Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

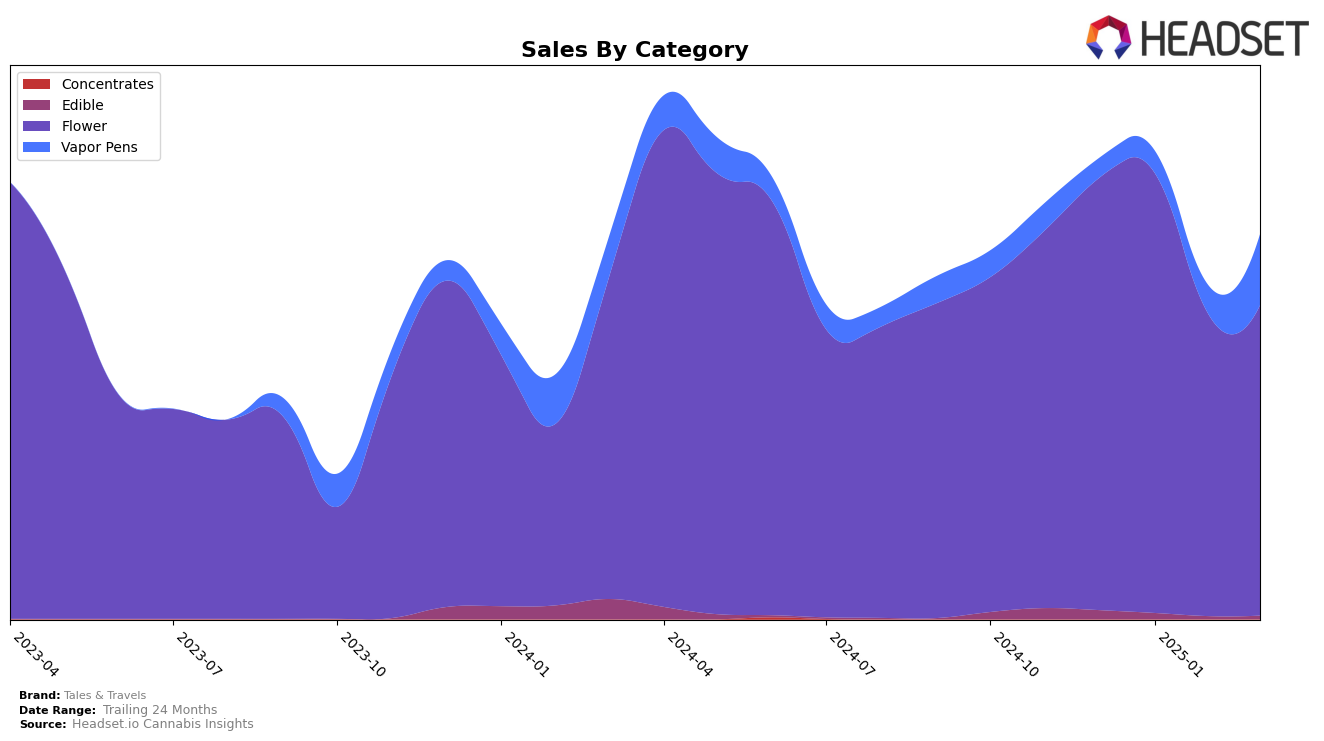

In the state of Illinois, Tales & Travels has shown varied performance across different product categories. In the Flower category, the brand maintained a strong presence, holding a rank of 13 in December 2024, slightly improving to 11 in January 2025, but then dropping to 17 in both February and March 2025. This indicates a relatively stable, yet slightly declining trend in their Flower sales. On the other hand, their performance in the Edible category was less impressive, as they were ranked 52 in December 2024 and did not make it to the top 30 in the following months, suggesting a significant challenge in gaining traction in this category.

The Vapor Pens category, however, tells a different story for Tales & Travels in Illinois. The brand showed consistent improvement, moving from a rank of 59 in December 2024 to 35 by March 2025. This upward trajectory indicates a growing acceptance and demand for their Vapor Pen products, which could be a promising area of expansion. The sales figures also reflect this positive trend, with a noticeable increase from January to March 2025. Overall, while the brand faces challenges in some categories, there are clear opportunities for growth, particularly in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Tales & Travels has experienced notable fluctuations in its ranking over recent months. Starting from a rank of 13 in December 2024, the brand improved to 11 in January 2025, but then dropped to 17 in February and maintained this position in March. This indicates a need for strategic adjustments to regain momentum. In comparison, Revolution Cannabis consistently outperformed Tales & Travels, maintaining a top 10 position until March, when it fell to 16. Meanwhile, UpNorth Humboldt and Lula's have shown less stable ranks, with UpNorth Humboldt dropping to 19 in March and Lula's improving to 18. Interestingly, The Botanist made a significant leap from 24 in February to 15 in March, suggesting a potential threat to Tales & Travels' market share. These dynamics highlight the competitive pressures and opportunities for Tales & Travels to enhance its market position in Illinois.

Notable Products

In March 2025, the top-performing product for Tales & Travels was the Blue Razz Distillate Disposable 1g, leading the sales in the Vapor Pens category with 1431 units sold. Following closely was Fruit Stand 3.5g in the Flower category, which climbed to the second position after ranking third in February. Sunset Sherb 3.5g, also in the Flower category, dropped to the third rank after being the top product in February. Raspberry Shortcake 3.5g fell to fourth place from its second-place position in February, showing a notable decline in sales. Berry Cherry Distillate Disposable 1g entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.