Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

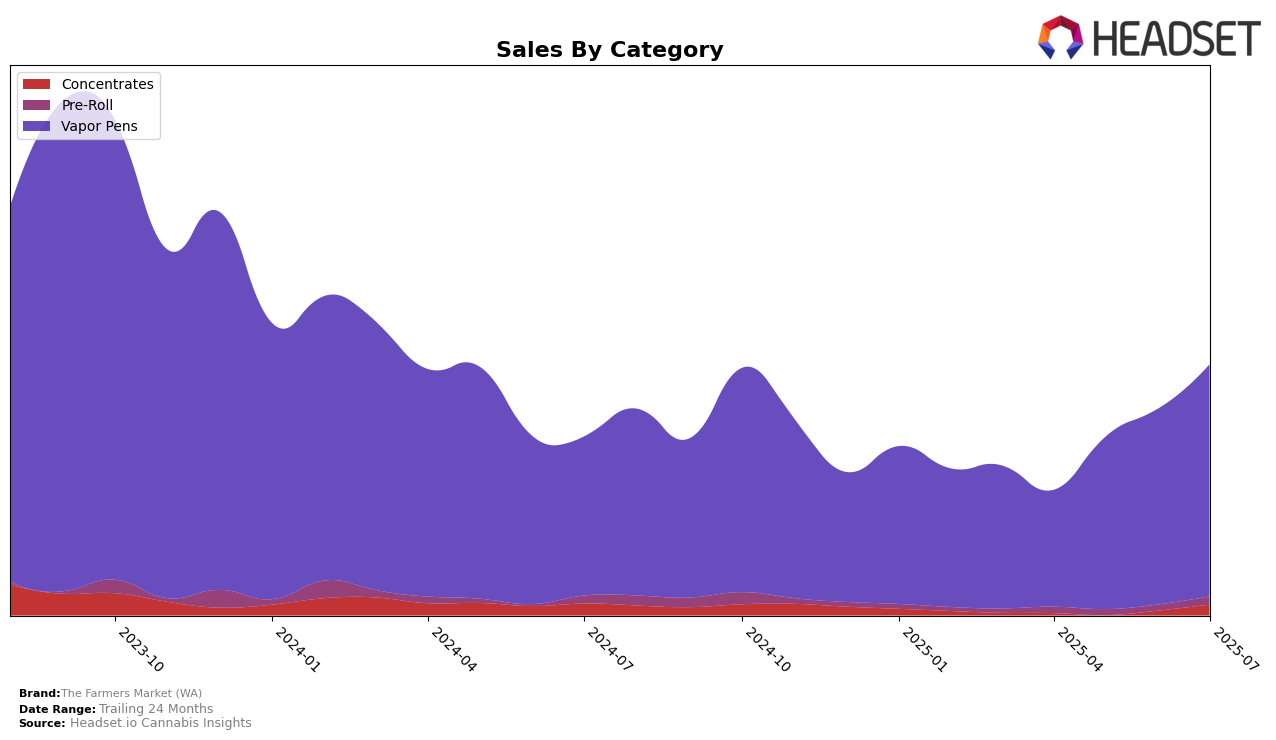

The Farmers Market (WA) has shown a promising upward trajectory in the Vapor Pens category within Washington. Starting from a rank of 50 in April 2025, the brand has climbed steadily, reaching the 27th position by July 2025. This consistent improvement indicates a growing consumer preference for their products and possibly effective marketing strategies or product innovations. The increase in sales from $92,267 in April to $180,310 in July further underscores their strengthening market presence. Such positive movement in rankings and sales is a testament to the brand's potential to continue its growth in the competitive cannabis market.

However, it is important to note that The Farmers Market (WA) did not appear in the top 30 brands in any other state or category during this period. This absence in other markets may suggest a need for the brand to diversify its reach or enhance its competitive strategies outside of Washington. While their performance in Washington is commendable, expanding their influence across additional states could be crucial for long-term growth and stability. The brand's focus on the Vapor Pens category might also indicate a strategic decision to concentrate efforts where they see the most potential for impact before branching out further.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, The Farmers Market (WA) has shown a remarkable upward trajectory in rank and sales over the past few months. Starting from a rank of 50 in April 2025, it has climbed to 27 by July 2025, indicating a significant improvement in market presence. This upward trend is notable when compared to competitors like Bodhi High, which fluctuated around the 20th position but dropped out of the top 20 by July, and Cookies, which maintained a steady rank at 26. Meanwhile, 5Th House Farms and Kelso Kandy (aka Kelso Kreeper) have remained outside the top 20 throughout this period. The Farmers Market (WA)'s sales have also seen a consistent increase, suggesting a growing consumer preference and effective market strategies that have enabled it to close the gap with more established brands. This momentum positions The Farmers Market (WA) as a rising contender in the Washington vapor pen market.

Notable Products

In July 2025, The Farmers Market (WA) saw Pineapple Express Distillate Cartridge (1g) maintain its top position in the Vapor Pens category, with sales reaching $822. This product has consistently held the number one rank since April 2025. Blackberry Gelato Distillate Cartridge (1g) also retained its second-place ranking, showing a steady increase in sales over the months. Blueberry Muffin OG Distillate Cartridge (1g) secured the third spot, marking its return to the rankings after a brief absence in June. Meanwhile, Pineapple Express Distillate Disposable (1g) experienced a slight drop from third to fourth place, yet remained a strong performer in the category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.