Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

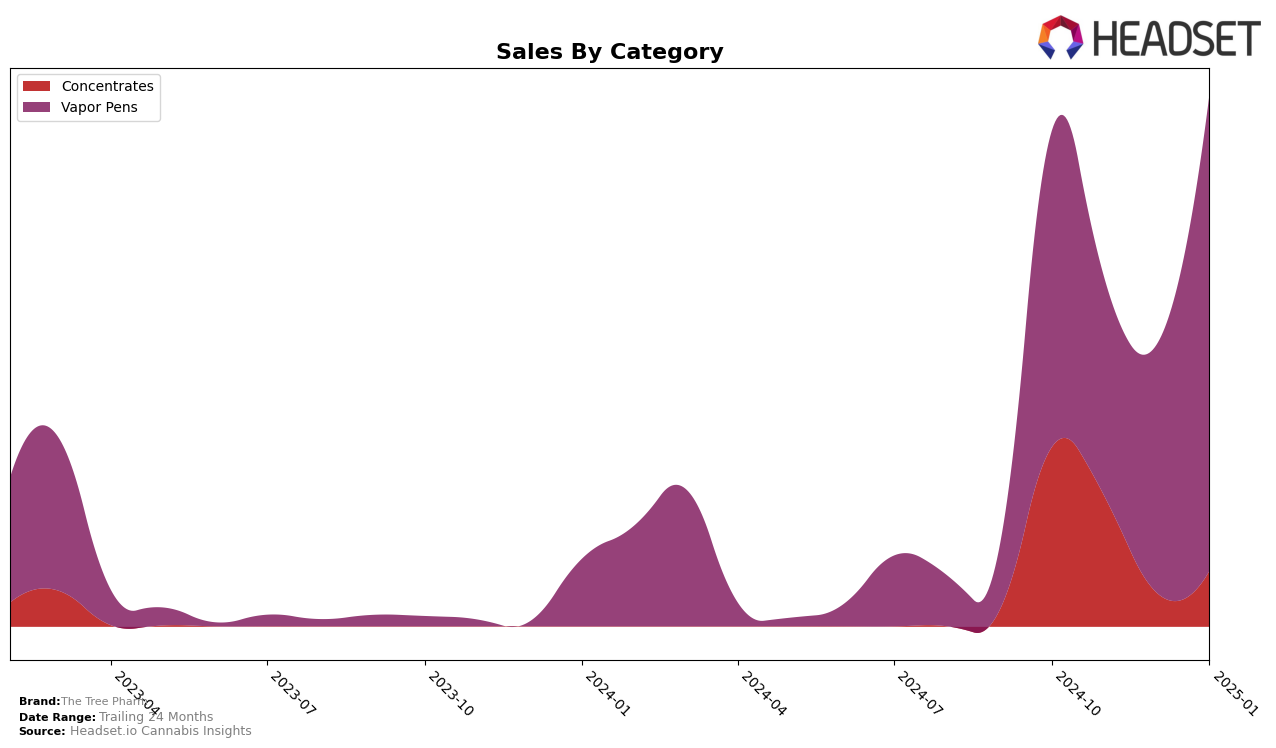

The Tree Pharm's performance in the Ohio market shows varied results across different product categories. In the Concentrates category, the brand managed to secure a spot in the top 30 rankings in October and November 2024, at 22nd and 28th, respectively. However, it fell out of the top 30 by December, indicating a potential decline in market presence or increased competition. This drop could be a cause for concern as maintaining visibility in the top rankings is crucial for sustained sales growth. The sales figures in this category showed a decrease from October to November, suggesting that the brand might need to reassess its strategy or product offerings to regain its standing.

In contrast, The Tree Pharm's performance in the Vapor Pens category in Ohio reflects a more positive trajectory. Although starting at the 51st position in October 2024, the brand experienced fluctuations, briefly dropping to 60th in December before climbing to 49th by January 2025. This upward movement by the start of 2025 could indicate a recovery or successful marketing efforts that resonated with consumers. The sales figures in this category reveal a significant increase from December to January, which might suggest a successful holiday season or the introduction of new products that captured consumer interest. This category's performance highlights the potential for growth and the importance of strategic positioning in a competitive market.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, The Tree Pharm has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. Notably, The Tree Pharm improved its rank from 60th in December 2024 to 49th in January 2025, suggesting a positive trend in sales performance. In contrast, Farmaceutical Rx (Frx) saw a decline from 29th in December 2024 to 53rd in January 2025, which may provide an opportunity for The Tree Pharm to capture market share from this competitor. Meanwhile, Neighborgoods experienced a significant drop from 12th in November 2024 to 46th in January 2025, highlighting potential volatility among top competitors. Additionally, HZ and #Hash have shown inconsistent rankings, with HZ falling to 52nd in January 2025 and #Hash re-entering the top 50 at 47th. These shifts underscore the competitive challenges and opportunities for The Tree Pharm in the Ohio vapor pen market.

Notable Products

In January 2025, the top-performing product from The Tree Pharm was Afghan Kush Distillate Cartridge (1g) in the Vapor Pens category, achieving the first rank with sales of 782 units. Lavender Kush Distillate Cartridge (1g) also showed significant performance by climbing to the second rank from fourth in the previous month, with sales of 725 units. Bubblegum Distillate Cartridge (1g) and OG Strawberry Distillate Cartridge (1g) both entered the rankings at the third position, indicating a strong market presence. Neon Grape RSO Syringe (1g) in the Concentrates category maintained a steady performance, ranked fourth, although its sales figures were notably lower than the top Vapor Pens. Overall, January saw a reshuffling in rankings with Afghan Kush Distillate Cartridge (1g) emerging as a clear leader, while other products showed varying degrees of improvement.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.