Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

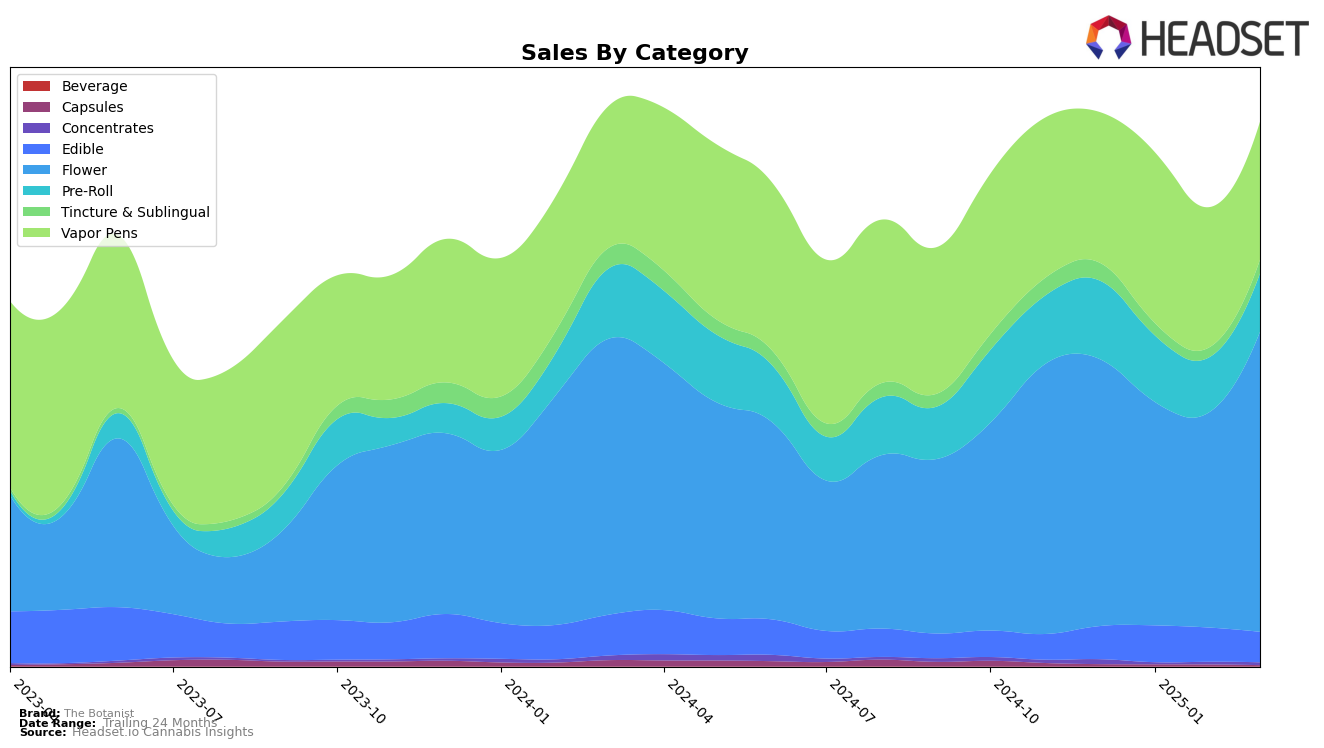

The Botanist has shown varied performance across different states and categories, with notable trends emerging in specific areas. In Illinois, the brand's Flower category saw a significant rebound in March 2025, moving up to the 15th rank from 24th in February, indicating a resurgence in consumer interest or effective market strategies. Conversely, their Edible category in Illinois did not maintain a top 30 position in March, which could suggest a need for strategic adjustments or shifts in consumer preferences. Meanwhile, in New Jersey, The Botanist's Pre-Roll category maintained a steady presence, only dropping slightly from 13th to 15th position by March, which might reflect a stable consumer base for this product line.

In Massachusetts, The Botanist's Flower category showed a marked improvement, climbing to 31st place in March from 51st in February, indicating a positive trend in consumer demand or effective promotional activities. However, in Ohio, the Flower category did not appear in the top 30 ranks for December 2024 and February 2025, highlighting potential challenges in maintaining a competitive edge in this market. In New York, the brand's Flower category showed a promising increase, moving to 15th position by March 2025, suggesting a strengthening market position. These movements across states underscore the dynamic nature of The Botanist's performance, with certain areas showing strong growth potential while others may require strategic reevaluation.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, The Botanist has shown a notable fluctuation in its rankings over the period from December 2024 to March 2025. Starting at rank 19 in December 2024, The Botanist dropped out of the top 20 in January and February 2025 but made a significant comeback to rank 15 in March 2025. This recovery is indicative of a positive shift in sales momentum, as March sales figures nearly matched those of December. In contrast, competitors like Cresco Labs and Aeriz maintained relatively stable positions within the top 20, with Aeriz experiencing a slight dip in March. Meanwhile, Revolution Cannabis saw a decline in rank from 10 to 16 over the same period, suggesting potential challenges in maintaining its market share. The Botanist's ability to rebound in March highlights its resilience and potential for growth amidst a competitive environment.

Notable Products

In March 2025, The Botanist's top-performing product was Mint Sherbert (3.5g) in the Flower category, maintaining its number one rank from December 2024 with sales of $4,632. Chem Chillz #17 (3.5g) climbed to the second position, a significant rise from its fifth-place ranking in December 2024, showing strong sales momentum. Tropical Punch Extra High Potency Gummies (50mg) secured the third spot in the Edible category, slightly up from its fourth rank in January 2025. Jungle Grapes #38 (2.83g) debuted at fourth place, indicating a strong market entry in March. LA Kush Cake (3.5g) rounded out the top five, marking its first appearance in the rankings during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.