Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

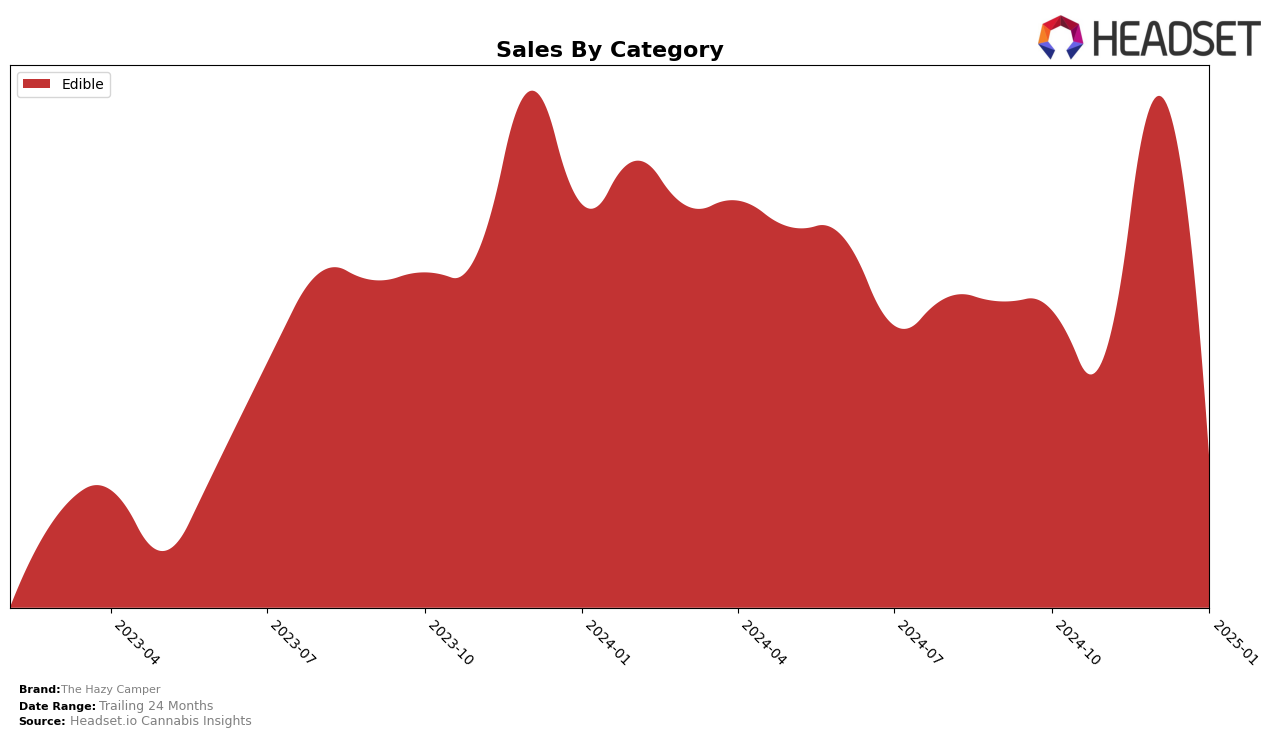

The Hazy Camper's performance in the Edible category has shown some interesting trends across Canadian provinces. In Alberta, the brand made an appearance in the rankings at position 27 in October 2024, but subsequently fell out of the top 30 in the following months. This indicates a potential challenge in maintaining a competitive edge in Alberta's market. In contrast, the brand has demonstrated more consistent performance in British Columbia. Starting at rank 21 in October 2024, The Hazy Camper climbed to 17th position by December 2024, before slightly dropping to 20th in January 2025. This movement suggests fluctuations in consumer interest or competitive dynamics, yet the brand remains a notable player within the top 20 for most of the observed period.

Sales data for The Hazy Camper reveals a notable trend in British Columbia. The brand's sales peaked in December 2024, suggesting a surge in demand possibly due to seasonal factors or successful marketing strategies. However, the subsequent decline in January 2025 could indicate the need for sustained engagement efforts to maintain momentum. In Alberta, the absence from the top 30 after October 2024 suggests a significant drop in market presence, which could be attributed to increased competition or shifts in consumer preferences. This divergence in performance between provinces highlights the varying market dynamics and the necessity for tailored strategies to capitalize on regional opportunities.

Competitive Landscape

In the competitive landscape of the Edible category in British Columbia, The Hazy Camper has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked 21st in October, The Hazy Camper improved to 17th by December, indicating a significant upward trend in sales performance during this period. However, by January 2025, it slipped back to 20th place, suggesting a need for strategic adjustments to maintain its competitive edge. In comparison, Edison Cannabis Co consistently maintained a higher rank, fluctuating between 15th and 19th, while Olli showed a stable presence around the 18th and 20th positions. The data highlights that while The Hazy Camper had a moment of increased sales, sustaining this momentum against competitors like Edison Cannabis Co and Olli remains a challenge, emphasizing the importance of strategic marketing and product differentiation to enhance its market share in British Columbia's edible sector.

Notable Products

In January 2025, the top-performing product for The Hazy Camper was Wild Raspberry Dark Chocolate (10mg), which climbed to the number one spot from its previous second position in December 2024, achieving sales of 947 units. Hazy Mint Organic Dark Chocolate Bite (10mg) slipped to second place after consistently holding the top rank for the last three months. CBD/THC 1:1 Mochaccino Milk Chocolate (10mg CBD, 10mg THC) rose to third place from fifth in December, indicating a growing preference for balanced CBD/THC products. Pumpkin Spice Organic Milk Chocolate (10mg) maintained its fourth rank from the previous month, showing steady performance. Notably, CBD Linalool Organic Milk Chocolate (720mg CBD) made its debut in the rankings at fifth place, highlighting an emerging interest in high-CBD edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.