Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

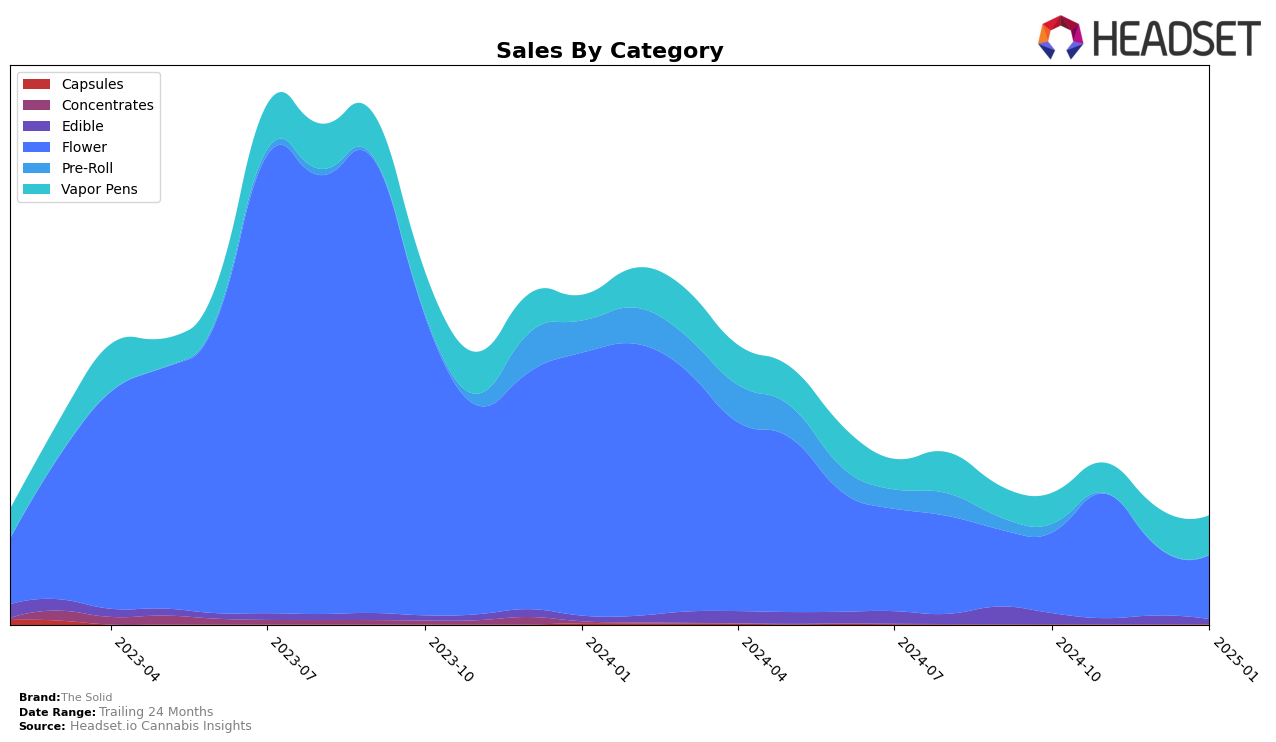

The Solid has shown varied performance across different states and product categories. In Missouri, the brand's Flower category experienced fluctuations, peaking at 31st in November 2024 before dropping out of the top 30 in December and returning to 39th in January 2025. This indicates some volatility in consumer preference or competition within the Flower market in Missouri. The Pre-Roll category, however, did not make it into the top 30 rankings, which could suggest either a lack of focus on this category or stiff competition from other brands. This underperformance in Pre-Rolls might be an area for The Solid to explore for potential growth or strategic adjustments.

In Ohio, The Solid's performance in the Edible category saw a decline from 37th in October 2024 to 50th by January 2025, indicating potential challenges in maintaining a competitive edge. Despite this, the Vapor Pens category in Ohio remained stable, consistently holding the 31st position before improving to 28th in January 2025. This upward trend in Vapor Pens might signal a growing consumer interest or successful brand initiatives in Ohio. Meanwhile, the Flower category in Ohio showed a slight improvement in December 2024 but did not maintain momentum, suggesting room for strategic enhancement to boost rankings.

Competitive Landscape

In the Missouri flower category, The Solid has experienced fluctuations in its rankings, with notable movements from 39th in October 2024 to 31st in November 2024, before dropping back to 42nd in December 2024 and slightly recovering to 39th in January 2025. This volatility indicates a competitive landscape where brands like Atta and The Standard have maintained more consistent positions, with Atta even reaching as high as 20th in November 2024. The Solid's sales trajectory mirrors its ranking shifts, with a peak in November 2024, suggesting that while it can capture market interest, sustaining it remains a challenge. Meanwhile, Cookies and Farmer G have seen declines in both rank and sales, potentially offering The Solid an opportunity to capitalize on their downward trends if it can stabilize its performance.

Notable Products

In January 2025, Jungle Pie (3.5g) emerged as the top-performing product for The Solid, with notable sales reaching 1409 units. California Dream (2.83g) climbed to the second position from fourth in December 2024, showing a steady increase in demand with 1193 units sold. Snowcaine (3.5g) secured the third spot, marking its first appearance in the top rankings. Durban Poison (3.5g) followed closely in fourth place, while Lemon Cherry Gelato x CAP Junky (3.5g) rounded out the top five. The rankings indicate a dynamic shift in consumer preferences, with new entries and upward movements among the leading products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.