Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

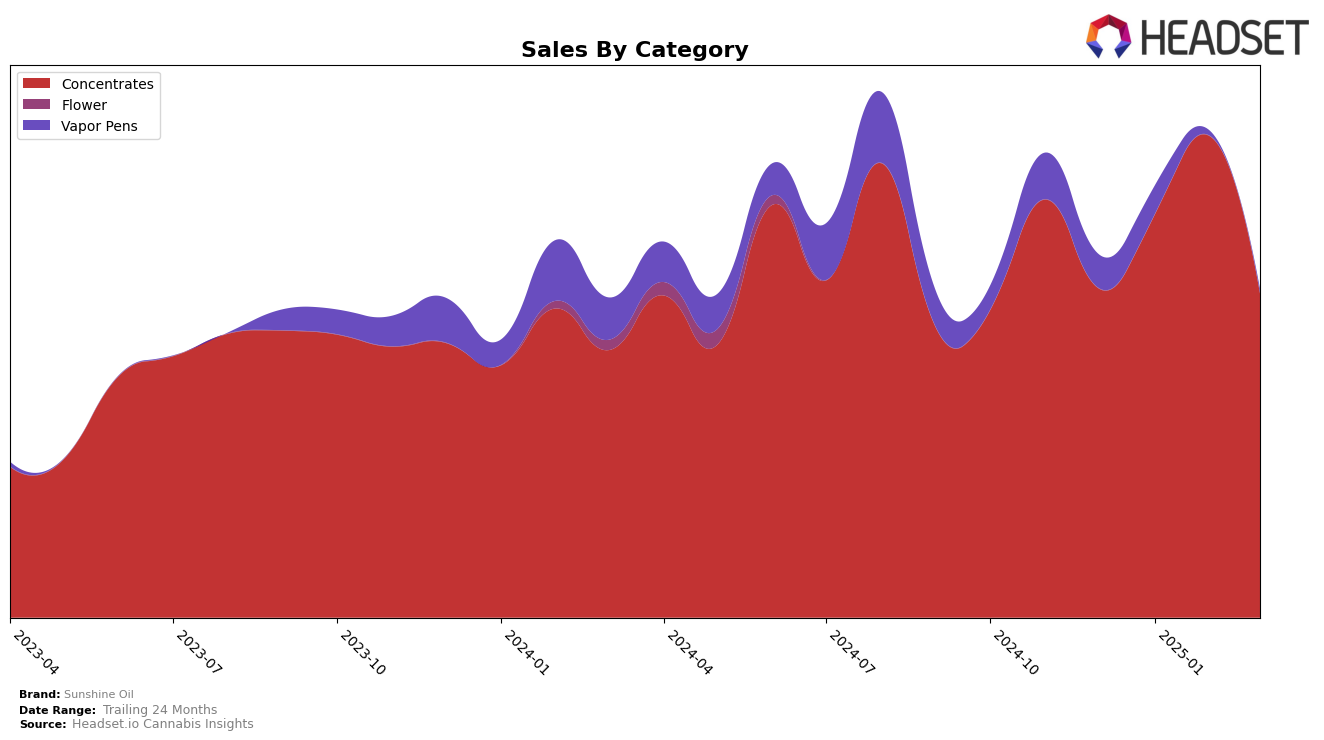

Sunshine Oil has shown dynamic performance in the Oregon market, particularly within the Concentrates category. Starting from a rank of 17 in December 2024, the brand improved its position to 13 in January and then further to 10 in February, before experiencing a slight drop to 19 in March 2025. This fluctuation indicates a competitive landscape where Sunshine Oil has managed to climb the ranks, though sustaining a top position remains a challenge. Notably, their sales peaked in February, suggesting a successful strategy during that period, but they faced a setback in March, reflecting the volatility of consumer preferences or market competition.

In the Vapor Pens category, Sunshine Oil's presence in Oregon was less prominent as they did not make it into the top 30 ranks after December 2024, where they were positioned at 95. This absence from the rankings in the following months suggests a need for strategic adjustments to capture market share in this segment. The contrast between their performance in Concentrates and Vapor Pens highlights the brand's varying success across different product categories, and it underscores the importance of targeted strategies to enhance their standing in underperforming areas.

Competitive Landscape

In the competitive landscape of the Oregon concentrates market, Sunshine Oil experienced notable fluctuations in its ranking from December 2024 to March 2025. Starting at 17th place in December, Sunshine Oil climbed to 10th in February, marking a significant improvement, before dropping to 19th in March. This volatility is mirrored in its sales performance, which peaked in February before declining in March. Competitors like Echo Electuary and Disco Dabs also showed dynamic ranking shifts, with Echo Electuary dropping from 9th to 17th and Disco Dabs slipping from 14th to 20th over the same period. Notably, Farmer's Friend Extracts improved its position, moving from 25th to 18th, suggesting a competitive pressure on Sunshine Oil. These trends highlight the competitive and fluctuating nature of the market, indicating that Sunshine Oil's ability to maintain and improve its ranking is crucial for sustaining its sales momentum.

Notable Products

In March 2025, Granny Mac Shatter (1g) emerged as the top-performing product for Sunshine Oil, leading the sales with 763 units sold. Sunset Runtz Shatter (2g) and Project Runtz Shatter (1g) followed closely, securing the second and third positions, respectively. Outlaw Shatter (1g) ranked fourth, while Green Thang Shatter (1g) rounded out the top five. Notably, all these products were not ranked in the previous months, indicating a significant rise in their popularity and market presence. This shift suggests a growing consumer preference for the Concentrates category within Sunshine Oil's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.