Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

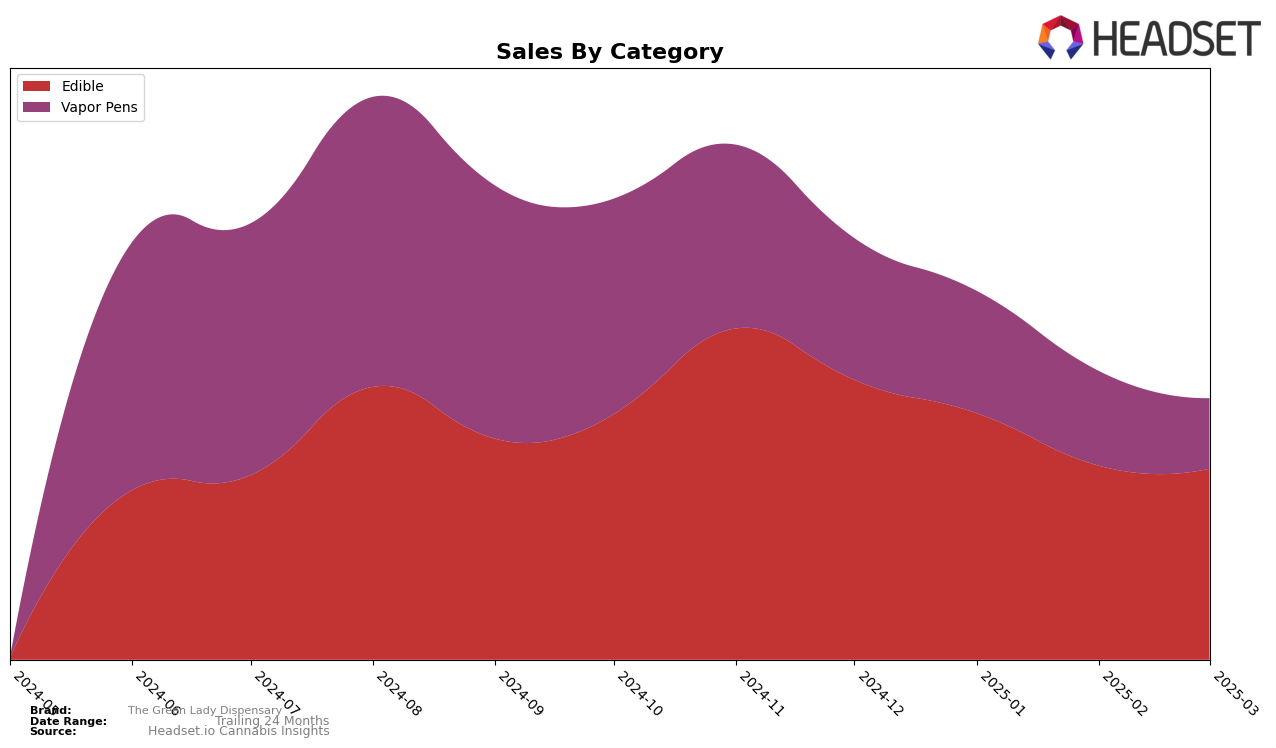

The Green Lady Dispensary has shown a consistent presence in the New York market, particularly within the Edible category. Over the first three months of 2025, the brand's ranking in this category has seen a gradual decline, moving from 24th in December 2024 to 30th by March 2025. This downward trend in rankings aligns with a noticeable decrease in sales, indicating potential challenges in maintaining their market position. The brand's ability to remain within the top 30, despite this decline, suggests a level of resilience, but it also highlights the competitive nature of the Edible market in New York.

In contrast, The Green Lady Dispensary's performance in the Vapor Pens category in New York has not been as strong, with rankings consistently outside the top 60. Starting at 63rd place in December 2024 and dropping to 66th by March 2025, the brand is struggling to gain traction in this category. The consistent decrease in sales figures further underscores the challenges faced in capturing a larger market share. This trend suggests that while The Green Lady Dispensary has a foothold in the Edible category, its presence in Vapor Pens requires strategic attention to improve its competitive standing.

Competitive Landscape

In the competitive landscape of the edible cannabis category in New York, The Green Lady Dispensary has experienced fluctuations in its market position, reflecting a dynamic environment. As of March 2025, The Green Lady Dispensary ranked 30th, showing a decline from its 24th position in December 2024. This downward trend in rank is mirrored by a decrease in sales over the same period. Competitors such as Gezoont and Nanticoke have maintained relatively stable positions, with Gezoont consistently outperforming The Green Lady Dispensary in terms of rank since January 2025. Meanwhile, Pure Vibe and To The Moon have shown varying performance, with Pure Vibe experiencing a notable improvement in March 2025, surpassing The Green Lady Dispensary. These shifts suggest that while The Green Lady Dispensary maintains a competitive presence, it faces challenges from both stable and improving rivals, indicating a need for strategic adjustments to regain its earlier momentum.

Notable Products

In March 2025, The Green Lady Dispensary's top-performing product was the THC/CBN 1:1 Nightcap Sleep Blueberry, Spiced Cinnamon & Chamomile Gummies 10-Pack, maintaining its first-place position from previous months despite a decrease in sales to 616 units. The THC/THCV 2:1 Spicy Peach Margarita Gummies 10-Pack moved up to the second position, showing a recovery with sales rising to 545 units. The CBD/THC 1:1 Summer Sangria Chill Gummies 10-Pack slipped to third place, continuing its decline in sales. The Grape Cream Cake Distillate Disposable remained in fourth place, while the Apple Runtz Live Resin Disposable held steady in fifth, both showing minimal changes in sales figures. Overall, the rankings indicate a consistent preference for edible products, with slight shifts in popularity among specific gummy varieties.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.