May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

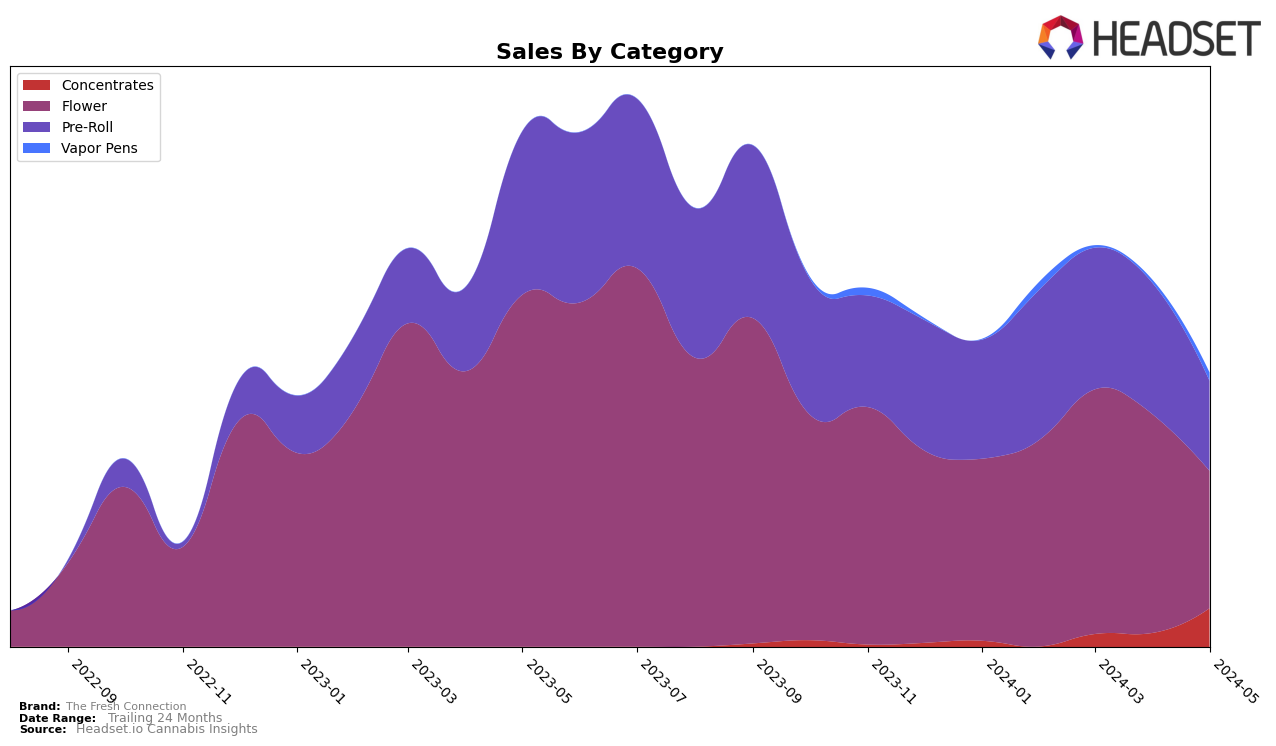

The Fresh Connection has shown a dynamic performance in the Massachusetts cannabis market across various categories. In the Concentrates category, the brand made a significant leap from not being in the top 30 in February to ranking 18th by May 2024. This upward trend signifies a growing acceptance and popularity among consumers. However, in the Flower category, the brand's rank has seen a decline, dropping from 50th in February to 66th in May. This could indicate increased competition or a shift in consumer preferences. The brand's performance in the Pre-Roll category also saw a downward trend, falling from 26th in February to 55th in May, which might be a point of concern for the brand's strategy team.

Interestingly, The Fresh Connection did not make it to the top 30 brands in the Vapor Pens category until May, where it debuted at 99th. This late entry suggests either a recent product launch or a slow adoption rate in this segment. The sales figures in the Vapor Pens category, although modest, indicate a starting point for potential growth. The significant jump in sales for Concentrates from March to May also highlights a positive reception and increasing market penetration. Overall, while The Fresh Connection has made notable strides in some categories, there are areas, particularly in Flower and Pre-Rolls, where the brand needs to reassess its strategy to regain or improve its market position.

Competitive Landscape

In the competitive landscape of the Massachusetts Flower category, The Fresh Connection has experienced notable fluctuations in its rank and sales over the past few months. From February to May 2024, The Fresh Connection's rank dropped from 50th to 66th, indicating a downward trend. This decline is significant when compared to competitors like Khalifa Kush and INSA, which also saw drops but remained relatively more stable. For instance, Khalifa Kush fluctuated between 56th and 64th, while INSA varied between 59th and 74th. Meanwhile, Mini Budz saw a sharp decline from 33rd to 62nd in May 2024, which may have impacted The Fresh Connection's market share. Despite the overall downward trend, The Fresh Connection's sales peaked in March 2024 at $316,810, indicating potential for recovery if strategic adjustments are made. Understanding these dynamics can help The Fresh Connection better position itself against competitors and capitalize on market opportunities.

Notable Products

In May-2024, the top-performing product for The Fresh Connection was Jelly Biscotti Pancakes Pre-Roll (1g), which reclaimed the number one spot with sales reaching $3,630. Jelly Biscotti Pancakes (3.5g) followed closely in second place, although its sales dropped from April. The MAC 31 Pre-Roll (1g) maintained its third position from April, despite a decline in sales. Sundae Driver Pre-Roll (1g) remained in fourth place, continuing its downward trend in sales. Notably, Moonbow Pre-Roll (1g) re-entered the rankings at fifth place after being absent in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.