Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

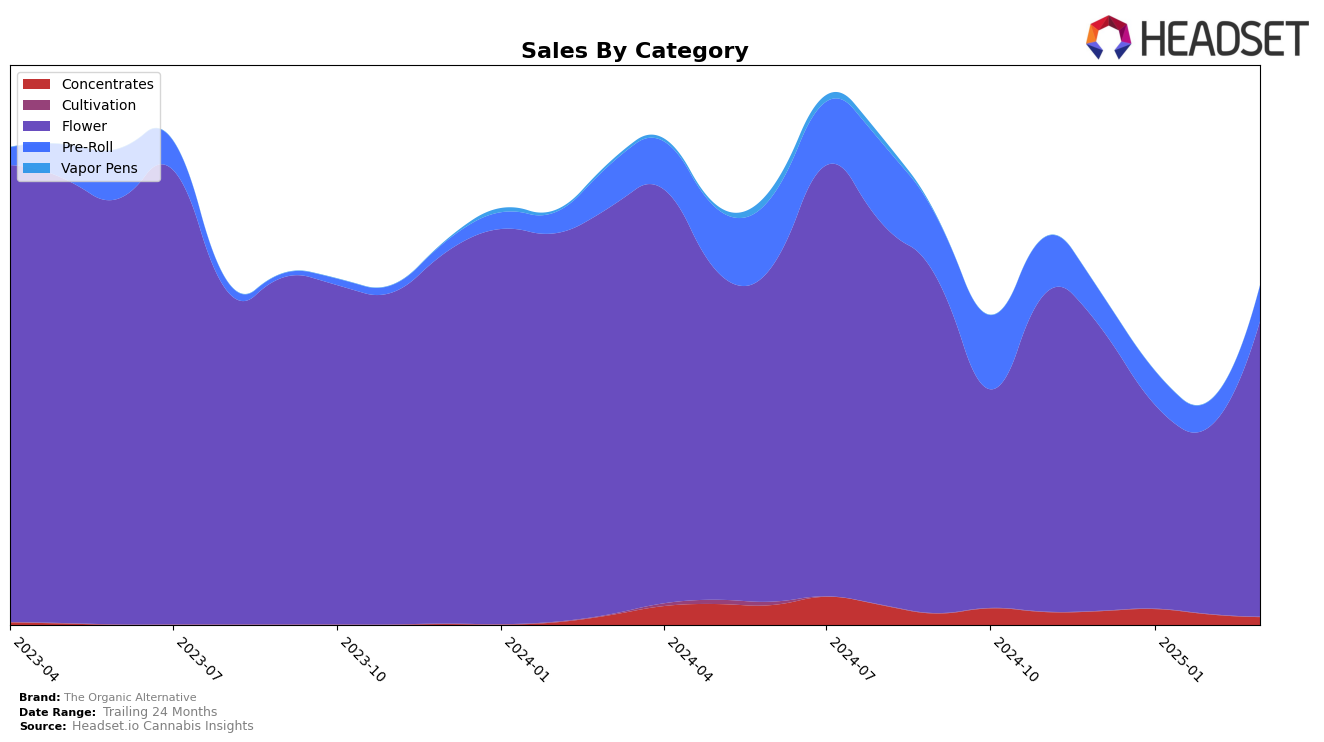

The Organic Alternative's performance in the Colorado market demonstrates a mixed trajectory across various product categories. In the Flower category, the brand experienced a notable rebound, climbing from the 31st position in February 2025 to the 21st position in March 2025. This upward movement suggests a strong recovery and possibly increased consumer preference or effective marketing strategies during that period. However, the Concentrates category tells a different story, with the brand failing to secure a spot in the top 30 by March 2025, indicating a potential decline in consumer interest or heightened competition in that segment. Such disparities in rankings across categories highlight the brand's varied performance and suggest areas for strategic focus and improvement.

In the Pre-Roll category, The Organic Alternative maintained a relatively stable presence, with a slight improvement from the 52nd position in February 2025 to the 46th position by March 2025. This stability, coupled with an uptick in sales, points to a consistent demand for their pre-roll products despite not breaking into the top 30. The brand's overall sales figures across categories reflect a dynamic market environment in Colorado, where shifts in consumer preferences and competitive pressures require continuous adaptation. While some categories show promise, others may need strategic adjustments to better capture market share and improve brand visibility in the future.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, The Organic Alternative has experienced notable fluctuations in its ranking over the past few months, impacting its market positioning. While it started at rank 24 in December 2024, it saw a decline to rank 31 by February 2025, before recovering to rank 21 in March 2025. This recovery is significant as it suggests a positive trend in sales performance, contrasting with some competitors. For example, Bloom County maintained a relatively stable position, peaking at rank 10 in January and February 2025, but dropped to rank 19 by March, indicating a potential decline in momentum. Similarly, 14er Gardens showed volatility, reaching as high as rank 14 in January before slipping to rank 20 by March. Meanwhile, Host and Kind Love have shown a consistent upward trajectory, with Kind Love climbing from rank 45 in December to rank 23 by March, suggesting a strong growth trend. These dynamics highlight the competitive pressures and opportunities for The Organic Alternative as it seeks to capitalize on its recent upward momentum in the Colorado Flower market.

Notable Products

In March 2025, Kush Mints (3.5g) emerged as the top-performing product for The Organic Alternative, achieving the number one rank with sales figures reaching 1058 units. Blue Dream (3.5g) climbed to the second position, improving from its third-place standing in February, with significant sales of 1006 units. Wedding Cake (3.5g) entered the top three for the first time, securing the third rank. Golden Goat (3.5g) saw a decline, dropping from second place in February to fourth in March. Mishawaka Jazz Cabbage (3.5g) maintained its fifth-place ranking from previous months, indicating stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.