Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

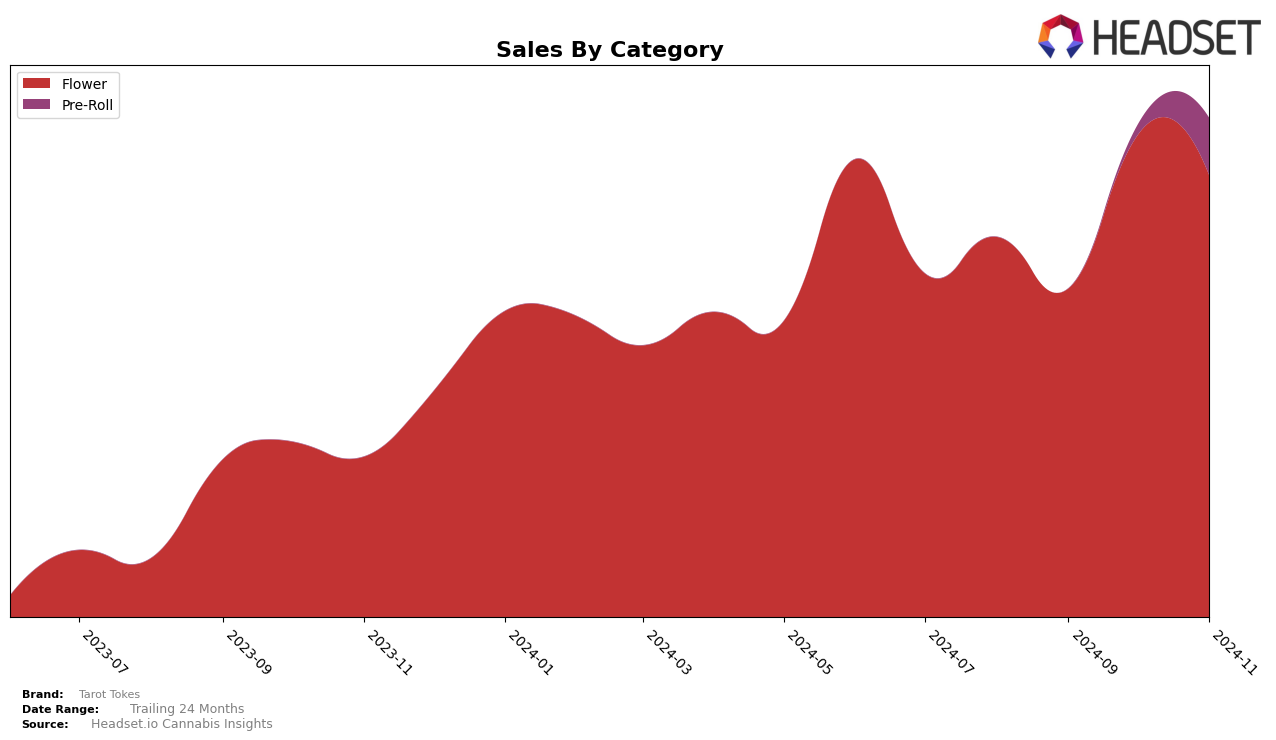

In the competitive landscape of cannabis brands, Tarot Tokes has shown a notable upward trajectory in the New York market, particularly within the Flower category. The brand has climbed from a rank of 36 in August 2024 to 25 by November 2024, indicating a strong performance and increased consumer preference. This consistent rise in ranking is complemented by a significant increase in sales from September to October, suggesting a successful strategic move or product offering that resonated with consumers during that period. However, it's worth noting that Tarot Tokes did not make it into the top 30 in the Pre-Roll category until November, where they debuted at rank 68, highlighting potential areas for growth or increased marketing focus.

While Tarot Tokes has made strides in the Flower category, their absence from the top 30 in the Pre-Roll category in the months leading up to November suggests a disparity in brand strength across different product types. This could point to a need for Tarot Tokes to reassess their strategy in the Pre-Roll space or perhaps capitalize on their strengths in Flower to drive overall brand growth. The brand's performance in New York serves as a case study in how targeted efforts can yield significant improvements in market positioning, with potential lessons for their approach in other states or categories. As Tarot Tokes continues to navigate the evolving cannabis market, monitoring these trends will be crucial for sustaining their upward momentum.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Tarot Tokes has demonstrated a notable upward trajectory in rankings and sales over recent months. From August to November 2024, Tarot Tokes improved its rank from 36th to 25th, showcasing a significant rise in market presence. This positive trend is contrasted by the performance of competitors such as Florist Farms, which experienced a decline from 15th to 23rd, and Hepworth, which fell from 13th to 24th. Meanwhile, Gypsy Weed made a remarkable leap from not being in the top 60 to reaching 27th place by November. Despite these shifts, Tarot Tokes' consistent improvement in rank and sales positions it favorably against its competitors, suggesting a strengthening brand presence and potential for continued growth in the New York Flower market.

Notable Products

In November 2024, Tarot Tokes' top-performing product was Lilac Diesel (3.5g) in the Flower category, maintaining its number one rank from previous months with impressive sales of 2125 units. The Lilac Diesel Pre-Roll 2-Pack (1g) climbed to the second position, showing a significant increase from its fourth place in October. Blue Ice (3.5g) held steady at the third rank, consistent with its October standing. The new entry, Lilac Diesel Pre-Roll 7-Pack (3.5g), debuted at fourth place, indicating strong market interest. Meanwhile, Chem Dawg (3.5g) experienced a notable drop from second to fifth position, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.