Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

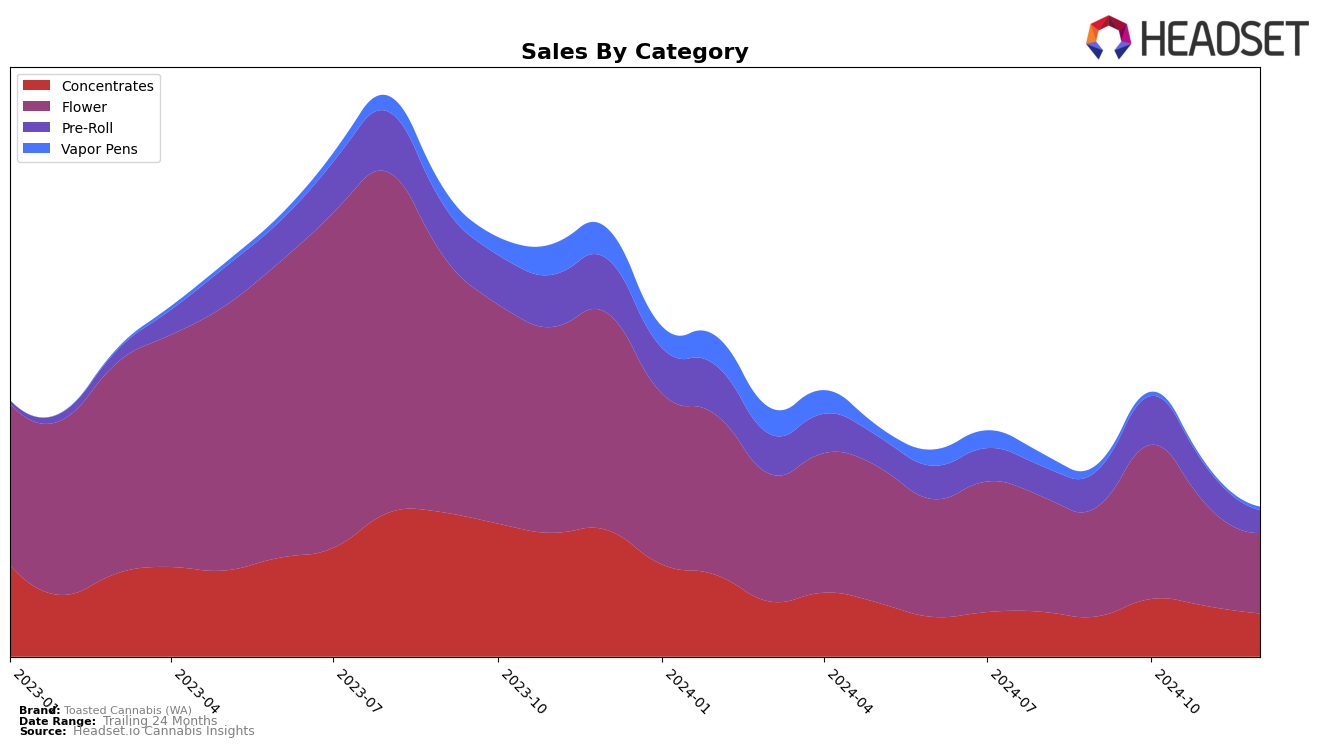

Toasted Cannabis (WA) has shown varied performance across different product categories in Washington. In the concentrates category, the brand has maintained a position within the top 30, with rankings fluctuating slightly over the months. Starting from a rank of 27 in September 2024, Toasted Cannabis improved to 24 in October, before dropping back to 27 in November and 29 in December. This indicates a slight downward trend in the latter months of the year, despite an initial boost in sales in October. The flower category, however, paints a different picture. The brand was not within the top 30 in December, with its ranking slipping from 42 in October to 74 by the end of the year. This significant drop suggests a challenging period for the brand in the flower market segment.

The performance of Toasted Cannabis in the pre-roll category in Washington also reflects some challenges. The brand's ranking improved from 75 in September to 60 in October, indicating a positive trajectory initially. However, by November, the ranking had slipped back to 73, and by December, the brand was no longer in the top 30. This absence from the top rankings in December could be seen as a setback, suggesting the need for strategic adjustments to regain market position. The brand's trajectory across these categories highlights the competitive nature of the cannabis market in Washington, with Toasted Cannabis experiencing both gains and losses in different segments.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Toasted Cannabis (WA) has experienced notable fluctuations in its ranking over the last few months. Starting strong in October 2024 with a rank of 42, Toasted Cannabis (WA) saw a decline to 62 in November and further to 74 in December. This downward trend could be attributed to the rising performance of competitors like Supernova (WA), which improved its rank from 98 in October to 70 by December, and From the Soil, which climbed from 100 in October to 75 in December. Meanwhile, Dab'Ums maintained a steady improvement, moving from 79 in October to 73 by December. Despite these challenges, Toasted Cannabis (WA) still managed to outperform Rochester Farms, which consistently ranked lower, ending at 77 in December. The competitive dynamics suggest that while Toasted Cannabis (WA) faces stiff competition, particularly from brands showing upward momentum, there is an opportunity to regain market position by addressing the factors contributing to its recent sales decline.

Notable Products

In December 2024, the top-performing product for Toasted Cannabis (WA) was Purple Punch Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place rank consistently since September. Gelato OG (3.5g) in the Flower category climbed to the second position from the fifth in November, showing a strong performance with sales figures reaching 1217. Gelato OG Pre-Roll (1g) slipped slightly to third place from its second-place ranking in November. DJ Short Blueberry BHO Wax (1g) entered the top five for the first time, securing the fourth position in the Concentrates category. Meanwhile, Granddaddy Purple Cured Resin (1g) also made its debut in the top rankings at fifth place, indicating a growing interest in Concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.