Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

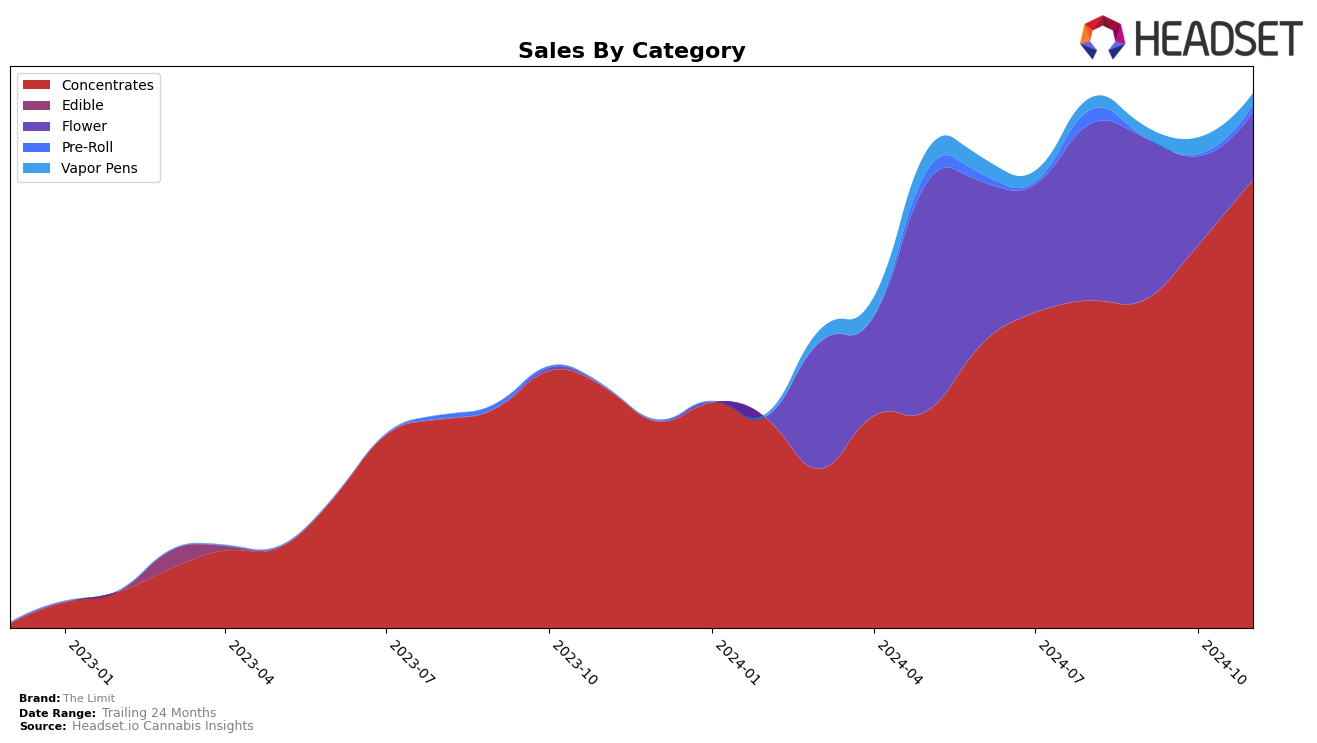

The Limit has demonstrated a strong performance in the Concentrates category in Michigan, consistently holding the number one rank from August to November 2024. This indicates a solid market presence and consumer preference in this category. However, their performance in the Flower category has seen a decline, dropping from a rank of 27 in August to 62 by November, suggesting challenges in maintaining competitiveness or consumer interest in this segment. This contrast between categories highlights the brand's dominance in Concentrates but also points to potential areas for improvement in other product lines.

In the Vapor Pens category, The Limit has shown some fluctuation in rankings within Michigan, improving from 82 in August to 59 in October, before slightly dropping to 75 in November. This indicates a potential for growth if the brand can stabilize its position. Notably, The Limit did not make the top 30 in the Pre-Roll category, which could be seen as a significant gap in their market strategy or product offering. This absence suggests either a lack of focus or competitive pressure in this category, which could be an area to explore for future growth opportunities.

Competitive Landscape

In the Michigan concentrates market, The Limit has consistently maintained its top rank from August to November 2024, showcasing its dominance in this category. Despite the steady competition, The Limit's sales have shown a robust upward trajectory, particularly notable in November 2024, indicating a strong consumer preference and effective market strategies. In contrast, #Hash, which has held the second position throughout the same period, has also experienced sales growth, but at a slower pace compared to The Limit. Meanwhile, Wojo Co has demonstrated significant rank improvement, jumping from seventh in September to third in November, suggesting a potential rise in market influence. However, the sales figures of Wojo Co remain considerably lower than those of The Limit, indicating that while competitors are making strides, The Limit's stronghold in the market remains unchallenged.

Notable Products

In November 2024, Gelatti (3.5g) maintained its top position as the leading product for The Limit, achieving sales of 10,262 units. Forbidden Fruit Live Resin (5g) saw a significant rise, moving up to second place from fourth in October, with notable sales growth. Blue Raspberry Slushie Live Resin (5g) entered the rankings for the first time, securing the third spot. Durban Poison Live Resin (5g) reappeared in the rankings at fourth, after being absent in the previous months. Purple Sunset (3.5g) also made its debut in the rankings, finishing in fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.