Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

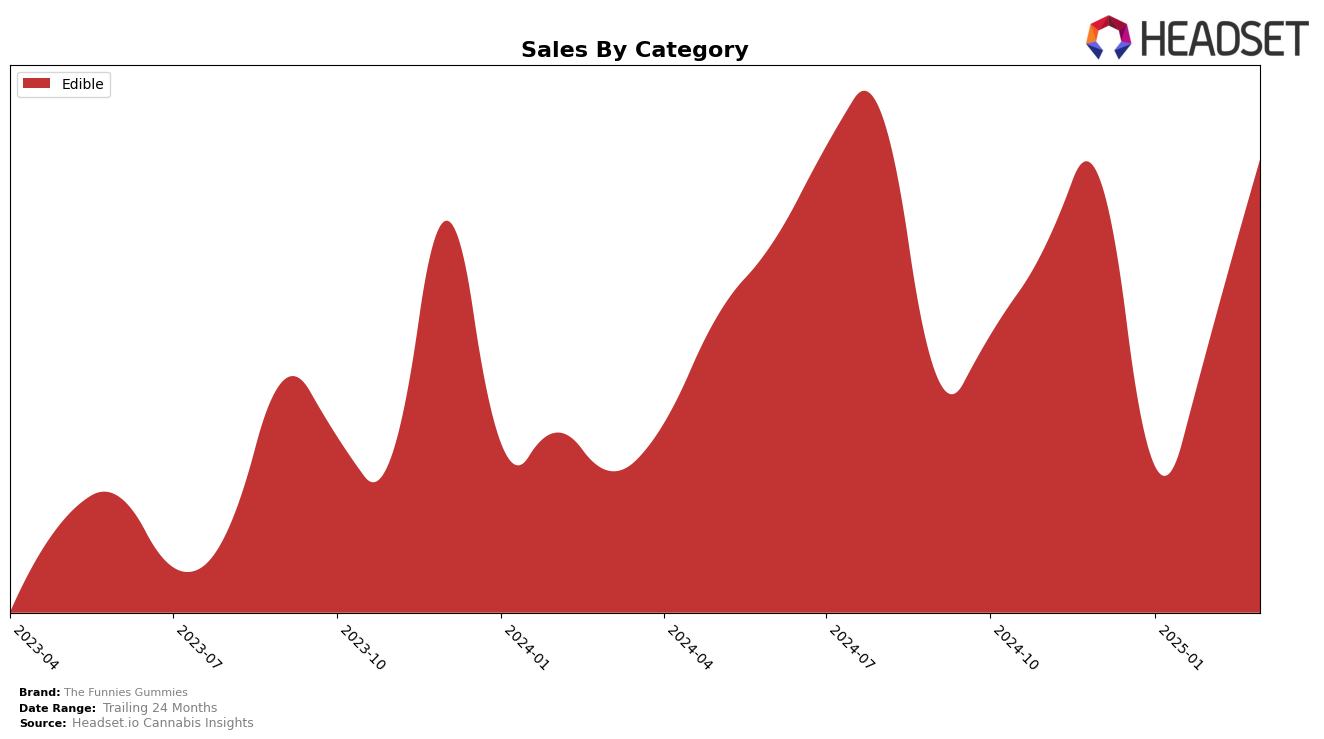

The Funnies Gummies have demonstrated notable performance in the Edibles category across various states. In Illinois, the brand showed a strong comeback after a dip in January 2025, where they ranked 10th. By February and March, they had climbed back to the 6th position, indicating a positive recovery and consistent demand in the market. This fluctuation underscores the competitive nature of the Edibles category in Illinois, where consumer preferences can shift rapidly, impacting brand rankings. The brand's ability to recover and maintain a top 10 position is a testament to its resilience and appeal among consumers in the state.

However, it's important to note that The Funnies Gummies' presence in the top 30 rankings is not consistent across all states, as they were absent from the list in some areas, indicating potential growth opportunities or challenges in those markets. This absence suggests that while the brand is performing well in certain locations, there might be untapped potential or competitive pressures in others that are affecting their visibility and sales performance. The varied performance across states highlights the importance of localized strategies to cater to specific market dynamics, which could be crucial for future growth and expansion.

```Competitive Landscape

In the competitive Illinois edible market, The Funnies Gummies have shown a dynamic performance from December 2024 to March 2025. Initially ranked 7th in December 2024, they experienced a dip to 10th place in January 2025, before rebounding to 6th place by February and maintaining this position in March. This fluctuation in rank reflects a competitive landscape where brands like Encore Edibles and Lost Farm consistently held higher positions, ranking 4th and 5th respectively throughout the period. Despite the challenges, The Funnies Gummies' sales trajectory shows a positive trend, with March 2025 sales surpassing those in December 2024, indicating a recovery and potential for growth. Meanwhile, competitors such as Ozone and Camino also faced fluctuations, with Ozone dropping out of the top 10 in February before climbing back to 8th place in March, and Camino experiencing a similar pattern. This competitive analysis highlights the importance for The Funnies Gummies to capitalize on their upward sales momentum to solidify their market position amidst strong competitors.

Notable Products

In March 2025, Purely Peach Gummies 2-Pack (100mg) emerged as the top-performing product for The Funnies Gummies, climbing from second place in February to first place with sales of $11,877. Sour Blue Raspberry Gummies 20-Pack (100mg) ranked second, a drop from its first-place position in December 2024. Pineapple Mango Mai Tai Gummies 20-Pack (100mg) achieved third place, marking a consistent climb from fifth in January and fourth in February. Super Funnies - Sour Blue Raspberry Gummies 2-Pack (100mg) maintained a steady presence in the top five, securing fourth place. Meanwhile, Super Funny - Strawberry Daiquiri Gummy (50mg) fell to fifth place after leading in February, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.