Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

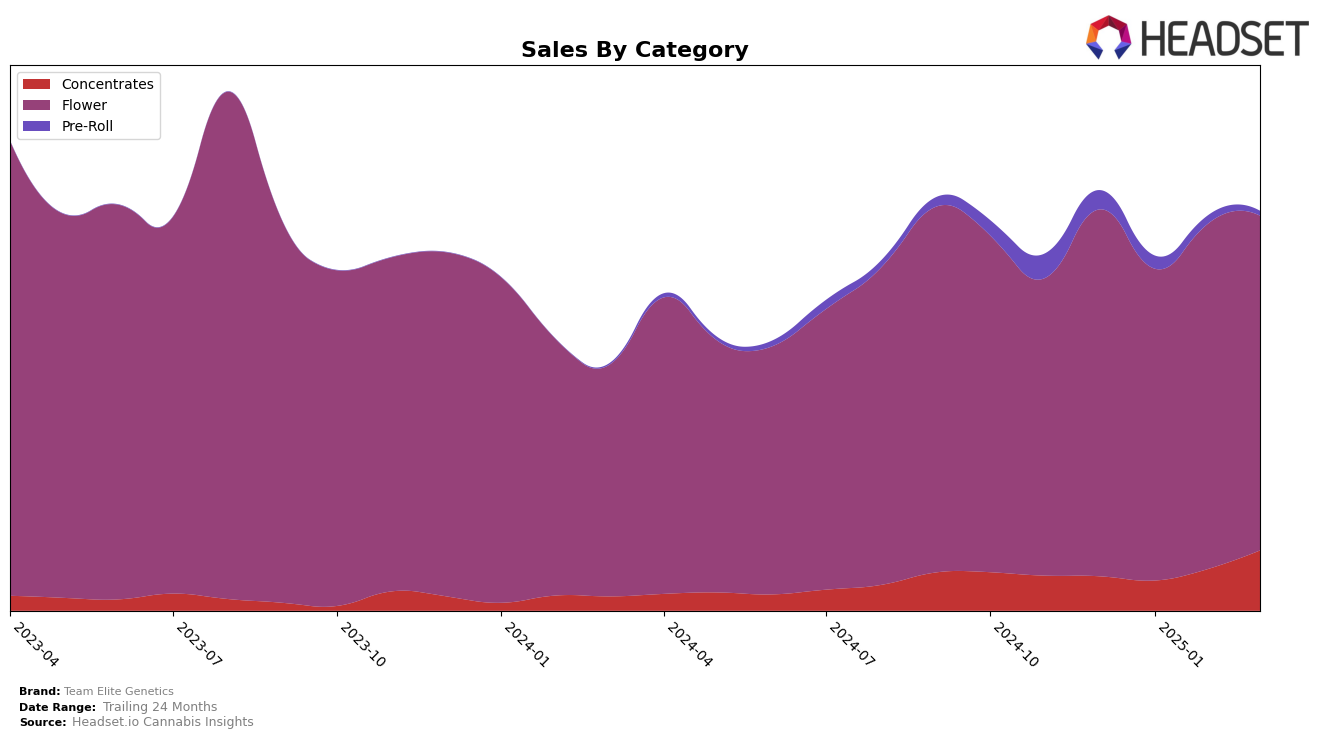

In the California market, Team Elite Genetics has shown a notable upward trajectory in the concentrates category. Starting from a rank of 50 in December 2024, the brand climbed to 29 by March 2025, indicating a significant improvement in market presence and consumer preference. This rise is complemented by a substantial increase in sales, with March 2025 figures reaching 115,532 USD, showcasing strong consumer demand. Conversely, the flower category presents a more stable yet less dynamic performance. The brand's ranking in this category fluctuated slightly, with a peak at 34 in February 2025, but generally remained in the mid-30s range, suggesting steady but not extraordinary growth. The absence of rankings in other states implies that Team Elite Genetics is yet to break into the top 30 in those regions, which could be seen as an area of potential growth or a current limitation in their market reach.

While Team Elite Genetics has made strides in the California concentrates market, the flower category tells a different story. Despite a consistent presence, the brand's ranking did not surpass 34 over the observed months, indicating a plateau in this segment. This stability, however, could be interpreted as maintaining a loyal customer base in a competitive market. The absence of rankings in other states or provinces highlights a strategic focus on California or possibly challenges in expanding their footprint. This concentrated effort in California could either be a strategic decision to dominate a local market before expanding or a sign of difficulties in penetrating other markets. Understanding the underlying reasons for these trends could provide insights into the brand's operational strategies and market positioning.

Competitive Landscape

In the competitive landscape of the California Flower category, Team Elite Genetics has experienced fluctuating ranks from December 2024 to March 2025, moving from 36th to 35th position. This indicates a relatively stable performance amidst a competitive market. Notably, Decibel Gardens and Dab Daddy have shown stronger upward trends, with Decibel Gardens climbing from 39th to 30th and Dab Daddy reaching as high as 18th in February 2025. These competitors have consistently outperformed Team Elite Genetics in sales, suggesting a need for strategic adjustments to capture more market share. Meanwhile, Almora Farms and Time Machine have remained lower in rank, with Almora Farms not breaking into the top 45 and Time Machine only reaching 48th by March 2025. This competitive analysis highlights the importance for Team Elite Genetics to innovate and differentiate to improve its standing and sales in the California market.

Notable Products

In March 2025, Styrofoam Cup (3.5g) maintained its position as the top-performing product from Team Elite Genetics, with sales figures reaching 3,485 units. J1 (3.5g) consistently held the second rank throughout the past months, with March sales at 1,738 units. Pearadise (3.5g) climbed to the third position in March, marking a notable improvement from its absence in the rankings in January and February. Purple Dump Truck (3.5g) entered the rankings for the first time, securing the fourth spot with sales of 1,069 units. Freeze Cup (3.5g) dropped from third in February to fifth in March, indicating a decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.