Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

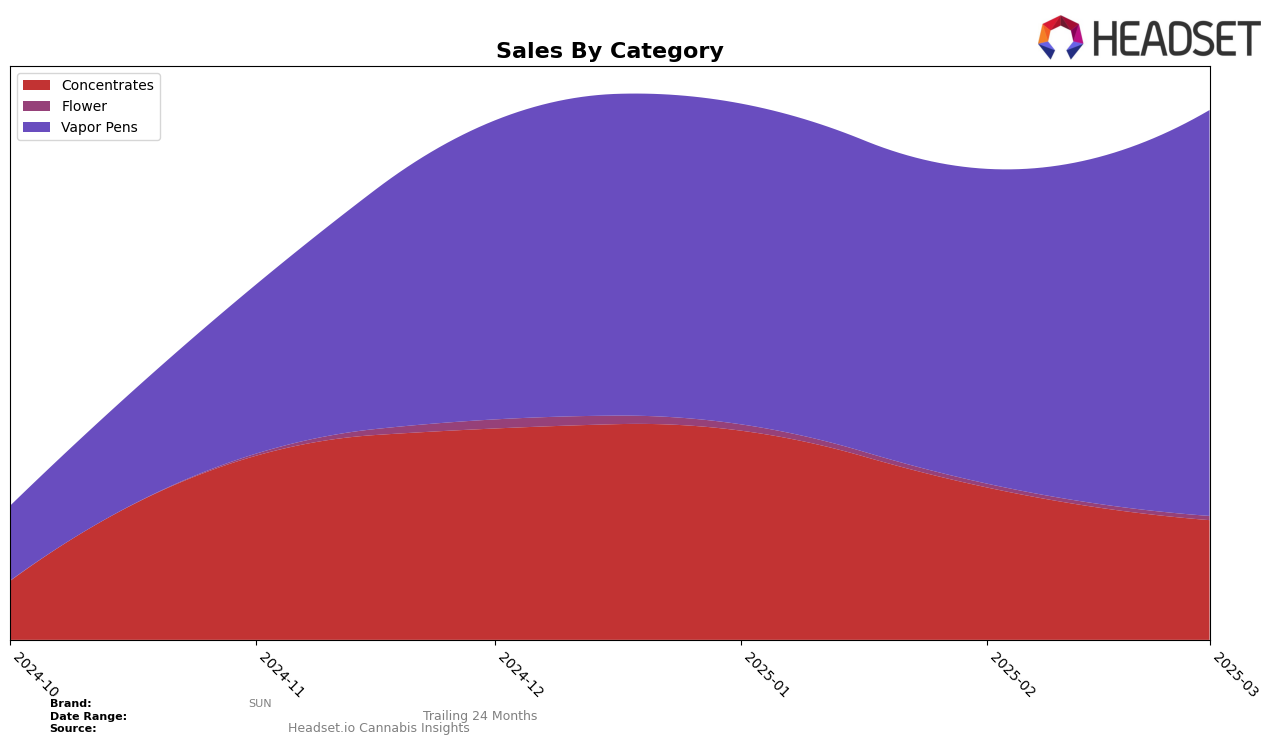

In the state of New Jersey, SUN has shown a consistent performance in the Concentrates category, maintaining a steady rank of 15th from January to March 2025. This stability indicates a strong foothold in this category, although there was a noticeable decline in sales from December 2024 to March 2025. The decrease in sales might suggest increasing competition or a shift in consumer preferences. On the other hand, SUN's absence from the top 30 in other categories suggests areas for potential growth or improvement.

Conversely, SUN's performance in the Vapor Pens category in New Jersey shows a promising upward trend. After starting at a rank of 33 in December 2024, SUN's rank slightly fluctuated but ultimately returned to 33 by March 2025, with a significant increase in sales during this period. This positive sales trend, despite the ranking fluctuation, could indicate growing consumer interest or successful marketing strategies. However, the lack of presence in the top 30 brands for other states or provinces in both categories suggests that SUN might need to explore expansion strategies to enhance its market presence beyond New Jersey.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, SUN has shown a noteworthy resilience in its market position from December 2024 to March 2025. Despite starting at the 33rd rank in December, SUN managed to maintain a consistent presence, fluctuating slightly but ultimately returning to its initial rank by March 2025. This stability is particularly significant when compared to competitors like MPX - Melting Point Extracts, which experienced a decline from 25th to 34th rank, and Superflux, which showed volatility but ended slightly better at 31st. Meanwhile, Drool improved its position from 37th in January to 32nd by March, indicating a positive trajectory. Notably, Old Pal entered the rankings in March at 36th, suggesting emerging competition. SUN's sales figures reflect a positive trend, particularly in March, where it outperformed its January and February numbers, contrasting with the declining sales of some competitors. This suggests that SUN is effectively leveraging its market strategies to maintain and potentially enhance its market share in the New Jersey vapor pen category.

Notable Products

In March 2025, the top-performing product for SUN was the Discodelic Live Resin Cartridge (0.5g) in the Vapor Pens category, which climbed to the number one rank with sales reaching 632 units. The Super Lemon Haze Live Resin Disposable (1.5g) made a notable debut at the second position, indicating strong market entry. Mango Gummibears Live Resin Disposable (0.5g) slipped to third place from its previous second-place ranking in February. Z Pie Live Resin Badder (1g) dropped to third place from consistently holding the top rank in prior months. Blueberry Cruffin Live Resin Disposable (0.5g) maintained its fourth position from February, showing stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.