Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

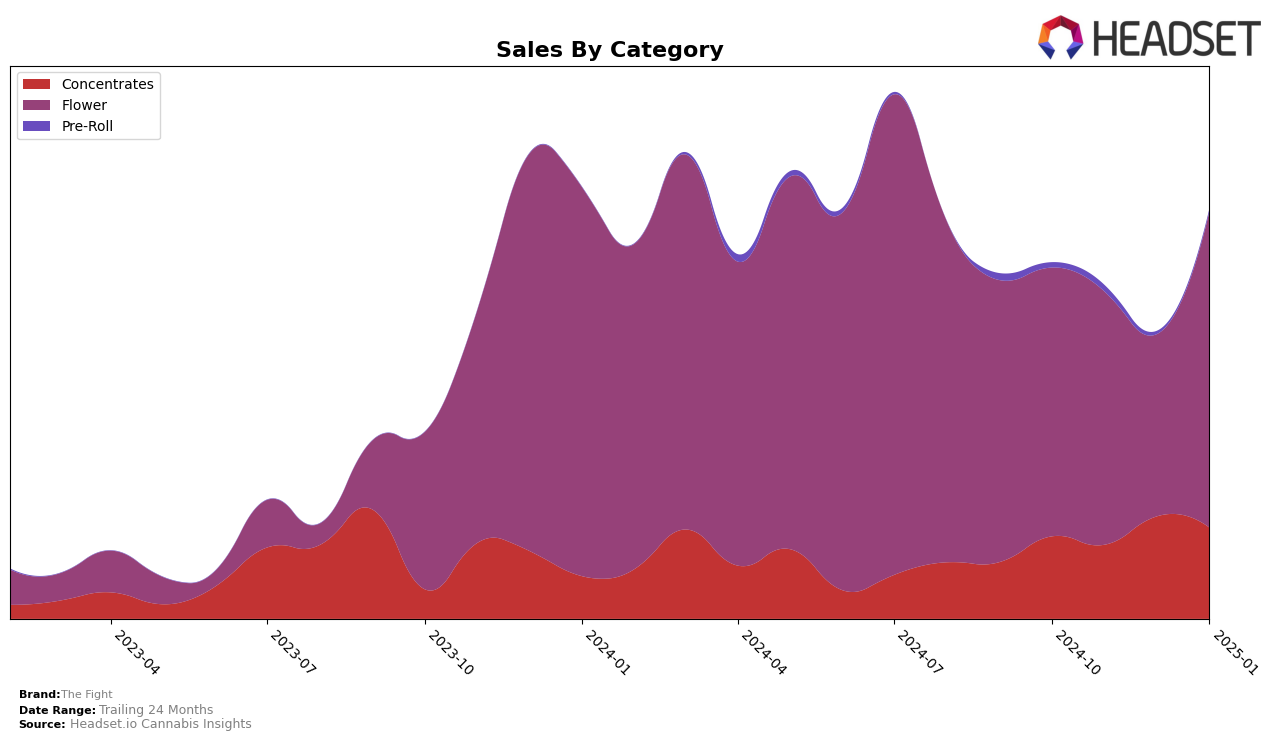

The Fight has shown fluctuating performance across various categories and states, with noteworthy movements in the California market. In the concentrates category, The Fight managed to break into the top 30 by December 2024, achieving a rank of 28, although it slipped slightly to 30 in January 2025. This indicates a positive trend from October's rank of 36, suggesting improved market penetration or consumer preference in this category. However, the brand was not consistently in the top 30 for all months, highlighting challenges in maintaining a steady position. This variability could point to competitive pressures or seasonal demand fluctuations impacting their standings.

In the flower category, The Fight experienced a significant jump in its rankings in California, moving from 89 in December 2024 to 62 in January 2025. This upward trajectory suggests a strong recovery in sales or a successful strategic shift, as reflected by the increase in sales figures from December to January. Despite not being in the top 30 for any month in this category, the substantial improvement in rank indicates potential for future growth. These movements highlight the dynamic nature of The Fight's performance, with both challenges and opportunities present in its market strategy.

Competitive Landscape

In the competitive landscape of the California flower category, The Fight has shown a notable upward trajectory in its rank from December 2024 to January 2025, climbing from 89th to 62nd place. This improvement is significant, especially when compared to brands like 710 Labs, which saw a slight improvement but remained outside the top 50, and Autumn Brands, which experienced a decline from 51st to 69th place over the same period. Meanwhile, Pure Beauty and Time Machine maintained relatively stable positions, with Time Machine consistently ranking higher than The Fight. Despite lower sales figures compared to these competitors, The Fight's recent rank improvement suggests a positive shift in market perception or strategy, potentially positioning it for increased future sales.

Notable Products

In January 2025, LA Confidential Badder (1g) emerged as the top-performing product for The Fight, climbing from second place in December 2024 to first place with sales of $6,114. Alaskan Thunder Fuck Crumble (1g) also improved its ranking, moving up from fifth to second place. AK 47 Crumble (1g) maintained its consistent performance, holding steady at third place for two consecutive months. Gorilla Cookies Sugar (1g) remained in fourth place, while Bubba Kush Badder (1g) experienced a significant drop from first place in December 2024 to fifth place in January 2025. Overall, the concentrates category dominated the top ranks for The Fight, with notable shifts in product popularity from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.