Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

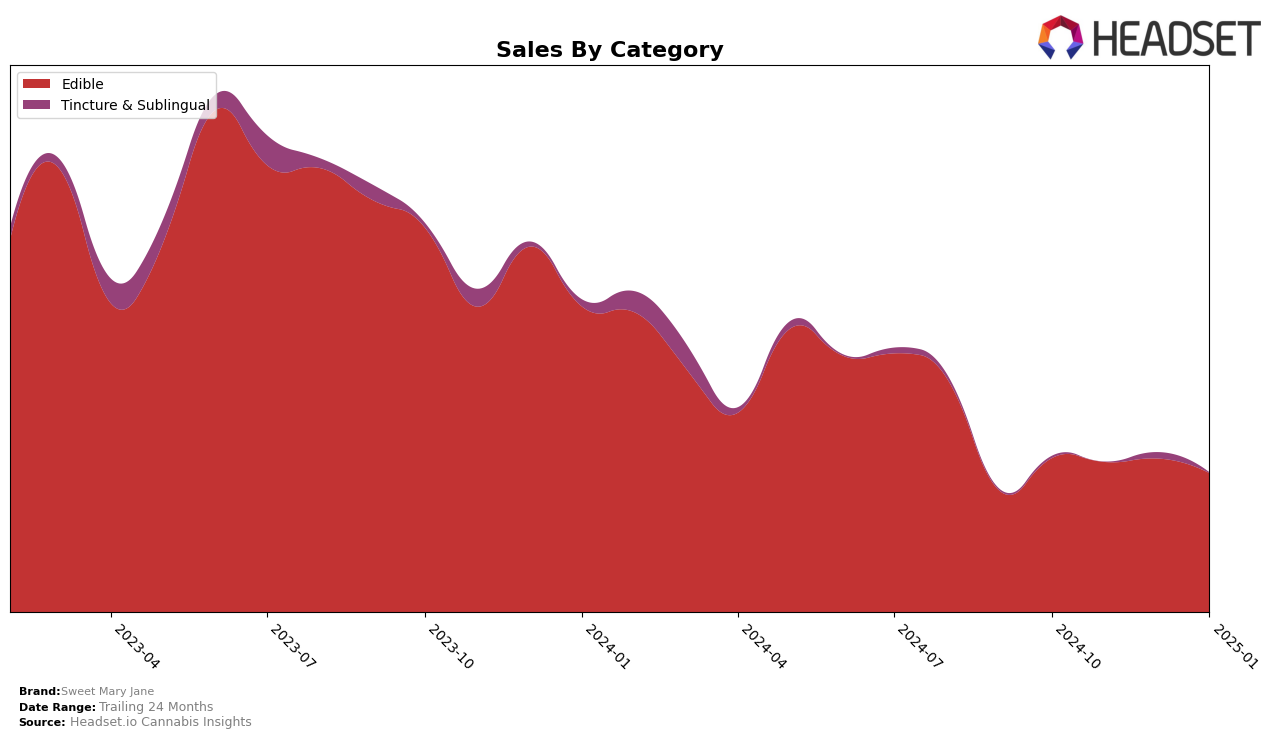

Sweet Mary Jane has shown a consistent presence in the Colorado edibles market, although it has struggled to break into the top 30 rankings. Over the months from October 2024 to January 2025, the brand maintained a steady position just outside the top 30, ranking 33rd in both October and November, and slightly improving to 32nd in December and January. Despite this, the brand's sales figures in Colorado have experienced a slight decline, with a notable drop from October to January. This indicates a potential challenge in increasing market share within the highly competitive edibles category in the state.

Across other states and categories, Sweet Mary Jane's performance varies, reflecting different market dynamics and consumer preferences. In some regions, the brand does not appear within the top 30 rankings, suggesting opportunities for growth or areas where the brand might need to enhance its market strategy. The absence of rankings in certain states could be seen as a challenge, indicating that Sweet Mary Jane may need to innovate or adjust its offerings to better align with local consumer tastes. This variability highlights the importance of localized strategies and the potential for expansion if the brand can capitalize on emerging trends and consumer demands in these markets.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Sweet Mary Jane has shown a steady presence, maintaining its rank at 32 by January 2025, despite a slight dip in sales from October 2024 to January 2025. This stability in rank is notable given the fluctuations experienced by competitors such as Devour, which saw a significant drop from rank 21 in October 2024 to 30 by January 2025, despite initially higher sales. Meanwhile, Nove Luxury Chocolate experienced a decline from rank 17 to 31, with sales decreasing sharply over the same period. The consistent ranking of Sweet Mary Jane, amidst these shifts, suggests a loyal customer base and effective market positioning. Competitors like ROBHOTS and Chaos Crispies did not pose a significant threat, as they remained outside the top 30 rankings. This analysis highlights Sweet Mary Jane's resilience and potential for growth in a dynamic market.

Notable Products

In January 2025, the top-performing product from Sweet Mary Jane remains the Hybrid Classic Pot Brownie (100mg) in the Edible category, maintaining its first-place ranking since October 2024 with sales of 1149 units. The Cookie Dough Cookies (100mg) also held steady in the second position, although its sales have gradually decreased over the months. Notably, Sweet Mary Jane Brownies (100mg) climbed to the second rank in January, matching the sales of Cookie Dough Cookies, showing a significant improvement from its fourth position in October. The CBD:THC 10:1 Butter & Sea Salt Popcorn (100mg CBD, 10mg THC) made an impressive leap to third place in January from its previous absence in the top rankings. Hybrid Salted Caramel Cookies (100mg) returned to the rankings at third place, after not being ranked in December, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.