Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

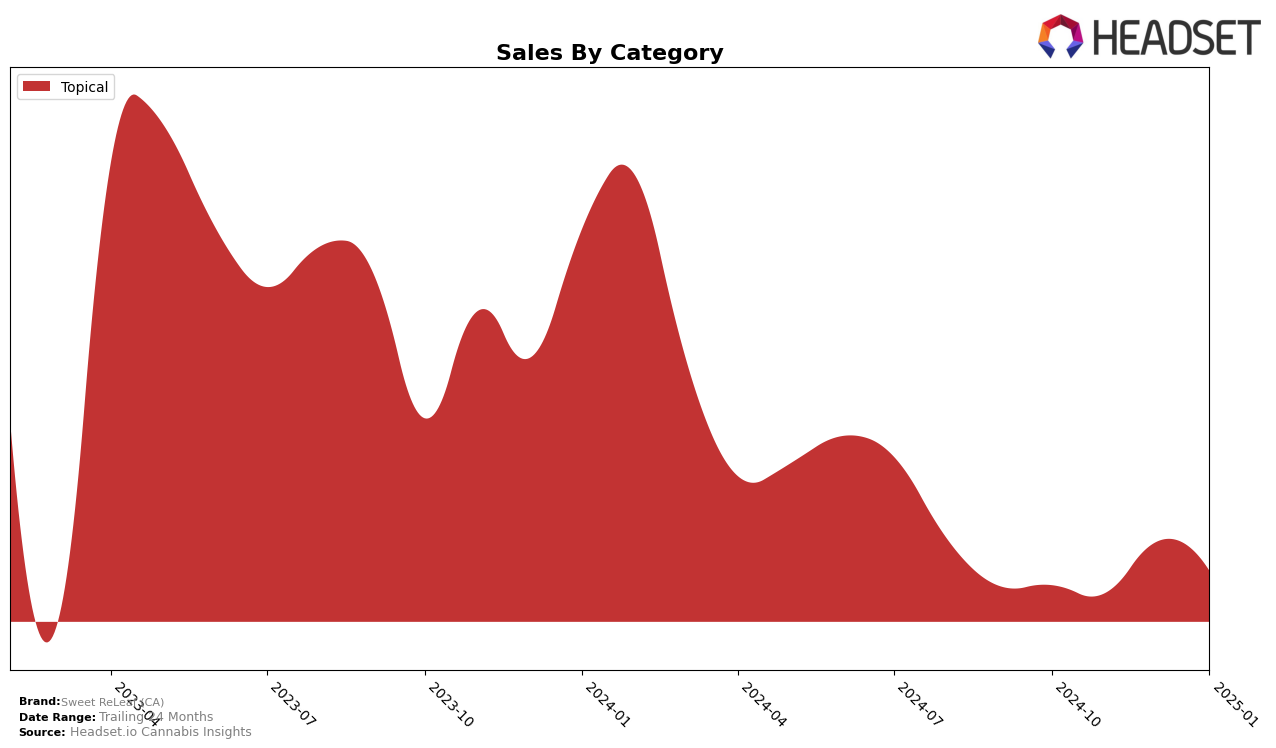

Sweet ReLeaf (CA) has shown a solid performance in the Topical category within California, maintaining a strong presence in the top rankings over several months. The brand's rank fluctuated slightly from 6th in October 2024 to 7th in November 2024, but it bounced back to 5th place in both December 2024 and January 2025. This consistent ranking in the top 10 indicates a stable demand for their products in the Topical category. Notably, their sales figures saw a notable increase in December, reflecting a seasonal boost or a successful promotional strategy. However, the brand's absence from the top 30 in other states or categories suggests areas for potential growth and expansion.

While Sweet ReLeaf (CA) has demonstrated resilience in California's Topical category, their lack of presence in the top 30 rankings of other states or categories highlights a significant opportunity for the brand to expand its market share. This absence could be perceived as a gap in their distribution or marketing strategy outside of California, or possibly a focus on maintaining a stronghold in their home state. The brand's ability to capitalize on this opportunity could dictate their future growth trajectory, especially if they aim to diversify their product offerings or enter new markets. Understanding the factors that contribute to their success in California could provide valuable insights for replicating this performance elsewhere.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, Sweet ReLeaf (CA) has shown a dynamic performance over the past few months. Notably, Sweet ReLeaf (CA) experienced a fluctuation in its ranking, moving from 6th place in October 2024 to 7th in November, before climbing back to 5th in December and maintaining that position in January 2025. This upward trend in the latter months suggests a positive reception to their product offerings or marketing strategies. In comparison, Care By Design consistently held the 5th and 6th positions, indicating a stable but slightly declining sales trend. Meanwhile, Kush Queen improved its rank from 8th to 7th, with a notable sales increase in December, which could pose a competitive challenge. Buddies and Carter's Aromatherapy Designs (C.A.D.) maintained strong positions at 3rd and 4th, respectively, with Buddies leading in sales by a significant margin. Sweet ReLeaf (CA)'s ability to regain its rank amidst such strong competitors highlights its resilience and potential for growth in the California market.

Notable Products

In January 2025, Sweet ReLeaf (CA) saw its CBD:THC 1:14 Comfort + Extra Strength Body Butter (9.5mg CBD, 131mg THC, 25ml) rise to the top spot in sales, achieving a raw sales figure of 312 units. This product improved from a consistent third place in the previous months to first place, indicating a significant increase in popularity. The CBD:THC 1:14 Comfort + Extra Strength Body Butter (37.5mg CBD, 525mg THC, 100ml) maintained its strong performance, holding the second rank after previously being first or second. The CBD:THC 1:14 Body Butter Comfort Plus Creme (18.75mg CBD, 263mg THC, 50ml), which was the top-ranked product in November and December 2024, dropped to third place in January. The CBD:THC 1:14 Comfort Warm Dry Oil (6.5mg CBD, 90mg THC, 10ml, 0.33oz) consistently remained in the fifth position, except for November, where it was not ranked.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.