Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

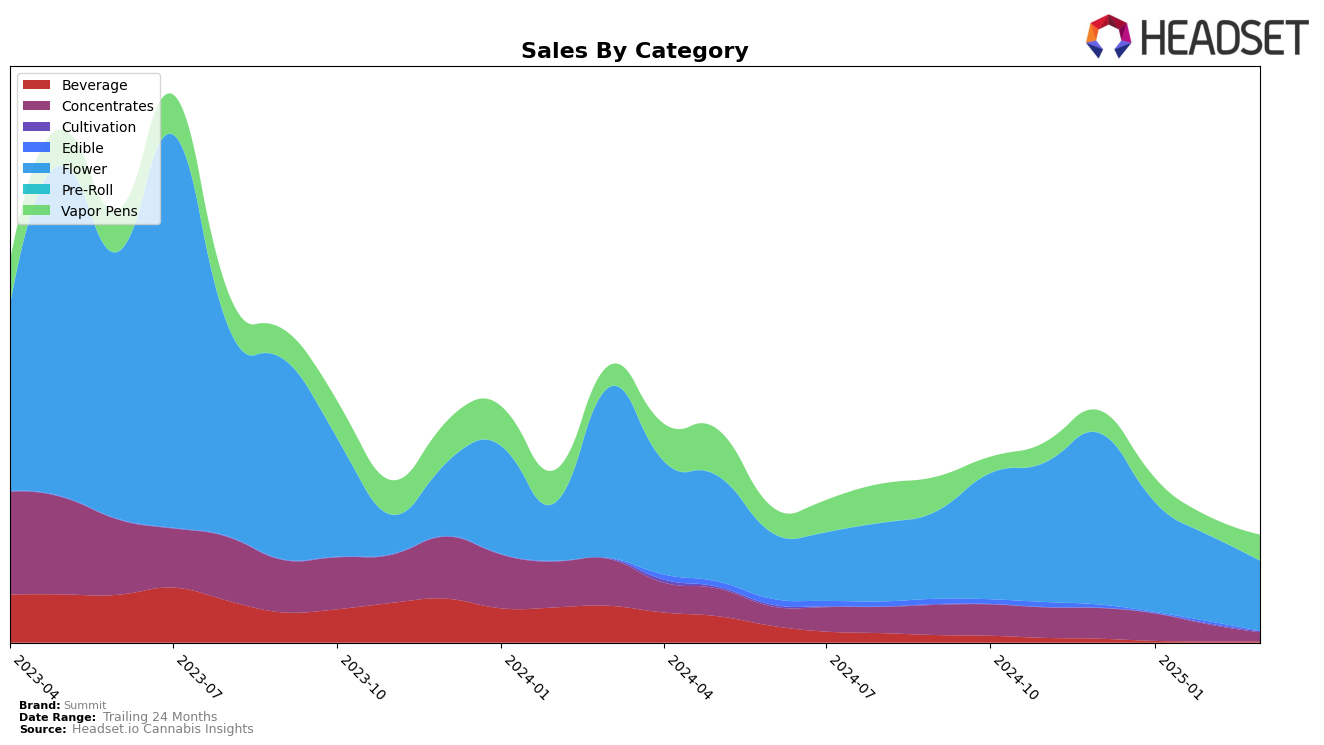

Summit's performance across different categories and states reveals some intriguing trends. In Colorado, the brand has shown a consistent presence in the Flower category, although its ranking has seen a gradual decline from 32nd in December 2024 to 56th by March 2025. This downward trend might be indicative of increasing competition or shifting consumer preferences in the state. Notably, Summit did not make it into the top 30 for Concentrates in Colorado, which could be a point of concern or an area for potential growth. Meanwhile, in the Vapor Pens category, Summit's ranking remained relatively stable, with minor fluctuations, suggesting a steady consumer base for this product line.

In Michigan, Summit's presence in the Concentrates category was visible at the end of 2024, with a ranking of 78th, which slipped to 90th in January 2025. However, the absence of rankings for February and March might suggest that Summit fell out of the top 30, indicating a potential decline in market share or sales volume. This could be a strategic area for Summit to focus on to regain visibility and traction. Overall, the data highlights both opportunities and challenges for Summit, with specific categories and regions showing varying degrees of performance that could inform future strategies.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Summit has experienced a notable shift in its market position over the past few months. Starting from a rank of 32 in December 2024, Summit's position has gradually declined to 56 by March 2025. This downward trend in ranking is mirrored by a decrease in sales, which fell from a high in December to lower figures by March. In contrast, Viola has shown a significant improvement, climbing from a rank of 92 to 54, with a corresponding increase in sales, particularly in March. Meanwhile, Rare Dankness and Sunshine Extracts have seen fluctuations in their rankings, with both brands experiencing a dip in March, though Rare Dankness maintained a higher rank than Summit throughout this period. Rocky Mountain High has remained relatively stable, showing a slight improvement by March. These dynamics suggest that Summit may need to reassess its market strategies to regain its competitive edge in the Colorado Flower market.

Notable Products

In March 2025, RS-11 Bulk emerged as the top-performing product for Summit, climbing from its previous rank of 2 in February to 1, with impressive sales figures reaching 4977 units. Sherbanger Bulk slipped to the second position after leading in February, while Tropic Cherry Bulk maintained its consistent performance at rank 3 for two consecutive months. Creamsicle Bulk entered the rankings at position 4, showing a notable presence after not being ranked in the prior months. Apricot Scone Bulk, which started strong in December 2024 at rank 1, has seen a steady decline, settling at rank 5 in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.