Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

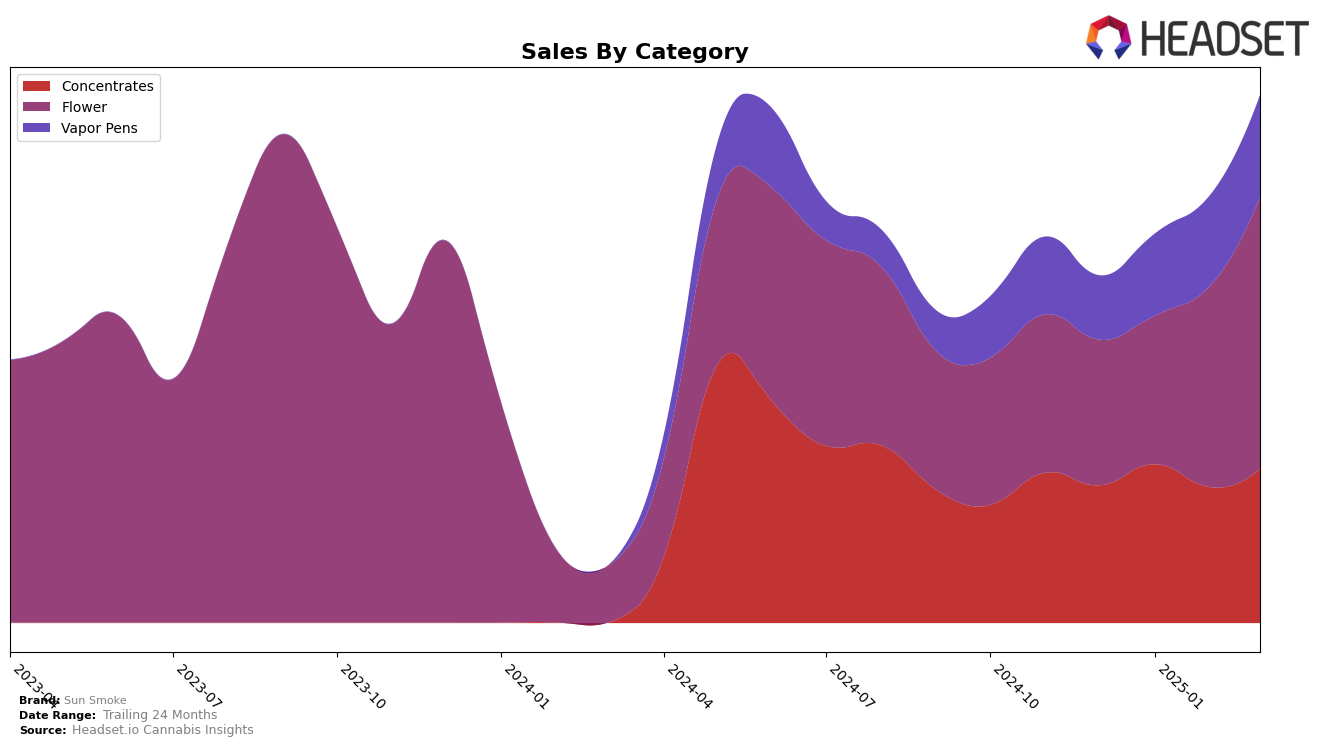

Sun Smoke has shown a noteworthy performance in the California cannabis market, particularly in the Concentrates category. The brand made a significant leap from being ranked 35th in December 2024 to 25th by March 2025. This upward movement indicates a strengthening presence and an increasing consumer preference for their products. However, in the Flower category, Sun Smoke has struggled to break into the top 30, only reaching the 97th position by March 2025. This suggests potential challenges in gaining traction or possibly a highly competitive landscape in this category.

In the Vapor Pens category, Sun Smoke has managed to enter the rankings, albeit at the lower end, moving from 95th to 94th from February to March 2025. This slight improvement suggests a slow but steady growth in consumer interest. Despite not being in the top 30, the entry into the rankings could be seen as a positive sign for future potential. The brand's performance across these categories highlights areas of success and opportunities for growth, particularly in the highly competitive California market. Further analysis would be needed to understand the specific strategies contributing to these trends.

Competitive Landscape

In the competitive landscape of the California Flower category, Sun Smoke experienced a notable shift in its market position from December 2024 to March 2025. Initially absent from the top 20 rankings, Sun Smoke emerged in March 2025, securing the 97th position. This entry into the rankings indicates a positive trajectory, likely driven by strategic marketing or product improvements. In contrast, Revelry Herb Company consistently maintained its presence in the top 100, fluctuating slightly but showing a downward trend from 80th in December 2024 to 85th by March 2025. Meanwhile, White Label / White Lvbel (NV) demonstrated a significant rise, moving from 98th in December 2024 to 79th in January 2025, although it did not sustain this momentum in the subsequent months. The absence of Greenline Organics and TRENDI from the top 20 throughout this period suggests they are trailing behind in terms of sales performance. Sun Smoke's entry into the rankings amidst these dynamics highlights its potential to capitalize on market opportunities and possibly climb higher in the future.

Notable Products

In March 2025, Sun Smoke's top-performing product was the Hybrid Blend Preground (14g) in the Flower category, maintaining its leading position from February. Granola Funk (3.5g) emerged as the second best-seller, achieving notable sales of 1018 units. Fatso (3.5g) secured the third position, marking its first appearance in the top rankings. Indica Blend Preground (28g) dropped to fourth place, despite showing strong sales in previous months. Banana Beltz (3.5g) rounded out the top five, entering the list for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.