Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

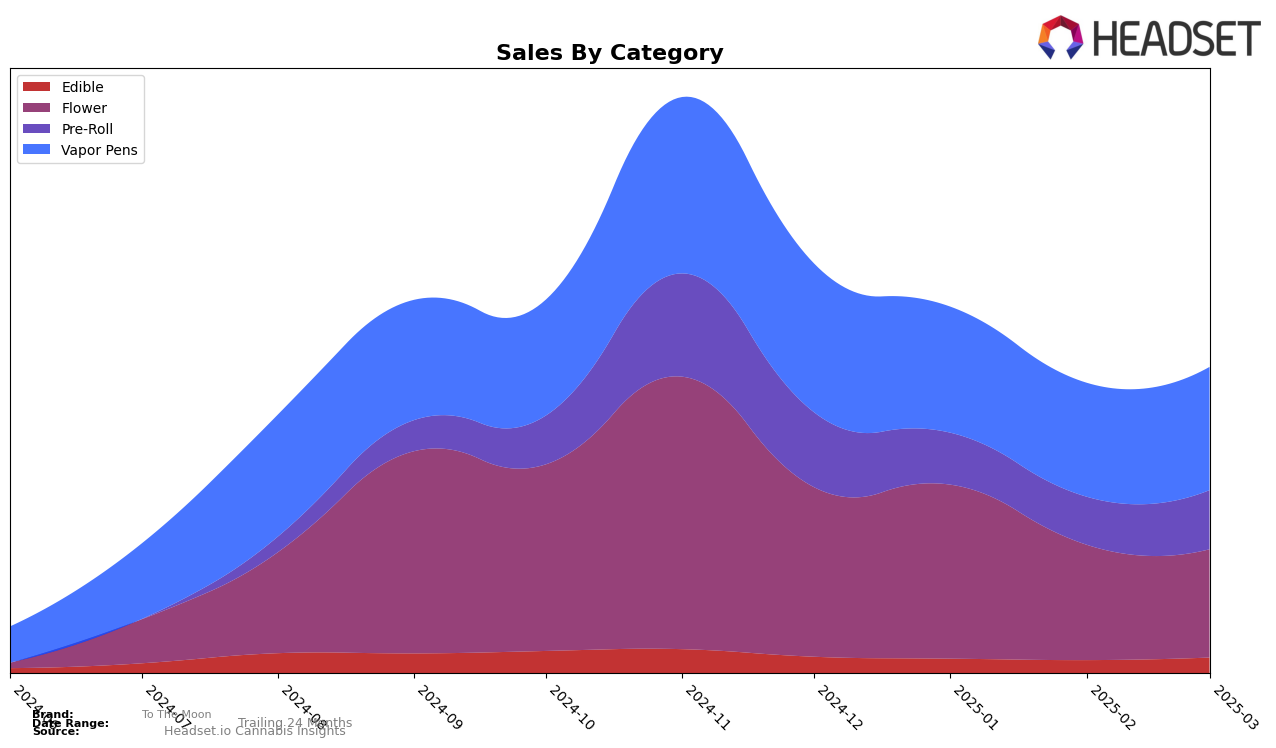

In the competitive landscape of New York, To The Moon has demonstrated varied performances across different cannabis categories. In the Edible category, the brand has shown some stability, re-entering the top 30 in January 2025 after a dip in December 2024. However, their rank slipped again slightly in February and March 2025. This fluctuation suggests that while they have managed to maintain a presence, consistent growth remains a challenge. The Flower category paints a different picture, where To The Moon maintained a steady 17th rank from December 2024 to January 2025, before dropping to 25th in the subsequent months, highlighting potential market pressures or shifts in consumer preferences.

To The Moon's performance in the Pre-Roll and Vapor Pens categories also reflects a mix of challenges and opportunities. In Pre-Rolls, the brand experienced a decline from 21st to 32nd between December 2024 and February 2025, before improving to 26th in March 2025. This upward movement in March could indicate a strategic adjustment or successful marketing efforts. Meanwhile, in the Vapor Pens category, To The Moon's rankings gradually declined from 20th in December 2024 to 25th in March 2025, suggesting a need for innovation or differentiation to regain higher standings. The overall trends indicate that while To The Moon remains a notable player, they must navigate the dynamic market conditions to enhance their rankings across these categories.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, To The Moon has experienced notable fluctuations in its ranking, moving from 20th in December 2024 to 25th by March 2025. This decline in rank suggests increased competition and potential challenges in maintaining market share. Competitors like High Garden and Dime Industries have shown resilience, with High Garden improving its rank from 26th in February 2025 to 22nd in March 2025, and Dime Industries climbing from 28th to 23rd in the same period. Meanwhile, Jetty Extracts has seen a slight dip, falling out of the top 20 by March 2025. These shifts highlight the dynamic nature of the market, where To The Moon must strategize to regain its competitive edge and counter the upward trends of its rivals.

Notable Products

In March 2025, the top-performing product for To The Moon was Skywalker (1g) in the Flower category, securing the first rank with notable sales of 2903 units. Jet Popz (1g), also in the Flower category, followed closely in second place. Alien Cookies (1g) experienced a drop in ranking from first in January and February to third in March. Kandy Kaboom (1g) came in fourth, while Star Berry (1g) maintained its fifth position from February. The rankings for these products indicate a shift in consumer preference towards Skywalker (1g) and Jet Popz (1g) over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.