Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

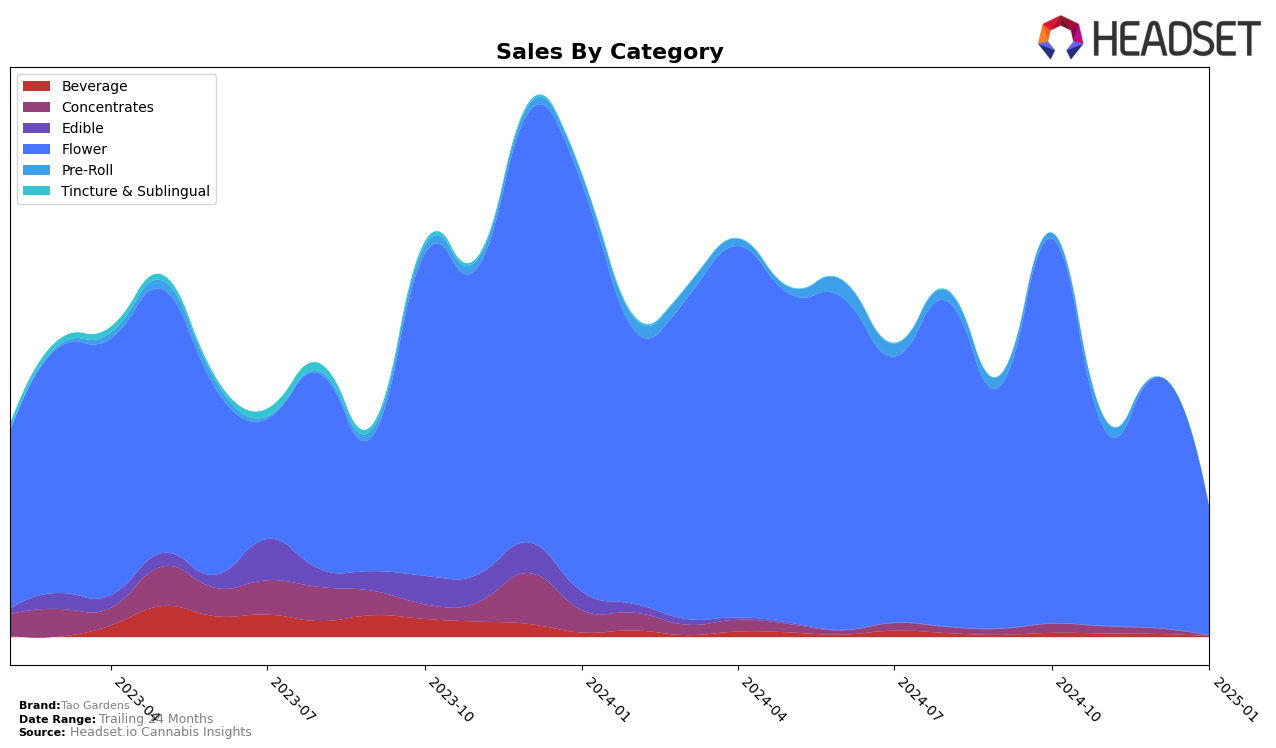

Tao Gardens has been experiencing some fluctuations in its performance across various states and categories, particularly in the flower category within Oregon. In October 2024, the brand managed to secure the 28th position, but by November, it had dropped out of the top 30, landing at 59th place. This decline was followed by a slight improvement in December, moving up to the 42nd rank, before falling again to 69th in January 2025. Such volatility indicates a challenging market environment or potential internal adjustments within the brand. The sales figures reflect this instability, with a notable decrease from October to January, suggesting that Tao Gardens might need to reassess its strategies in the Oregon market.

While the flower category in Oregon shows a downward trend for Tao Gardens, it is crucial to observe how this brand is performing in other states and categories where data might not be as readily available. The absence of rankings in other states or categories implies that Tao Gardens did not make it to the top 30, which could be either a concern or an opportunity for growth. Understanding these dynamics would require a closer look at market conditions and consumer preferences in those regions. Such insights could help Tao Gardens identify potential areas for expansion or improvement to bolster its market presence and performance.

Competitive Landscape

In the competitive landscape of the Flower category in Oregon, Tao Gardens has experienced notable fluctuations in its market position, which may impact its sales trajectory. From October 2024 to January 2025, Tao Gardens' rank shifted from 28th to 69th, indicating a significant decline in its competitive standing. This downward trend in rank correlates with a decrease in sales over the same period. In contrast, competitors such as Decibel Farms and Belushi's Farm have shown more stability, with Decibel Farms re-entering the top 100 in January 2025 and Belushi's Farm maintaining a consistent presence in the rankings. Additionally, Piff Stixs improved its rank from 77th in October 2024 to 60th in January 2025, suggesting a positive sales momentum. These dynamics highlight the competitive pressures Tao Gardens faces, emphasizing the need for strategic adjustments to regain market share in the Oregon Flower category.

Notable Products

In January 2025, Cap Junky (Bulk) reclaimed its position as the top-performing product for Tao Gardens, despite a slight drop in sales to 1167 units from previous months. True Glue (Bulk) rose to the second position, showing a consistent performance with 978 units sold. Jungle Juice (Bulk) made its debut in the rankings, securing the third spot with 711 units sold. True Glue (1g) and Big Wilson (3.5g) followed in fourth and fifth place, respectively, marking their first appearances in the top five. These shifts highlight a dynamic sales landscape for Tao Gardens, with Cap Junky maintaining a strong presence despite fluctuating sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.