Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

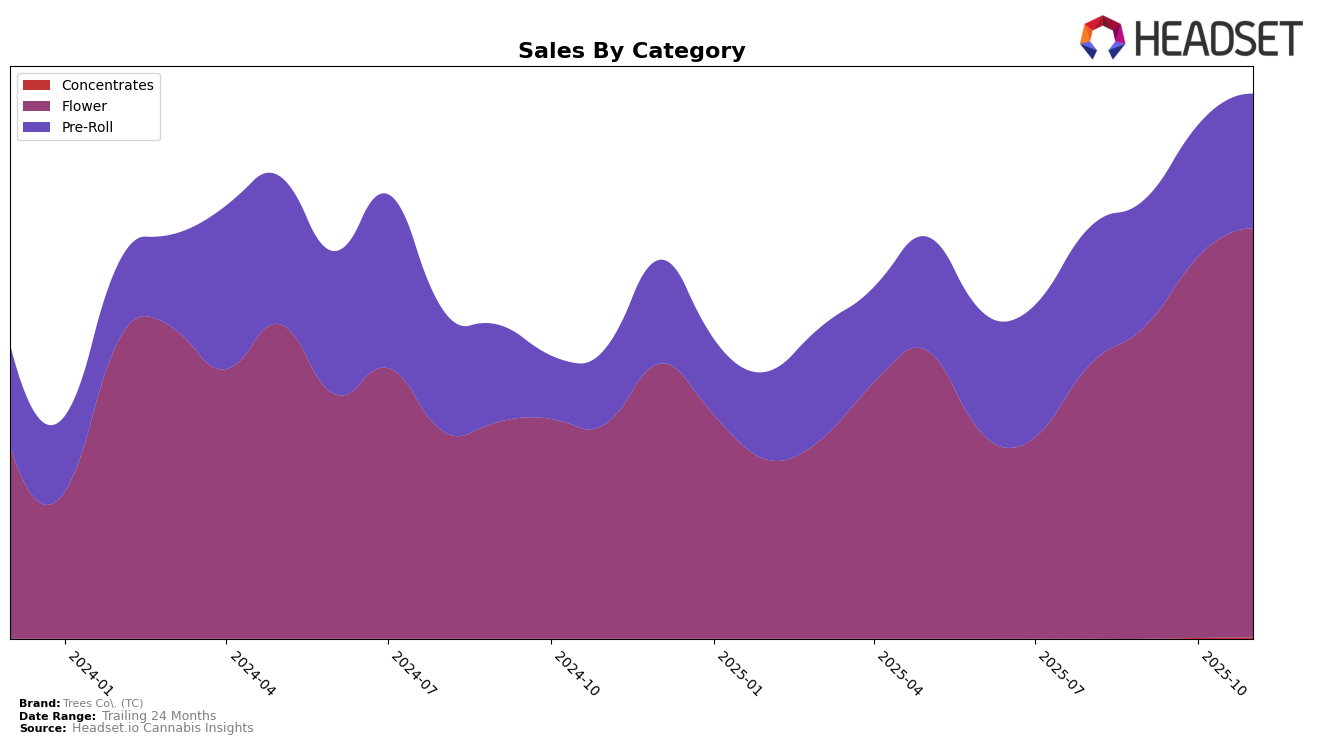

In the Massachusetts market, Trees Co. (TC) has shown a notable upward trajectory in the Flower category. Starting from a rank of 36 in August 2025, the brand made significant strides to break into the top 20 by October, maintaining its position in November. This consistent climb is indicative of a strengthening presence and possibly increased consumer preference in this category. The sales figures reflect this positive trend, with a steady increase from August through November, signaling a healthy demand for TC's Flower products.

Conversely, in the Pre-Roll category within Massachusetts, Trees Co. (TC) has faced more challenges maintaining a competitive edge. Despite a slight improvement in rank from 37 in August to 31 in November, the brand has yet to secure a position within the top 30. This suggests that while there is some progress, there is still significant room for growth and improvement in this category. The sales figures for Pre-Rolls have shown fluctuations, with a slight dip in September and October before a recovery in November, indicating a volatile market presence that may require strategic adjustments to achieve more consistent performance.

Competitive Landscape

In the Massachusetts flower category, Trees Co. (TC) has demonstrated a notable upward trajectory in brand ranking and sales performance over the past few months. From August to November 2025, TC climbed from 36th to 20th place, showcasing a consistent improvement in market presence. This upward movement is contrasted by competitors such as Ozone, which experienced a decline from 7th to 21st place, and Bostica, which fell from 11th to 19th place. Meanwhile, NEA (Northeast Alternatives) and Cheech & Chong's maintained relatively stable positions, with NEA fluctuating between 14th and 18th and Cheech & Chong's hovering around the 22nd spot. TC's sales growth trajectory, rising from $435,123 in August to $678,369 in November, indicates a robust demand and effective market strategies, setting it apart from competitors who have faced sales declines or stagnation during the same period.

Notable Products

In November 2025, So F'n Gassy Pre-Roll (1g) reclaimed its top spot as the leading product for Trees Co. (TC), with sales reaching 3,549 units. This product had previously slipped to third place in October but surged back to first. The So F'n Gassy (3.5g) flower followed closely in second place, dropping from its first-place position in October. The Dub Pre-Roll (1g) maintained a strong presence, coming in third, despite being a new entry in the rankings in October. Rocket Fuel Pre-Roll (1g) and Melonade Gibson (3.5g) rounded out the top five, both making their debut in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.