Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

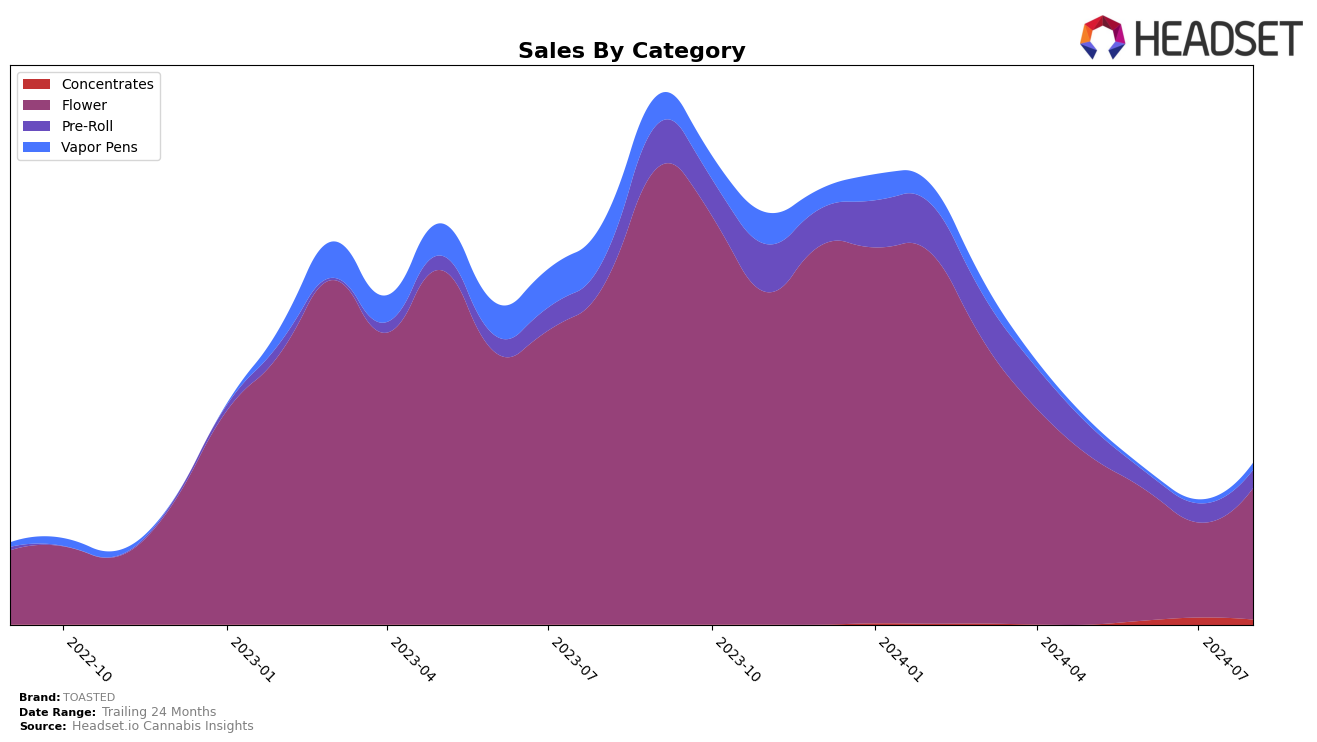

TOASTED's performance across different categories in Arizona has shown a mix of stability and challenges. In the Flower category, TOASTED has maintained a consistent presence within the top 30, ranging from rank 24 in May and August to a slight dip to rank 29 in June. This consistency in the Flower category indicates a steady consumer base, despite fluctuations in sales figures. However, the situation is less favorable in the Concentrates and Vapor Pens categories, where TOASTED did not make it into the top 30 rankings for most of the observed months, only appearing at rank 48 in August for Concentrates and rank 57 in August for Vapor Pens. This suggests that while TOASTED has a strong foothold in the Flower category, it faces significant competition in other product lines.

In the Pre-Roll category, TOASTED experienced a notable decline in rankings, starting at rank 32 in May and falling to rank 44 in June, before slightly recovering to ranks 37 and 38 in July and August, respectively. Such movements indicate that TOASTED may need to reassess its strategy in the Pre-Roll segment to regain its previous market position. The overall trend across categories suggests that while TOASTED has a strong presence in certain areas, there is room for improvement in others to achieve a more balanced performance. The brand's ability to climb back into higher ranks in the Pre-Roll category is a positive sign, but the lack of top 30 presence in Concentrates and Vapor Pens highlights areas needing attention.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, TOASTED has experienced notable fluctuations in its rank and sales over the past few months. Starting from a rank of 24 in May 2024, TOASTED dropped to 29 in June, slightly improved to 28 in July, and returned to its initial rank of 24 in August. This volatility is indicative of a highly competitive market. Brands like Abundant Organics and Grow Sciences have shown more consistent upward trends, with Abundant Organics moving from 28 to 22 and Grow Sciences peaking at 21 in July before slightly declining. Meanwhile, Savvy, despite starting strong at rank 9 in May, saw a significant drop to 26 by August. This dynamic market environment suggests that while TOASTED has managed to regain its position, it faces stiff competition from brands that are either steadily climbing or experiencing their own fluctuations. For a deeper understanding of these trends and to strategize effectively, advanced data analytics can provide more granular insights into consumer preferences and market movements.

Notable Products

In August 2024, the top-performing product from TOASTED was Jenny Kush (5g) in the Flower category, maintaining its first-place ranking with notable sales of 2186 units. Safari Kush (3.5g) climbed to second place from fourth in July, showing a significant increase in sales. Blue Thai Kush (3.5g) held steady in third place, while Jenny Kush Pre-Roll 6-Pack (3g) made its debut in the rankings at fourth place with 893 units sold. Sunset Sherbet (3.5g) dropped from second place in July to fifth place in August. This month saw Jenny Kush (5g) solidify its dominance, while other products experienced notable shifts in their rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.