Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

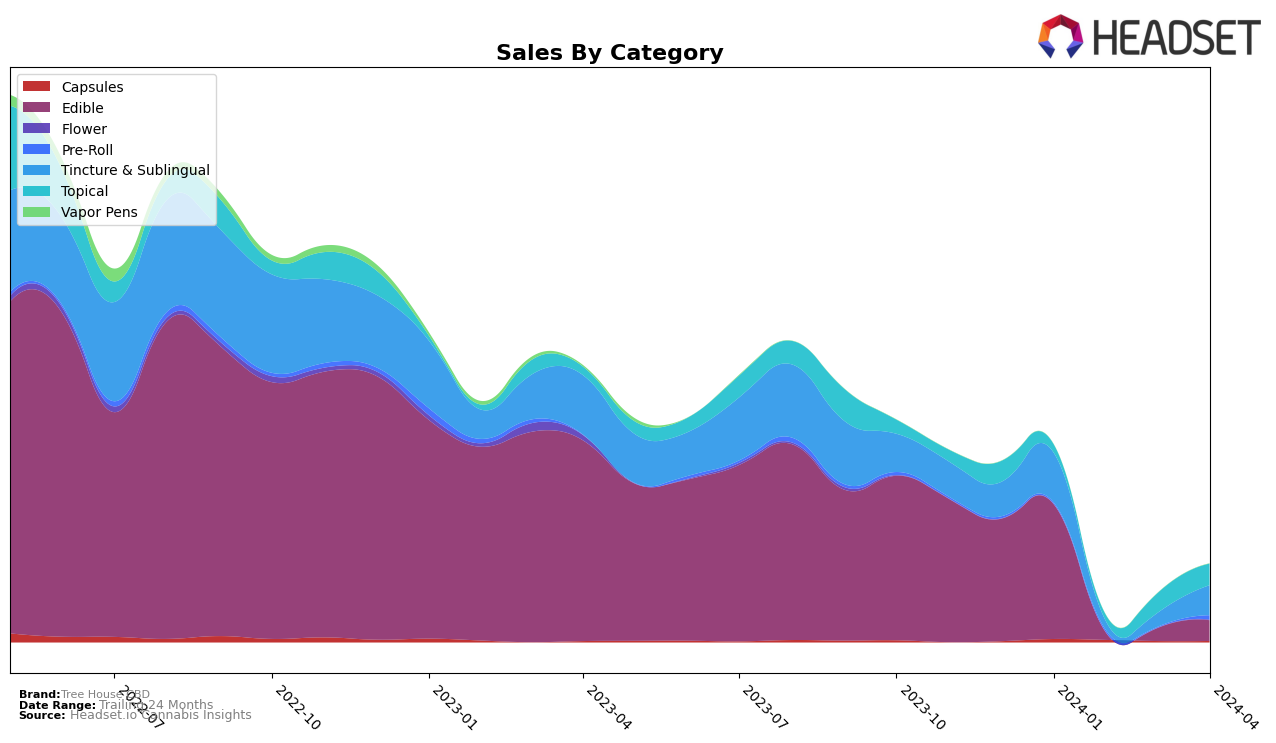

In Michigan, Tree House CBD has shown a notable performance in the Tincture & Sublingual category, securing the 6th position. This ranking is particularly impressive, considering the competitive nature of the cannabis market in the state. However, the brand's performance in the Edible category tells a different story. With a ranking of 75th, Tree House CBD seems to struggle in penetrating this segment effectively. The disparity in rankings between these two categories highlights the brand's strengths and weaknesses across its product lineup. While the exact sales figures for February through April are not disclosed, a January sales figure of $29,509 for Edibles, despite the low ranking, suggests that there is a market presence, albeit not as strong as desired.

The absence of Tree House CBD from the top 30 brands in any category for the months following January in Michigan could be interpreted in several ways. On one hand, it might indicate a decline in the brand's market share or effectiveness in marketing and distribution within the state. On the other hand, it could also suggest a strategic shift or a temporary setback. The significant presence in the Tincture & Sublingual category, however, underscores the brand's potential in specialized segments. The lack of data for subsequent months leaves room for speculation on whether Tree House CBD has managed to maintain its foothold in the Tincture & Sublingual category or if it has seen similar declines as in the Edible category. This mixed performance across categories and the notable absence in later months highlight areas of both opportunity and challenge for Tree House CBD in the Michigan market.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Michigan, Tree House CBD has shown a notable presence. Starting in January 2024, Tree House CBD ranked 75th, indicating a challenging position amidst stiff competition. Notably, its competitors have shown varying degrees of performance. For example, Smokiez Edibles demonstrated significant market presence, ranking 41st in February and 42nd in March, showcasing a stable demand for their products. In contrast, Dope only appeared in the April rankings at 89th, suggesting a late entry or fluctuation in their market appeal. FloraCal Farms and CBD Living also varied in their rankings, with FloraCal Farms maintaining a mid-tier position in January and February (53rd and 56th, respectively) and CBD Living trailing at 94th in January. This competitive analysis underscores the volatile nature of the edible cannabis market in Michigan, with Tree House CBD facing an uphill battle to improve its rank and sales amidst these dynamics.

Notable Products

In April 2024, Tree House CBD saw the CBD Dog Treats 10-Pack (200mg CBD) from the Edible category take the lead in sales with 89 units sold, marking a significant jump from its previous month's rank to the top position. Following closely was the CBD Bath Bomb (250mg CBD) in the Topical category, which climbed to the second spot, showcasing a notable increase in consumer interest. The Sleep - CBD Nighttime Gummies 10-Pack (300mg CBD), also from the Edible category, experienced a remarkable rise, moving from third to the top position, indicating a growing demand for sleep aid products. The CBD Sour Diesel Pre-Roll (1g) from the Pre-Roll category secured the third rank, maintaining a steady interest among consumers for inhalable options. Lastly, the CBD Assorted Gummies 10-Pack (300mg CBD) held its ground in the fifth position, demonstrating consistent popularity within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.