Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

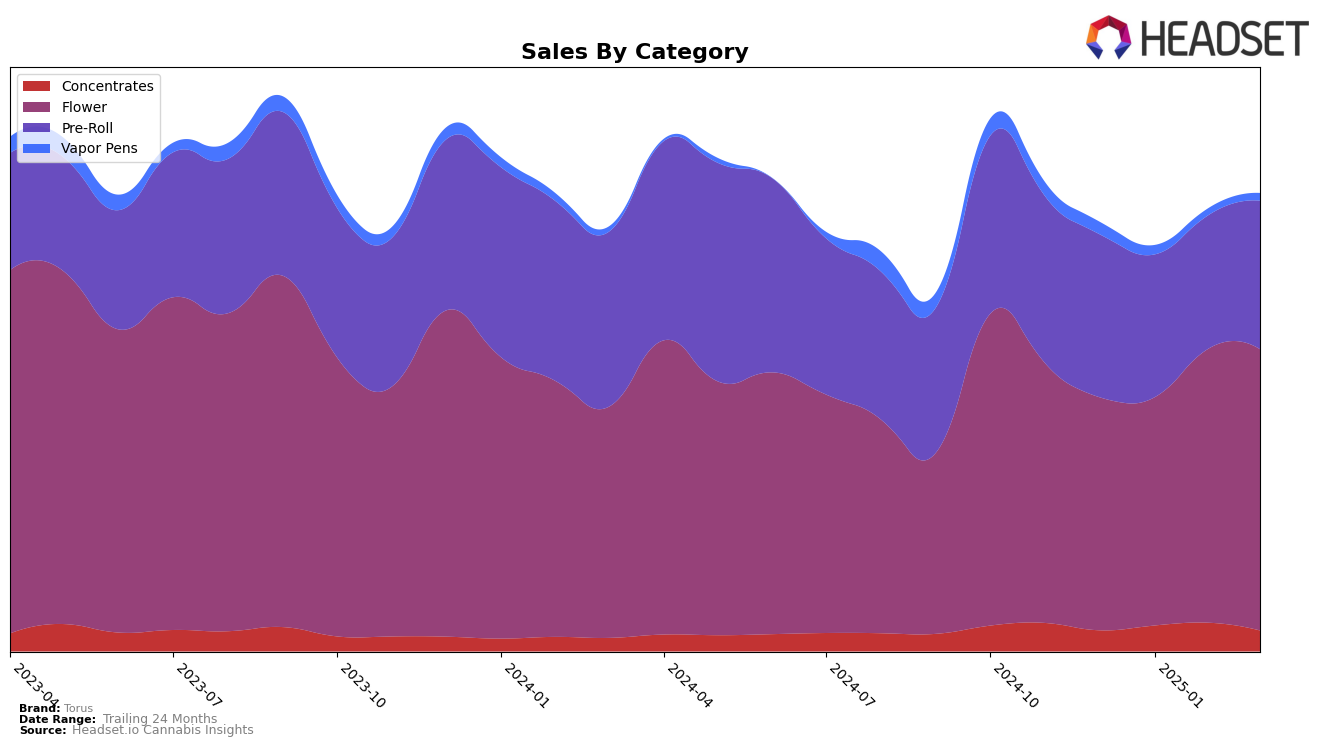

In the Washington market, Torus has demonstrated varying performance across different product categories. In the Concentrates category, Torus saw an improvement in its ranking from December 2024 to February 2025, moving from 74th to 53rd, before experiencing a decline to 69th in March 2025. This fluctuation suggests potential volatility in the demand or competition in this segment. In contrast, the Flower category has shown a more stable and positive trajectory, with Torus maintaining a steady presence in the top 30, consistently improving from 31st in December 2024 to 23rd by March 2025. This sustained performance in the Flower category indicates a strong market position and a growing consumer base in Washington.

The Pre-Roll category presents a different story for Torus in Washington. The brand maintained a consistent ranking within the top 30, although it experienced a slight decline from 24th in December 2024 to 30th in March 2025. This could suggest either increased competition or a shift in consumer preferences within this category. Despite this, the fact that Torus remained in the top 30 highlights its resilience and ability to maintain a competitive edge. The sales data from February 2025 also shows a dip, which might be indicative of broader market trends or seasonal variations affecting the Pre-Roll category. Overall, Torus's performance across these categories in Washington reflects both challenges and opportunities in maintaining its market presence.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Torus has demonstrated a notable upward trajectory in rankings from December 2024 to March 2025. Starting at rank 31 in December, Torus climbed to rank 23 by February and maintained this position in March. This is indicative of a positive trend in sales performance, contrasting with competitors like Royal Tree Gardens, which saw a decline in rank from 20 to 25 over the same period. Similarly, Smokey Point Productions (SPP) experienced a drop from rank 14 to 21. Meanwhile, SKÖRD showed fluctuations but ultimately decreased in rank from 17 to 22. Despite Passion Flower Cannabis briefly outperforming Torus in January, it fell to rank 24 by March. These shifts highlight Torus's growing market presence and potential to capture a larger share of the Flower category in Washington.

Notable Products

In March 2025, Mint Milkshake (3.5g) from the Flower category maintained its position as the top-selling product for Torus, with sales reaching 1398. Gas Face Pre-Roll 2-Pack (1g) climbed to the second spot, showing a consistent presence in the top three over the months. Lemon Heads #3 Pre-Roll 2-Pack (1g) emerged in the rankings for the first time, securing the third position. Gas Face (3.5g) and Grape GMO (3.5g) were ranked fourth and fifth, respectively, both experiencing a drop from their previous positions. Notably, Gas Face (3.5g) fell from second place in February to fourth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.