Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

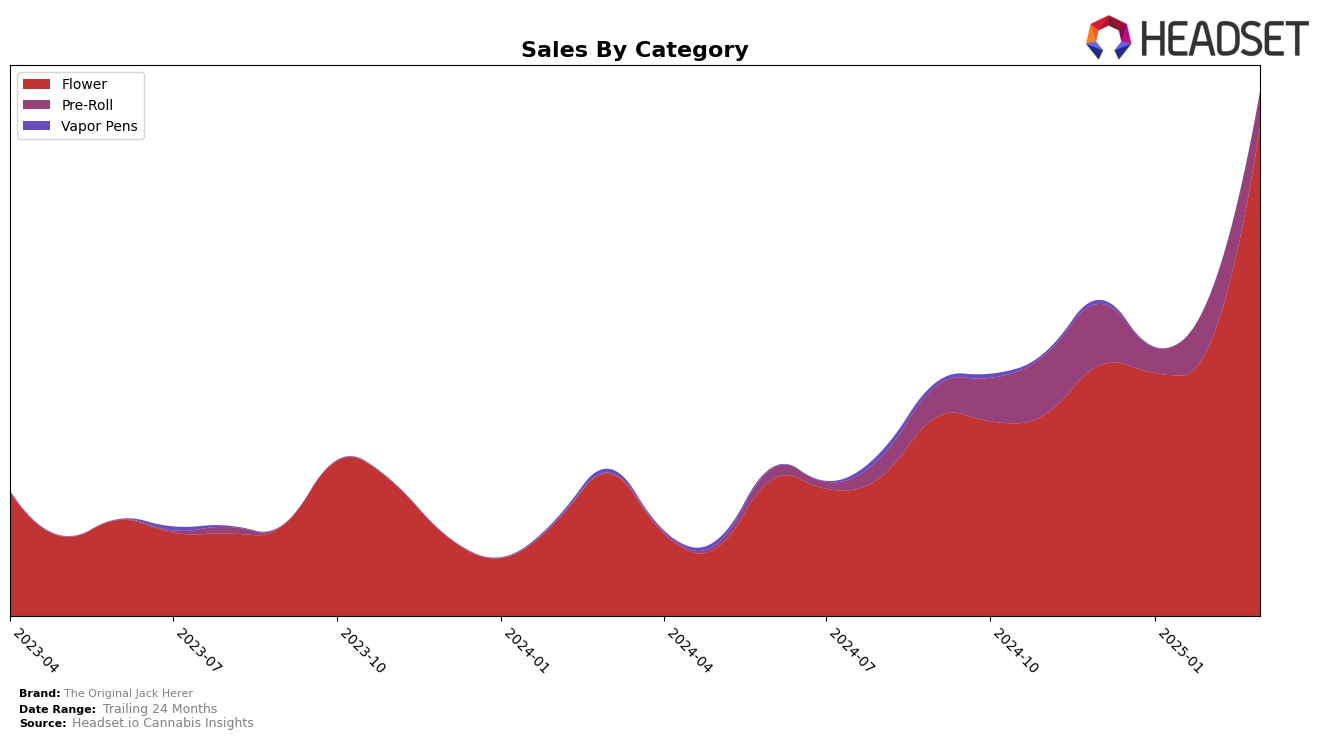

The Original Jack Herer has demonstrated a notable shift in its performance across various categories and states over recent months. In the Colorado market, the brand's presence in the Flower category has seen a significant improvement. Starting from a rank outside the top 30 in December 2024, it made a breakthrough in March 2025, climbing to the 28th position. This upward movement is supported by a substantial increase in sales, which nearly doubled from December 2024 to March 2025. Such a leap suggests a growing consumer preference or effective market strategies that have bolstered the brand's visibility and appeal in the Flower category.

Conversely, the Pre-Roll category paints a different picture for The Original Jack Herer in Colorado. The brand did not appear in the top 30 rankings for January and March 2025, indicating challenges in maintaining a competitive edge in this segment. The absence from these rankings could be seen as a potential area for improvement or a reflection of shifting market dynamics. Despite this, the brand's ability to re-enter the rankings in February, albeit at 60th place, suggests there might be underlying factors or efforts that could be leveraged to regain traction in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Colorado flower category, The Original Jack Herer has shown a significant upward trajectory, moving from a rank of 46 in December 2024 to 28 by March 2025. This improvement is notable, especially when compared to competitors like Equinox Gardens, which fell out of the top 20 by March 2025, and Green Tree Medicinals (CO), which saw a slight decline in rank. Meanwhile, Canna Club experienced a remarkable rise, surpassing The Original Jack Herer in February but slightly trailing in March. The Original Jack Herer's sales surge in March 2025, which nearly doubled from February, underscores its growing market presence, contrasting with the sales decline of Equinox Gardens and the relatively stable sales of Green Tree Medicinals (CO). This positive trend suggests that The Original Jack Herer is gaining traction among consumers, potentially due to strategic marketing efforts or product innovations.

Notable Products

In March 2025, the top-performing product from The Original Jack Herer was Jack Herer (3.5g) in the Flower category, maintaining its first-place rank from previous months and achieving a notable sales figure of 13,964 units. Oaksterdam Pre-Roll (1g) rose to second place in the Pre-Roll category, improving from fourth place in February 2025. The Jack Herer Pre-Roll 3-Pack (3g) made a significant jump to third place after not being ranked in February. Sweet n Sour Jack Pre-Roll (1g) experienced a decline, dropping to fourth place in March. Haze Weaver (3.5g) remained steady at fifth place, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.