Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

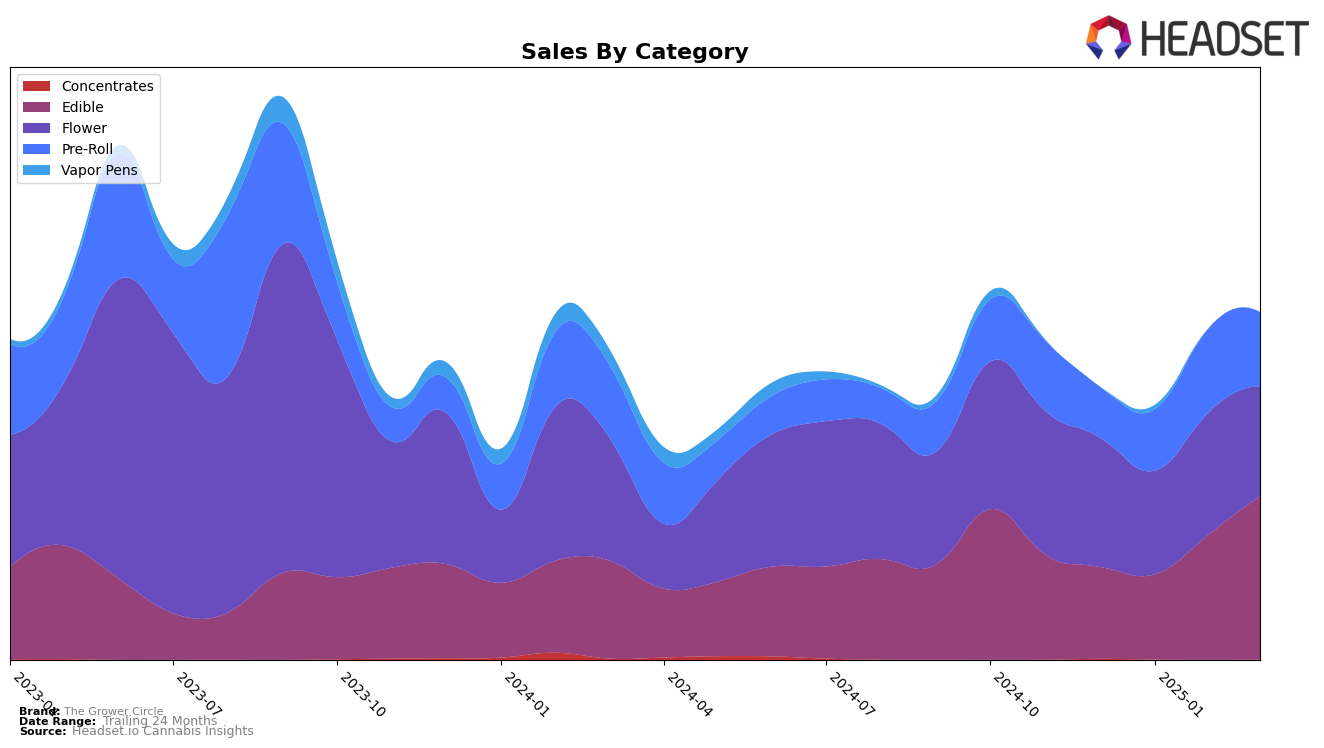

The Grower Circle has demonstrated notable performance in the Nevada market, particularly within the Edible category. Over a span of four months, the brand climbed from the 11th position in December 2024 to 7th by March 2025. This upward trajectory is indicative of a strong consumer response and effective market strategies, as evidenced by a significant increase in sales from $127,757 to $226,922 during this period. In contrast, their performance in the Flower category shows some volatility, with rankings fluctuating and eventually dropping from 31st in December to 38th in March, suggesting potential challenges in maintaining a consistent market presence in this segment.

In the Pre-Roll category, The Grower Circle's ascent from 25th to 12th position by February 2025 is noteworthy, although the brand maintained its position in March, indicating a stabilization at this higher rank. This stabilization could reflect a successful product offering that resonates well with consumers in Nevada. However, it is important to note that the brand did not feature in the top 30 for Flower in January 2025, which could be seen as an area for potential improvement or a shift in focus. Overall, while The Grower Circle shows promise in certain categories, there remain areas where strategic adjustments could further enhance their market standing.

Competitive Landscape

In the Nevada edibles market, The Grower Circle has shown a promising upward trajectory from December 2024 to March 2025, climbing from 11th to 7th place in rank. This improvement in rank is a reflection of their increasing sales, which have nearly doubled over this period. In contrast, Wana has experienced a decline in sales, maintaining a steady 6th place rank but with a downward trend in sales figures. Meanwhile, Gron / Grön has seen a slight fluctuation in rank but remains a strong competitor, consistently ranking in the top 5. Good Tide has experienced some volatility, dropping from 7th to 9th place by March 2025, despite a temporary increase in sales in February. Jams has seen a decline in both rank and sales, falling from 7th to 10th place. The Grower Circle's ability to improve its position in a competitive market suggests effective strategies in capturing consumer interest and expanding its market share.

Notable Products

In March 2025, Flight Bites - Sour Watermelon Gummies 10-Pack (100mg) maintained its top position as the best-performing product for The Grower Circle, with sales reaching an impressive 2955 units. Flight Bites - Sunset Punch Gummies 10-Pack (100mg) followed closely, holding steady at the second rank with 2832 units sold. Flight Bites - S'mores Gummies 10-Pack (100mg) saw a significant rise, climbing to third place from fifth in February, showcasing a notable increase in popularity. Meanwhile, Flight Bites - Rainbow Crunch Hash Rosin Gummies 10-Pack (100mg) slipped to fourth place, despite its previous dominance in December 2024. Lastly, Flight Bites - Mango Tajin Gummies 10-Pack (100mg) remained consistent in fifth place, continuing its steady performance from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.