Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

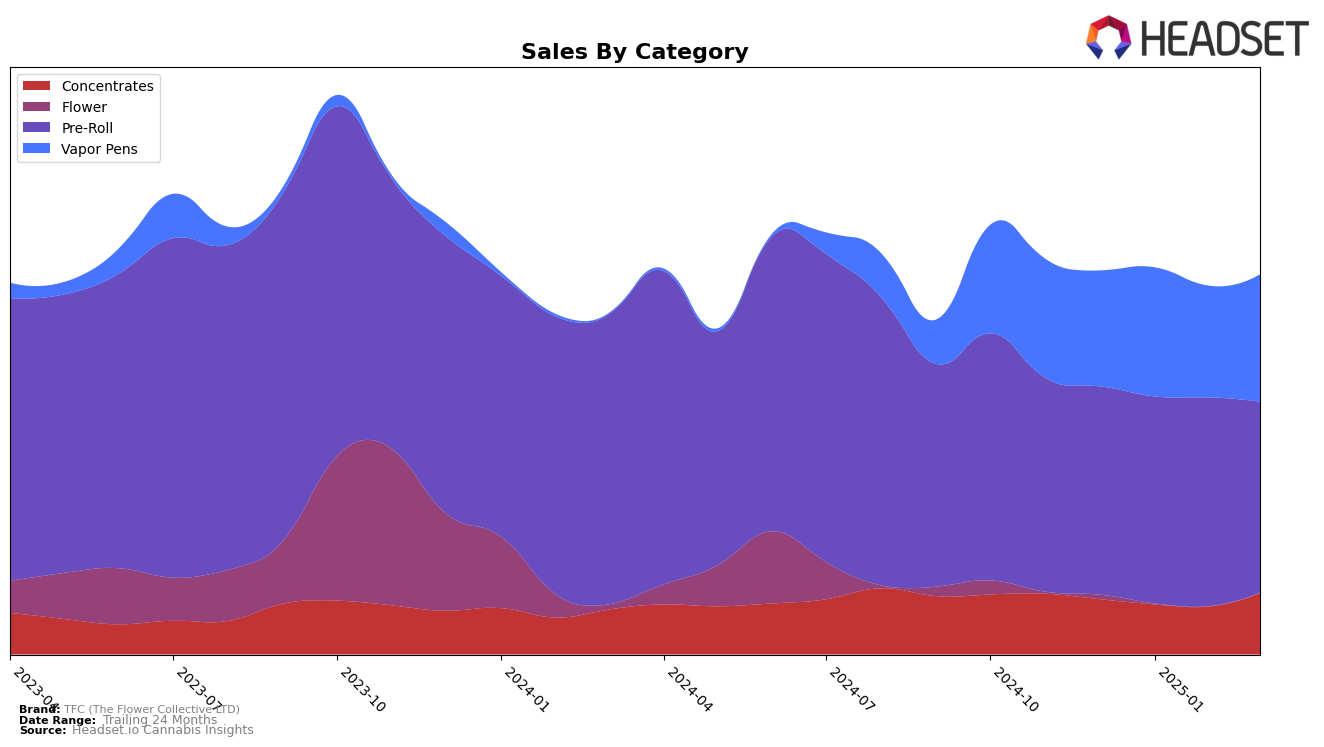

TFC (The Flower Collective LTD) has demonstrated varied performance across different product categories in Colorado. In the Concentrates category, TFC made a notable upward movement, improving its rank from 37 in December 2024 to 30 by March 2025. This upward trend is significant, especially considering the brand was not within the top 30 at the start of the period. Meanwhile, in the Pre-Roll category, TFC experienced a slight decline, moving from a rank of 11 in February 2025 to 15 by March. Despite this, their Pre-Roll sales have remained relatively stable, indicating a consistent demand in this category.

In the Vapor Pens category, TFC's performance has been more stable, with a gradual improvement in their ranking from 50 in December 2024 to 47 by March 2025. Although this category does not see TFC in the top 30, the steady climb suggests a positive reception to their products in Colorado. This incremental progress across categories highlights TFC's potential for growth in the market. However, the absence of top 30 rankings in some categories indicates areas where the brand could focus on increasing its competitive edge.

Competitive Landscape

In the competitive landscape of Colorado's Pre-Roll category, TFC (The Flower Collective LTD) has shown a dynamic performance from December 2024 to March 2025. Starting at rank 13 in December, TFC improved to rank 11 by February before slipping slightly to rank 15 in March. This fluctuation in rank indicates a competitive market environment, with brands like Old Pal and TWAX making significant upward movements. Notably, Old Pal climbed from rank 22 in December to 13 in March, showcasing a strong sales trajectory that could pose a challenge to TFC. Meanwhile, LoCol Love (TWG Limited) experienced a decline from rank 10 to 17, which might provide TFC an opportunity to capitalize on shifting consumer preferences. TFC's sales remained relatively stable compared to its competitors, suggesting a loyal customer base, but the brand may need to strategize to maintain or improve its market position amidst the dynamic shifts of its competitors.

Notable Products

In March 2025, the top-performing product from TFC (The Flower Collective LTD) was the Pinners Bubble Infused Pre-Roll 3-Pack (1.5g), maintaining its consistent rank of 1 since December 2024 with a notable sales figure of 1695 units. The Pinners Infused Pre-Roll 9-Pack (4.5g) also held steady in the second position across the same timeframe, demonstrating consistent consumer demand. The Dreamsicle Live Rosin Cartridge (1g) emerged as a new contender, securing the third spot in March. The Bubble Pre-Roll 3-Pack (3g) showed stability by maintaining its fourth position from February to March. Meanwhile, the Pinner Jar Bubble Infused Pre-Roll 9-Pack (4.5g) experienced a slight decline, dropping from third in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.