Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

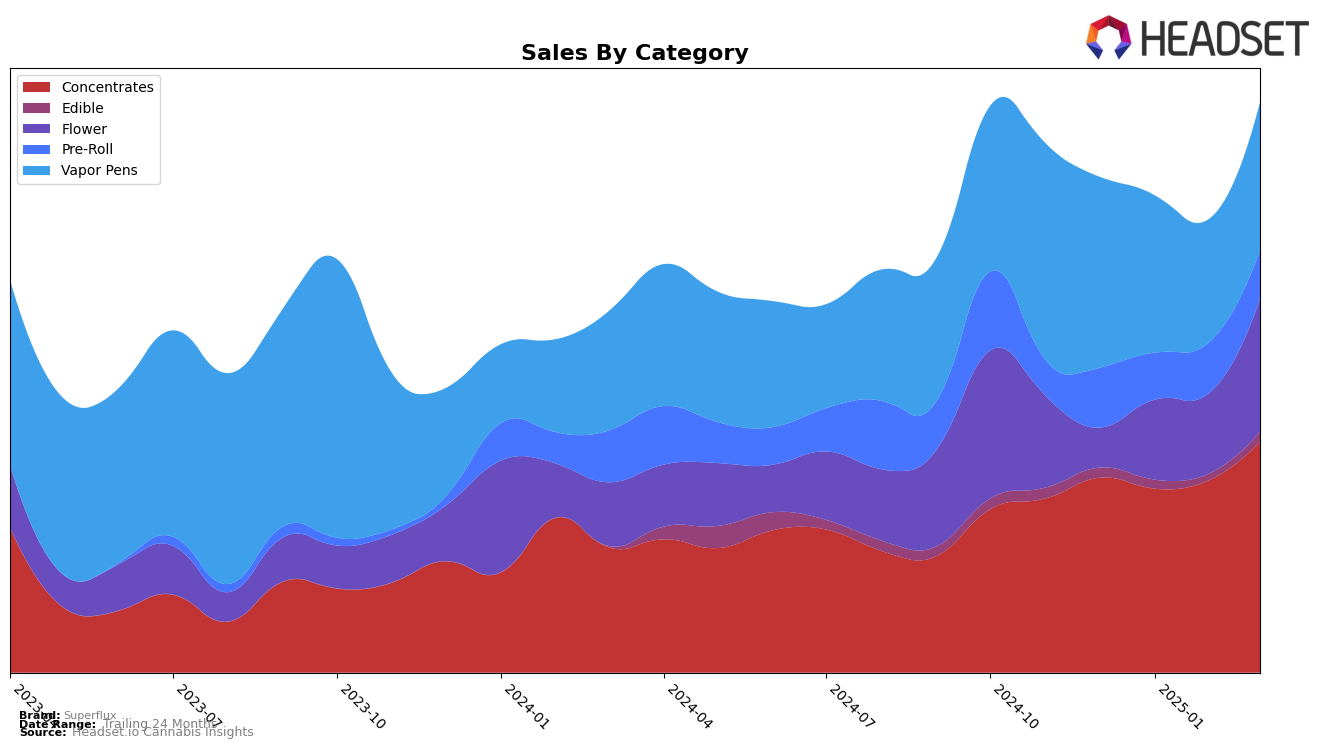

Superflux has demonstrated a notable performance trajectory across various categories and states. In Illinois, the brand made significant strides in the Concentrates category, ascending from 19th place in December 2024 to 10th by March 2025. This upward movement is indicative of a strong market presence and growing consumer preference. However, the brand's performance in the Vapor Pens category saw fluctuating rankings, with a dip to 44th place in February 2025 before rebounding to 40th in March. This suggests a volatile market position in this category. In contrast, Superflux's Pre-Roll category rankings in Illinois declined from 40th to 45th, highlighting potential challenges in maintaining consumer interest in this product line.

In New Jersey, Superflux maintained a robust position in the Concentrates category, consistently ranking in the top three throughout the observed period. This consistent performance underscores the brand's strong foothold and consumer loyalty in the state. The Flower category, however, experienced more variability, with rankings fluctuating from 44th in December 2024 to 40th by March 2025. Meanwhile, in Ohio, Superflux's performance in the Concentrates category improved significantly, moving from 10th place in December 2024 to 8th by March 2025. Despite this progress, the Vapor Pens category saw a decline in rankings, dropping to 32nd place by March, which may indicate a competitive market environment or shifting consumer preferences.

Competitive Landscape

In the competitive landscape of concentrates in New Jersey, Superflux has maintained a strong presence, consistently ranking within the top three from December 2024 to March 2025. Despite a slight dip from second to third place in February and March 2025, Superflux's sales trajectory has been upward, indicating robust consumer demand. Notably, Grassroots has been a formidable competitor, holding the second position consistently and even surpassing Superflux in sales during this period. Meanwhile, Verano and Kind Tree Cannabis have shown fluctuations in their rankings, with Verano experiencing a notable drop in January and February 2025, which could suggest an opportunity for Superflux to capitalize on any potential market share shifts. Overall, Superflux's stable ranking and increasing sales highlight its competitive strength in the New Jersey concentrates market.

Notable Products

In March 2025, the top-performing product for Superflux was Gelato Zkittles Cake (2.83g) in the Flower category, which rose to the number one rank with sales of 2388 units. The Stoke (3.5g), also in the Flower category, dropped to the second position, maintaining a close competition with consistent sales figures from February. Red Carpet Runtz Infused Pre-Roll 2-Pack (1g) entered the rankings at third place, indicating a strong debut in the Pre-Roll category. Super Silver Haze Live Cured Resin Sugar (1g) secured the fourth position in the Concentrates category, showing steady interest. Lemon Dosi (3.5g) was ranked fifth in the Flower category, highlighting a diverse range of top-performing products for Superflux in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.