Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

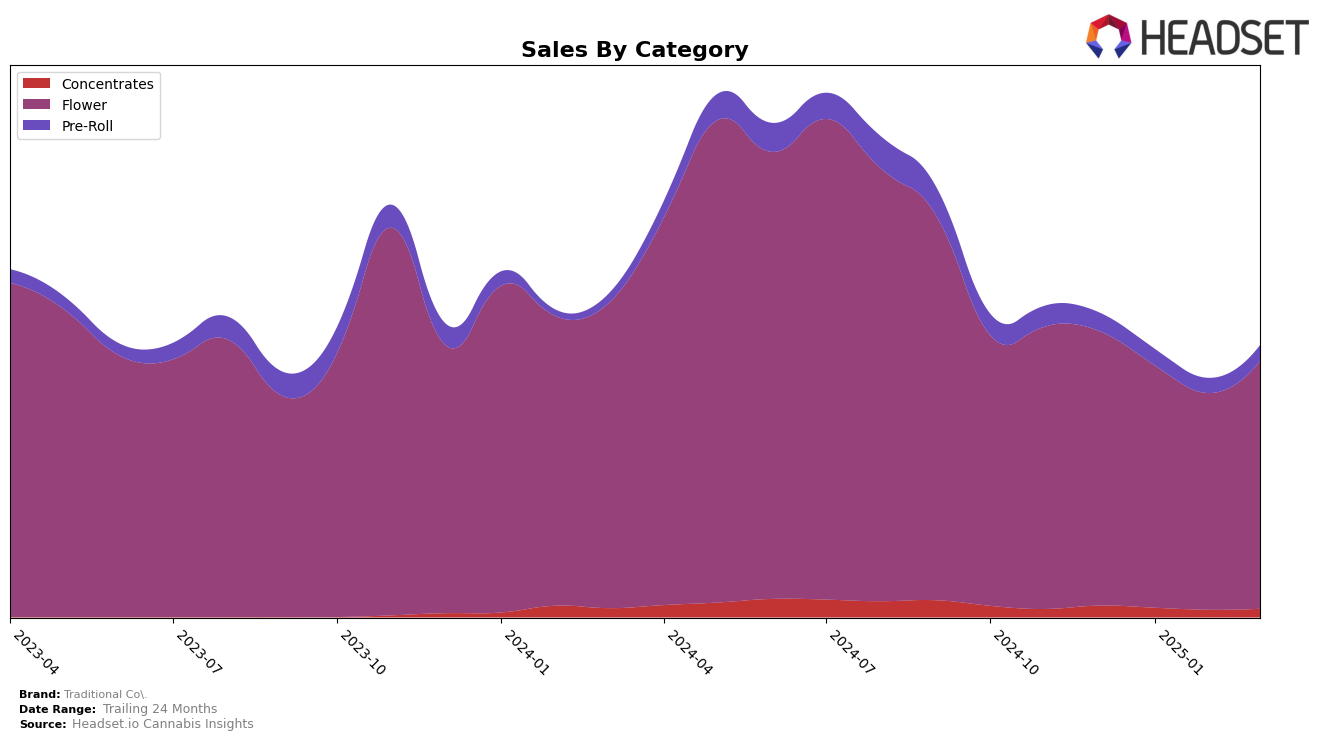

Traditional Co. has shown varied performance across different categories and states. In the California market, their presence in the Concentrates category appears to be fluctuating, with rankings moving from 68th in December 2024 to 70th by March 2025. This indicates a slight recovery after a dip to 77th in February 2025, suggesting some volatility in their market position. However, it's important to note that they did not make it into the top 30 brands in this category, which could be a concern for their market competitiveness. The overall sales trend for Concentrates shows a decline from December to February, with a minor rebound in March.

In the Flower category, Traditional Co. demonstrates more stability in California. Their ranking has remained relatively constant, hovering around the 27th and 28th positions from January to March 2025. Despite not breaking into the top 20, maintaining a spot in the top 30 suggests a steady foothold in this competitive category. The sales figures reflect a dip in January and February, yet a promising uptick in March indicates potential for growth or recovery. This consistency in the Flower category might offer Traditional Co. a strategic advantage in focusing efforts where they have a more established presence.

Competitive Landscape

In the competitive landscape of the California flower category, Traditional Co. has experienced a relatively stable yet challenging position in the rankings over the past few months. From December 2024 to March 2025, Traditional Co. maintained a rank between 23rd and 28th, indicating a consistent presence in the top 30 but facing stiff competition. Notably, Dab Daddy showed a significant improvement, peaking at 18th in February 2025 before dropping back to 29th in March, which suggests a temporary surge in popularity that could have impacted Traditional Co.'s sales. Meanwhile, Astronauts (CA) consistently outperformed Traditional Co., maintaining a higher rank throughout the period, which may indicate a stronger brand loyalty or market strategy. Despite these challenges, Traditional Co.'s sales figures suggest resilience, with a notable recovery in March 2025, hinting at potential strategic adjustments or market responses that could be explored further with advanced data insights.

Notable Products

In March 2025, Mamba 24 (3.5g) maintained its top position as the best-selling product for Traditional Co., despite a decrease in sales to 2867 units. Strawberry Milkshake (3.5g) rose back to the second position, reclaiming its rank from January after dropping to fourth in February. Rainbow Runtz (3.5g) made a notable debut in the rankings, securing the third spot. Blue Donut (3.5g) experienced a slight drop, moving to fourth place after being second in February. Gelato (3.5g) re-entered the rankings in fifth place, showcasing a consistent presence in the top five since December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.