Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

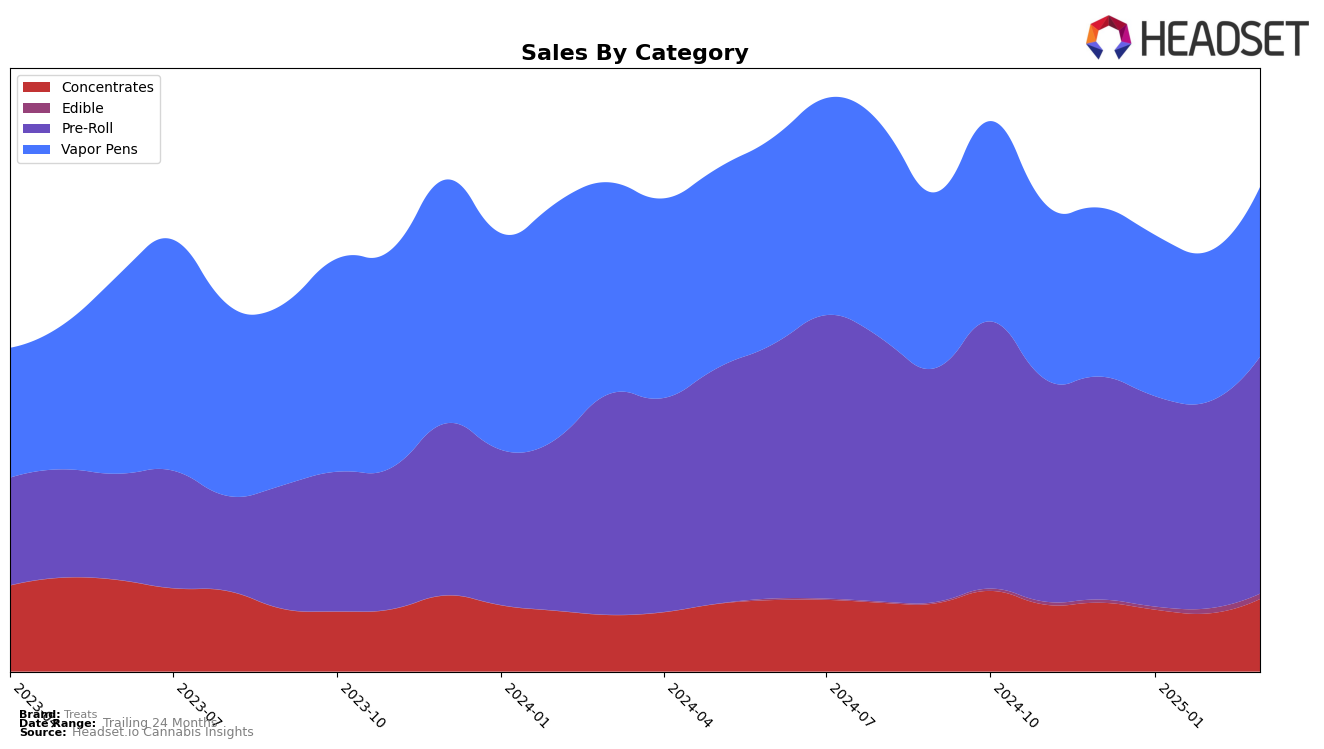

In the state of Washington, Treats has shown varied performance across different product categories. For Concentrates, the brand has not been able to secure a spot in the top 30, with rankings fluctuating between 44th and 48th from December 2024 to March 2025. Despite not breaking into the top tier, there was a noticeable uptick in sales from February to March, indicating a potential upward trend. Meanwhile, in the Pre-Roll category, Treats maintained a more stable presence, consistently ranking around the 29th position, except for a slight improvement to 26th in February. This stability is underscored by a notable increase in sales from February to March, suggesting a strengthening foothold in this category.

For Vapor Pens, Treats has remained outside the top 30 in Washington, with rankings slowly improving from 52nd in December 2024 to 49th by March 2025. This gradual climb, coupled with a rebound in sales from February to March, could signal positive momentum for the brand in this category. While Treats has not yet reached top-tier status in these categories, the recent sales growth suggests potential for future advancement. The brand's performance in Washington highlights the importance of monitoring these trends closely, as they may provide insights into strategic opportunities for Treats to enhance its market position.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Treats has maintained a relatively stable position, ranking 29th in December 2024, January 2025, and March 2025, with a slight improvement to 26th in February 2025. This consistency in rank suggests a steady performance amidst fluctuating market conditions. Notably, Seattle Marijuana Company and its sub-brand Shatter J's by Seattle Marijuana Company have shown strong competition, consistently ranking higher than Treats. Seattle Marijuana Company maintained a rank of 27th in February and March 2025, while Shatter J's improved to 28th in March 2025. Additionally, Torus experienced a rank drop from 24th in February to 30th in March, indicating potential volatility. Despite these competitive pressures, Treats' sales figures show a positive trend, with a notable increase in March 2025, suggesting effective strategies in capturing market share and consumer interest.

Notable Products

In March 2025, the top-performing product from Treats was Birthday Cake Infused Pre-Roll (1g), maintaining its first-place rank from February with notable sales reaching 8,494 units. Blueberry Pie Infused Pre-Roll (1g) held steady in second place, showing consistent performance over the months. Candy Cone Infused Pre-Roll (1g) climbed to third place, marking its return to the rankings after missing February's list. Strawberry Shortcake Infused Pre-Roll (1g) slipped to fourth place, despite a strong showing in February. Iced Watermelon Infused Pre-Roll (1g) remained in fifth place, consistent with its February ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.