Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

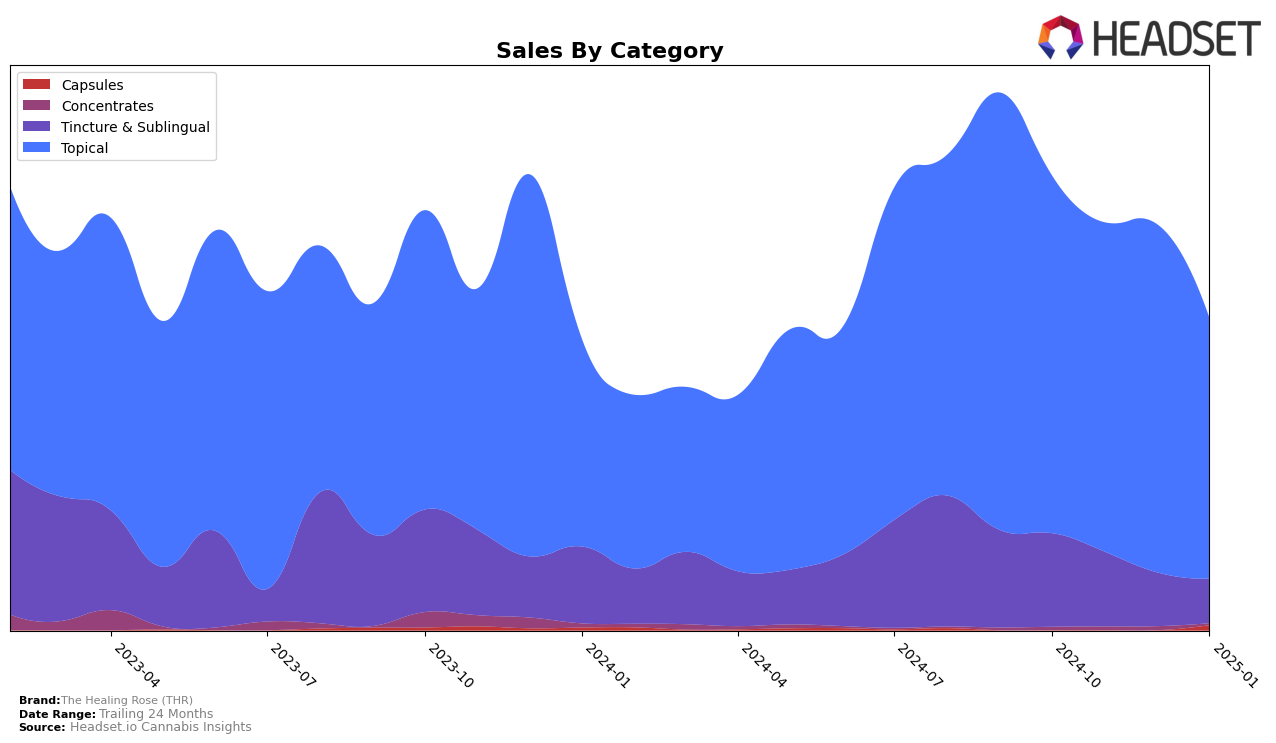

The Healing Rose (THR) has shown consistent performance in the Topical category within Massachusetts. For the months of October 2024 through January 2025, THR maintained a strong presence, ranking between 5th and 6th place. This stability suggests a solid foothold in the Massachusetts market, although there was a noticeable dip in sales in January 2025. This decline in sales could be indicative of seasonal trends or increased competition, but the brand's ability to remain within the top 10 suggests a resilient market strategy.

While THR's performance in Massachusetts is commendable, the absence of rankings in other states or provinces highlights potential areas for growth or expansion. Not being in the top 30 in other regions might suggest limited distribution or brand recognition outside Massachusetts. This presents both a challenge and an opportunity for THR to explore new markets and broaden its customer base. Understanding the dynamics in Massachusetts could be key to replicating success in other states and potentially improving their market presence across more regions.

Competitive Landscape

In the Massachusetts topical cannabis market, The Healing Rose (THR) has experienced fluctuating rankings from October 2024 to January 2025, maintaining a position within the top 10 but facing stiff competition. Notably, Nordic Goddess consistently outperformed THR, holding a top 4 rank throughout the period, while Attune showed resilience, bouncing between the 2nd and 4th positions. Despite a slight dip in sales from October to January, THR managed to improve its rank from 6th to 5th, suggesting a strategic response to market dynamics. Meanwhile, Avexia and Doctor Solomon's were not consistently ranked, indicating potential volatility or niche positioning. These insights highlight the competitive landscape THR navigates, emphasizing the need for strategic marketing and product differentiation to bolster its market presence.

Notable Products

In January 2025, The Healing Rose (THR) saw its CBD Coconut Lip Balm (25mg CBD) maintain its top position as the best-selling product, with sales reaching $123. The CBD Sweet Orange Lip Balm (25mg CBD) climbed to the second rank, improving from the third position in December 2024, while the CBD Spearmint Lip Balm (25mg CBD) rose to third place from fifth. The CBD Blood Orange Mint Lip Balm (25mg CBD) made its debut in the rankings, securing the fourth spot. The CBD Peppermint Rosemary Lip Balm (25mg CBD) saw a decline, dropping from second place in November 2024 to fifth in January 2025. Overall, the Topical category continues to dominate the sales for The Healing Rose (THR), with all top-ranked products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.