Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

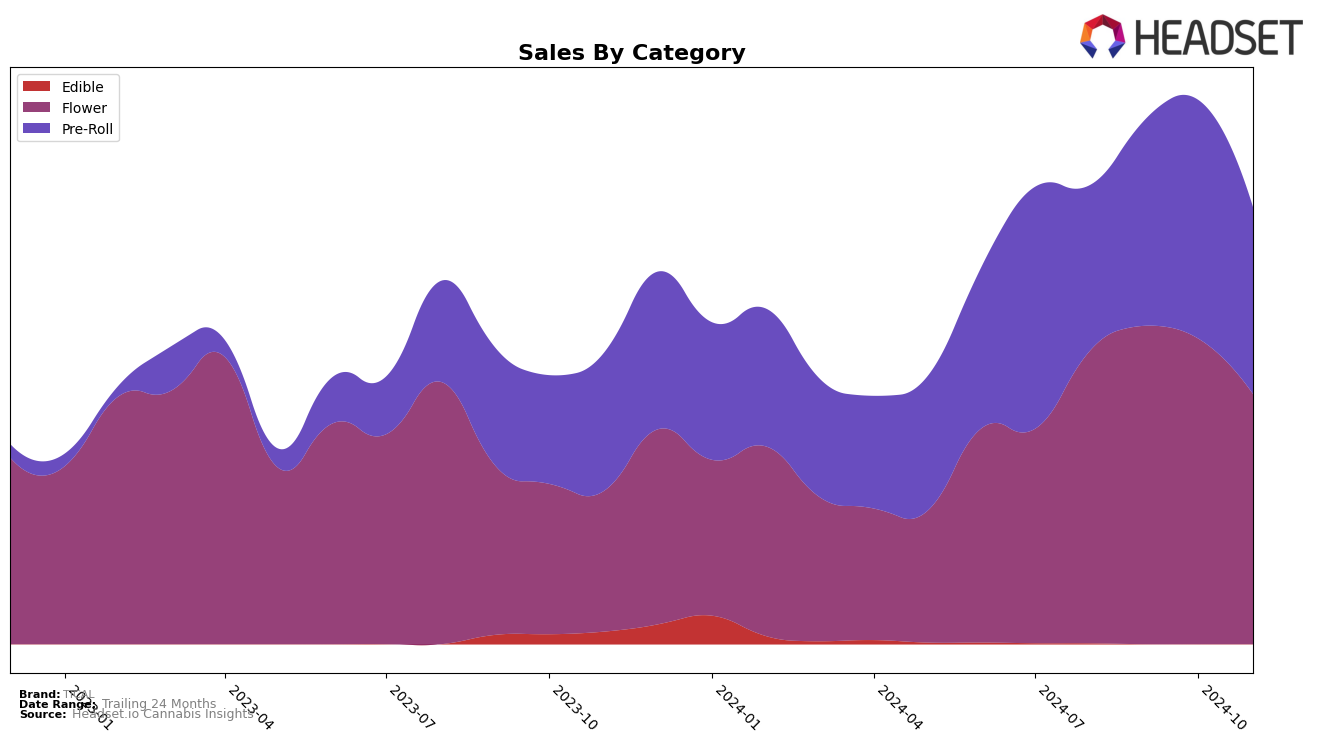

TICAL's performance in the Colorado market shows a consistent upward trend in both the Flower and Pre-Roll categories. In the Flower category, TICAL improved its ranking from 58th in August to 41st by November, indicating a positive reception and growing customer base in this segment. The Pre-Roll category also demonstrated a similar trend, with TICAL moving from 39th to 22nd place over the same period. This upward movement in rankings suggests a strengthening brand presence and possibly a strategic focus on these categories within Colorado. However, despite these gains, TICAL did not make it into the top 30 brands, which could point to potential areas for growth or increased competition in the state.

In contrast, TICAL's performance in Illinois and Missouri presents a more mixed picture. In Illinois, TICAL's ranking in the Pre-Roll category declined slightly from 37th in August to 45th in November, which could indicate challenges in maintaining market share or shifts in consumer preferences. Meanwhile, in Missouri, TICAL showed improvement, climbing from 50th to 36th place by October, before slightly dropping to 39th in November. This fluctuation could be attributed to market dynamics or seasonal purchasing trends. Notably, TICAL did not secure a spot in the top 30 in either state, highlighting potential competitive pressures or market entry challenges that may need to be addressed to enhance their standing.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, TICAL has demonstrated a promising upward trajectory in terms of rank, moving from 58th in August 2024 to 41st by November 2024. This improvement in rank is indicative of a positive trend in sales performance, with TICAL's sales peaking in October before experiencing a slight dip in November. Notably, Shift Cannabis experienced a significant decline in rank, dropping from 14th to 40th over the same period, which may have contributed to TICAL's relative improvement in the rankings. Meanwhile, Nuhi and CG Labs both showed a steady increase in sales, but their ranks remained lower than TICAL's by November. This suggests that while TICAL faces competition from brands like Sunshine Extracts, which maintained a consistent presence in the top 40, TICAL's strategic efforts are effectively enhancing its market position in Colorado's Flower category.

Notable Products

In November 2024, the top-performing product for TICAL was Apple Tartz Pre-Roll (1g), securing the number one rank with notable sales of 2211 units. Stimuli Pre-Roll (1g) rose significantly to the second position from its previous fifth place in August 2024, showing a strong performance with 2118 units sold. Baby Jokerz Pre-Roll (1g) maintained a consistent presence in the top ranks, moving from fourth in October 2024 to third in November with sales of 2112 units. Glitter Bomb Pre-Roll (1g) entered the rankings at fourth place, while Pipeline Pre-Roll (1g) debuted at fifth. These changes indicate a dynamic shift in consumer preferences towards these pre-roll products over recent months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.