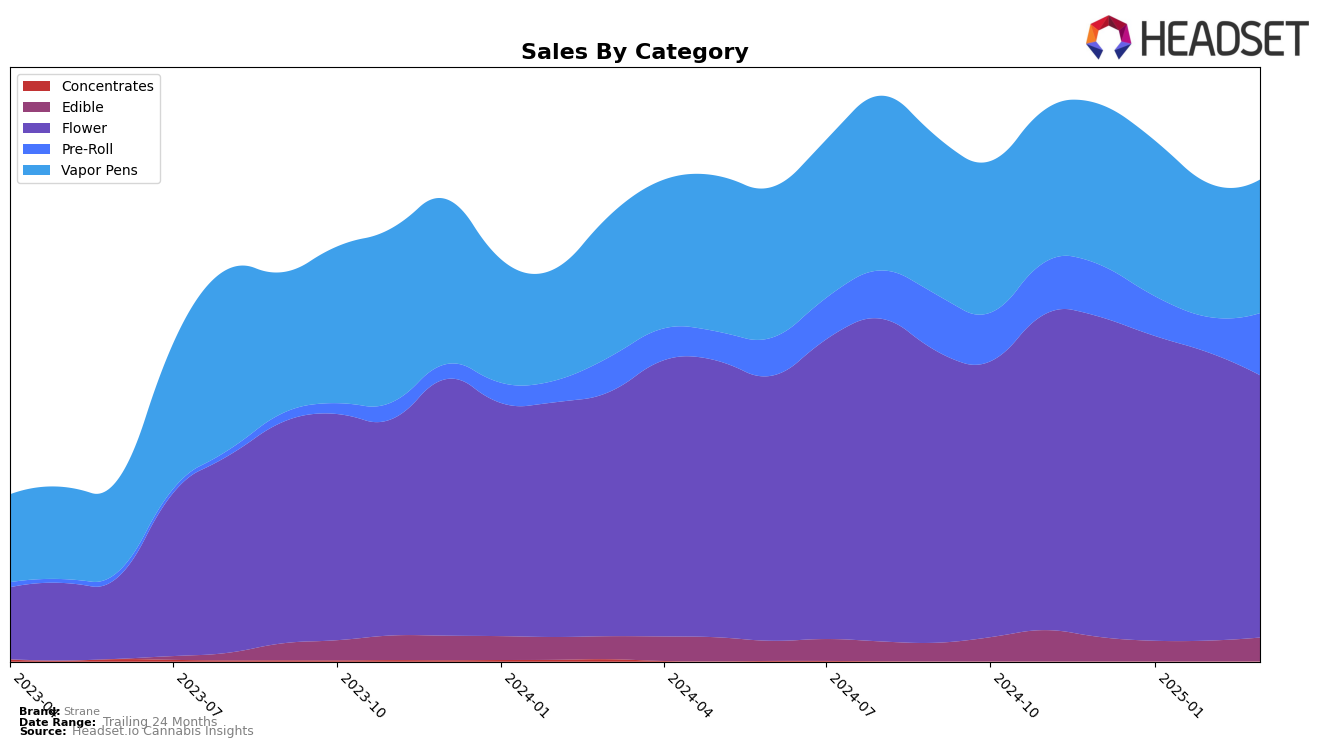

In the state of Massachusetts, Strane's performance in the Flower category has experienced a notable decline over the first quarter of 2025. Starting from a rank of 12 in December 2024, the brand slipped to 25 by March 2025, accompanied by a decrease in sales from $916,106 to $480,741. This trend suggests a weakening position in a competitive market. Meanwhile, in the Vapor Pens category, Strane maintained a relatively stable presence, ranking consistently between 8 and 10 during the same period, albeit with a gradual decline in sales figures. Interestingly, Strane did not make it into the top 30 for Pre-Rolls in February and March, indicating a potential area for improvement or a shift in consumer preference.

In Maryland, Strane has shown a more robust performance, particularly in the Flower category where it climbed to the third position in February 2025 before settling at fifth in March. This consistency highlights a strong foothold in Maryland's market. The brand also demonstrated resilience in the Pre-Roll category, where it improved its rank from 11 in January to 5 in March, alongside a notable increase in sales. However, Strane's presence in Michigan appears limited, as it failed to secure a spot in the top 30 for Flower in most of the months reported, indicating potential challenges or a nascent market presence in that state.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Strane has demonstrated notable fluctuations in its ranking and sales performance. As of March 2025, Strane holds the 5th position, a slight dip from its 3rd place in February 2025. This change in rank is influenced by the performance of competitors like District Cannabis, which consistently maintained a strong position, ranking 3rd in March 2025 with higher sales figures. Meanwhile, SunMed also saw an improvement, moving up to 4th place in March 2025. Despite these shifts, Strane's sales figures remain competitive, although they experienced a downward trend from December 2024 to March 2025. Brands like Savvy and Evermore Cannabis Company have not posed a significant threat to Strane's position, as they consistently ranked lower. This dynamic indicates that while Strane faces stiff competition, particularly from District Cannabis and SunMed, its market presence remains resilient, though it may need strategic adjustments to regain and maintain higher rankings.

Notable Products

In March 2025, the top-performing product for Strane was Reserve - Alien Mints (3.5g) in the Flower category, maintaining its position at rank 1 for four consecutive months with sales of 15,340 units. Juicee J (3.5g), also in the Flower category, held steady at rank 2, showcasing consistent popularity after climbing from rank 5 in December 2024. Lemon Maraschino (3.5g) saw an improvement, moving up to rank 3 from rank 5 in February 2025, indicating a rebound in consumer interest. The newly introduced Juicee J Pre-Roll 2-Pack (1g) debuted strongly at rank 4, suggesting a successful new product launch. Alien Mints Pre-Roll 2-Pack (1g), despite dropping to rank 5 from its previous positions, still maintained a solid presence in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.