Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

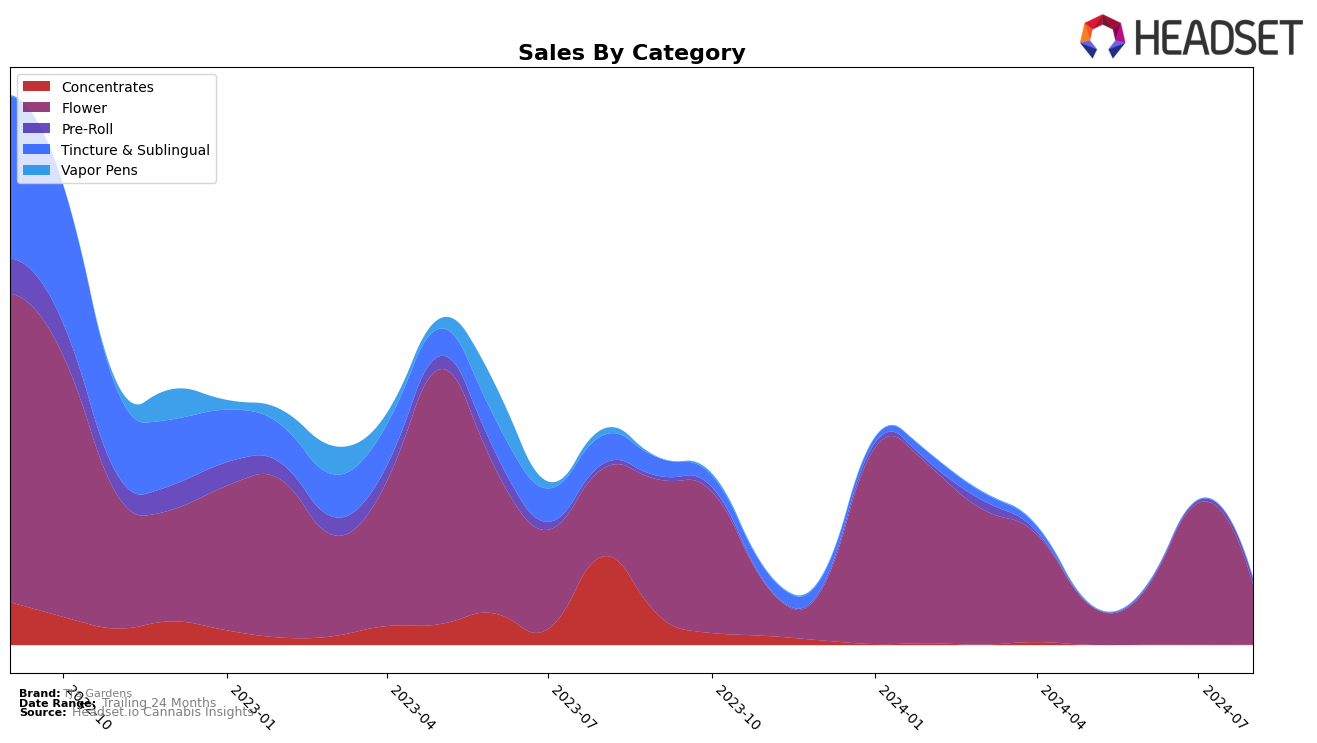

TJ's Gardens has shown a noteworthy performance in the Oregon market, particularly in the Flower category. In May 2024, they did not rank within the top 30 brands, indicating a challenging market presence. However, by August 2024, they had climbed to the 100th position, showcasing a significant improvement in their market penetration. This upward trend suggests that the brand is gaining traction and could potentially continue to rise in the rankings if this momentum is maintained. Despite not being in the top tier, the increase from zero presence to a ranking position is a positive indicator of growth and acceptance among consumers in Oregon.

Across other states, TJ's Gardens' performance has been less prominent, with no rankings reported in any other state categories for the months observed. This lack of presence in the top 30 brands outside of Oregon could be seen as a drawback, highlighting areas where the brand might need to focus more efforts to increase market share. The absence of rankings in other states suggests that while they are making strides in Oregon, there is still substantial room for growth and expansion in broader markets. This dual perspective of rising in one state while being absent in others provides a balanced view of their current market standing and potential opportunities.

Competitive Landscape

In the Oregon flower category, TJ's Gardens has experienced notable fluctuations in its market position, especially when compared to its competitors. While TJ's Gardens was not ranked in the top 20 for May and June 2024, it reappeared at the 100th position in August 2024, indicating a significant drop in visibility and sales. In contrast, Cannabis Nation INC saw a sharp decline from 13th place in May to 95th in August, suggesting a downward trend that could potentially benefit TJ's Gardens if they capitalize on this competitor's weakening market presence. Meanwhile, Mana Extracts and Decibel Farms have also shown inconsistent rankings, with Mana Extracts dropping out of the top 20 in June and reappearing at 97th in July, and Decibel Farms entering the rankings at 93rd in August. Additionally, Organic Theory briefly appeared at 95th in June but did not maintain its position. These fluctuations among competitors highlight opportunities for TJ's Gardens to strategize and potentially reclaim higher market share in the coming months.

Notable Products

In August 2024, the top-performing product from TJ's Gardens was 100 Racks (Bulk) in the Flower category, maintaining its first-place ranking from July with a notable sales figure of 2455 units. Colin OG (Bulk), also in the Flower category, held steady in the second position, showing consistent performance over the last few months. CBD Kush (Bulk) continued its streak in third place, demonstrating steady growth since its entry in June. A new entrant, MK Ultra Pre-Roll (Half Gram) in the Pre-Roll category, debuted strongly at fourth place. Blue Dragon Desert Frost (1g) in the Flower category moved up to fifth place, showing an upward trend from its previous fourth-place ranking in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.