Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

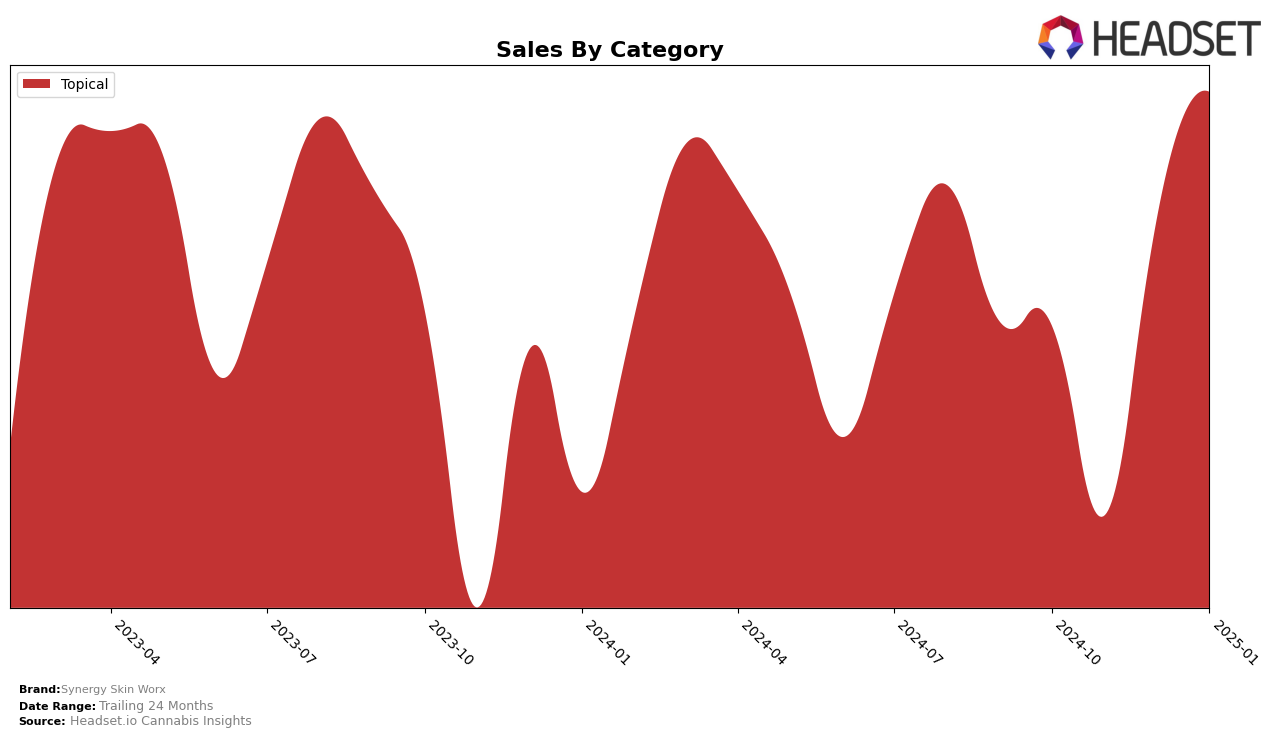

Synergy Skin Worx has demonstrated notable performance in the Topical category, particularly in Oregon. Over the months from October 2024 to January 2025, the brand consistently maintained a strong presence, ranking fourth in October and November, and improving to third in December and January. This upward movement in rankings is accompanied by a significant increase in sales, with January 2025 seeing a peak of $32,687. Such performance indicates a growing consumer preference and market penetration in Oregon's topical cannabis segment.

However, the performance of Synergy Skin Worx beyond Oregon remains less clear due to the absence of rankings in other states or provinces within the top 30 brands. This could either suggest a focus on strengthening their market share in Oregon or indicate potential challenges in expanding their footprint into other regions. The lack of presence in other markets might be an area for strategic development, considering the competitive nature of the cannabis industry and the potential for growth in new territories. Further insights into their strategies and market dynamics could provide a deeper understanding of their brand trajectory.

Competitive Landscape

In the Oregon Topical category, Synergy Skin Worx has shown a notable upward trend in its market positioning, climbing from the 4th rank in October 2024 to the 3rd rank by December 2024, where it maintained its position into January 2025. This positive shift in rank is indicative of a significant increase in sales, particularly evident in December 2024 and January 2025, where Synergy Skin Worx surpassed competitors like Physic Cannabis Therapy and Angel (OR). Despite the stronghold of High Desert Pure and Medicine Farm in the top two positions, Synergy Skin Worx's consistent sales growth suggests a strengthening brand presence and potential to challenge higher-ranked competitors in the near future.

Notable Products

In January 2025, the top-performing product for Synergy Skin Worx was the CBD/CBN/CBC/CBG/THC Entourage Patch, maintaining its first-place rank from December 2024, with notable sales figures reaching 925 units. The High CBD Transdermal Patch held steady in the second position, mirroring its rank from the previous month with sales of 605 units. The CBD/CBC/CBN/CBG/THC : 2:1 Entourage Transdermal Patch remained consistently in the third spot, though its sales dipped compared to December. The CBD/THC 1:1 Transdermal Patch (40.3mg CBD, 35.04mg THC) stayed in fourth place, reflecting a steady ranking since November 2024. Lastly, the CBD/THC 1:1 Transdermal Patch (25mg CBD, 24mg THC) maintained its fifth position, showing slight improvement in sales from the prior month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.